Last Week:

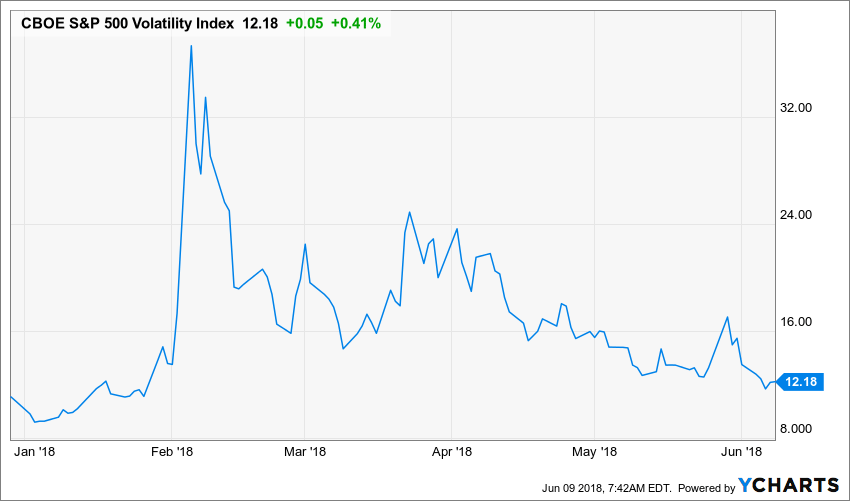

Once again, the market proved resilient, with the S&P 500 gaining 1.6%, despite numerous troubling global headlines. Most of the unsettling news relates to trade issues, which clearly could become significant impediments to the global economy if the proposed tariffs become reality. The market seems to be viewing the slew of trade policy tweets as negotiating ploys or bluffs, rather than actual policy statements. I hope that proves to be true, because the proposed trade restrictions would likely have a significant inflationary impact, which combined with rising interest rates could lead to a nasty recession. The VIX, otherwise known as the “fear index” certainly suggests a lack of concern. Perhaps investors are comforted by the belief that all negotiating parties recognize that free and fair trade is in their best interest.

The yield on the Ten-Year Treasury inched up 4 basis points to 2.93%, while the dollar slipped fractionally.

The Golden State Warriors swept the Cleveland Cavaliers in the NBA championship. Sorry LeBron, MJ remains the GOAT(greatest of all time)!

This Week:

The Trump/Kim summit Monday night will be a historic occasion, and given the personalities involved, it is hard to predict the outcome. If the meeting is cordial, then it should set a better tone for the US-China trade talks. On Tuesday, the long-awaited decision on the AT&T- Time Warner merger is anticipated. An approval of the merger would be a positive development for the M&A landscape (hopefully spreading down to food chain to smaller companies). The FOMC will issue its decision on interest rates on Wednesday. Given the certainty of a rate increase, much focus will be on the dot plot for future increases. It’s back to trade issues on Friday, with the US releasing a “final” list of Chinese imports subject to a 25% tariff.

Stocks on the Move:

Under Armour, Inc. (UAA) +13.8%: Dwayne “The Rock” Johnson’s Project Rock 1 shoes which were released on May 28 in limited quantities through the company’s website and in Brand Houses across the United States, sold out in 30 minutes. The Company will restock the $120 shoes on June 28, which will be the global launch for Project Rock 1. Further details have not yet been announced. Under Armour is a developer, marketer and distributor of branded performance apparel, footwear and accessories for men, women and youth. It markets its products under the brand name of Under Armour, Heatgear, Coldgear, and Allseasongear. UAA is a 2.6% position in the North Star Opportunity Fund and UAA Corporate Bonds are a 1.8% position in the North Star Bond Fund.

Oil-Dri Corp. (ODC) +10.9%: Recorded a 12% increase in net income for its fiscal third quarter, to $3.6 million, from $3.2 million in the corresponding period of the previous fiscal year, and a 9% increase in earnings per diluted share to $0.48, from $0.44. Most of the increase was a result of an income tax adjustment. Net sales for the company in the quarter, meanwhile, remained flat year over year at $64.8 million. CEO Daniel S. Jaffee stated, “Our business diversity and strategy to develop and support value-added products continues to prove effective. Net sales were an all-time record for the nine-month period.Oil-Dri develops, manufactures, and markets sorbent products made primarily from clay. Its offerings include cat litter, floor products, toxin control substances for livestock, agricultural chemical carriers, and filtration and purification aids. ODC is a 1.1% position in the North Star Dividend Fund.

Healthcare Services Group, Inc. (HCSG) +8.9%: The Company’s shares were upgraded to outperform by William Blair. Healthcare Services Group provides management, administrative and operating expertise and services to the housekeeping, laundry, linen, facility maintenance and dietary service departments of the health care industry in United States. HCSG is a 1.7% holding in the North Star Dividend Fund.

Lee Enterprises, Inc. (LEE) -11.1%: Sometimes low-priced stocks can be volatile for no apparent reason. The Company’s shares had reached a 52 week high the previous week following a good earnings report. Lee Enterprises is a premier publisher of local news, information and advertising in midsize markets, with 46 daily newspapers and a joint interest in four others, rapidly growing online sites. LEE is a 2.0% position in the North Star Opportunity Fund.