Last Week:

To the casual observer, it was a quiet week, with the S&P 500 posting a modest 0.59% gain, while the U.S. Dollar and bond markets were largely unchanged. On the other hand, there was tremendous daily volatility in the overall market, as well as continued stock specific winners and losers. The concern over the crisis in Turkey early in the week, gave way to optimism over the U.S. consumer (attention Walmart shoppers), and hopes that newly scheduled low-level trade talks between China and the U.S. might bear fruit.

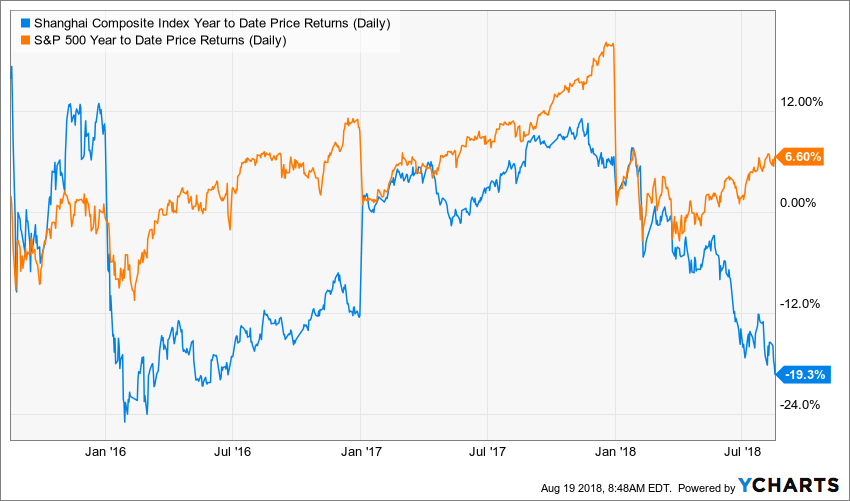

Is there method to this trade war madness? Many of the CEOs that we talk to have expressed concern over the disruption that this dialogue may cause to their supply chain, or the possibility that the Chinese government may respond by dictating that Chinese companies replace U.S. suppliers with Chinese suppliers. One positive (?) outcome so far has been the decoupling of our equity markets from the fate of the Chinese equity markets.

The apparent implication of the chart above is that the Chinese should be motivated to come to a swift resolution of this dispute. Of course, the issue is much more complicated.

As for the strength at Walmart, clearly their shoppers are reflecting the high-level of consumer confidence, with same-stores sales up 4.5% and online sales up 40%. Not to be a “Debby Downer” but often a recession follows a spike in consumer confidence, specifically in periods where the reading on current conditions gap up from future expectations, as is currently the case.

This Week:

The minutes from the FOMC meeting will be released on Wednesday afternoon, which could move the market, especially since trading will likely be thin with many professionals on an extended holiday. Additionally, the flash PMI for August will be out on Thursday. China trade will remain in the news, as well the developments in Turkey.

Stocks on the Move:

After the previous week’s record number of double-digit movers, things quieted down considerably in our portfolios, with only 2 companies posting large moves.

LSI Industries, Inc. (LYTS) +13.9%: Net sales in the fourth quarter of fiscal 2018 were $83,409,000, flat compared to the $83,419,000 reported in the same period of the prior year. Adjusted operating income was $1,045,000 compared to $1,012,000 for the fourth quarter last year. Ron Brown, CEO commented, “Our results in the fourth quarter were mixed. While the Graphics business posted strong results, we continue to face challenges in the Lighting business. During the quarter, we drove several improvement initiatives across the Company which will better position the business for growth in the coming quarters. These actions generated some very positive developments, as well as addressed some of our continuing challenges.” The Company also announced a series of organizational structure and leadership changes. LSI Industries provides corporate visual image solutions. Its products include digital signage, printed and structural graphics, electrical signage capabilities, indoor and outdoor lighting products, and others. LYTS is a 1.2% holding in the North Star Micro Cap Fund and a 1% holding in the North Star Dividend Fund.

Owens & Minor Inc (OMI) + 12.6%: Shares rebounded from their 17.5% decline after releasing earnings the previous week that failed to meet expectations. Owens & Minor is a healthcare logistics firm distributing low-tech, consumable medical supplies to acute-care hospitals. The company distributes products to healthcare service providers under various brands such as MediChoice and ArcRoyal. OMI is a 1.4% holding in the North Star Dividend Fund.