Second Quarter 2023 Economic Review

For the three-month period ending June 30ᵗʰ, the S&P 500 Total Return Index increased 8.7% while

the Bloomberg U.S. Aggregate Intermediate Bond Index fell 0.7%. Year to date, the S&P 500 Total

Return Index is up 16.9% and the Bloomberg U.S. Aggregate Intermediate Bond Index is up 1.6%.

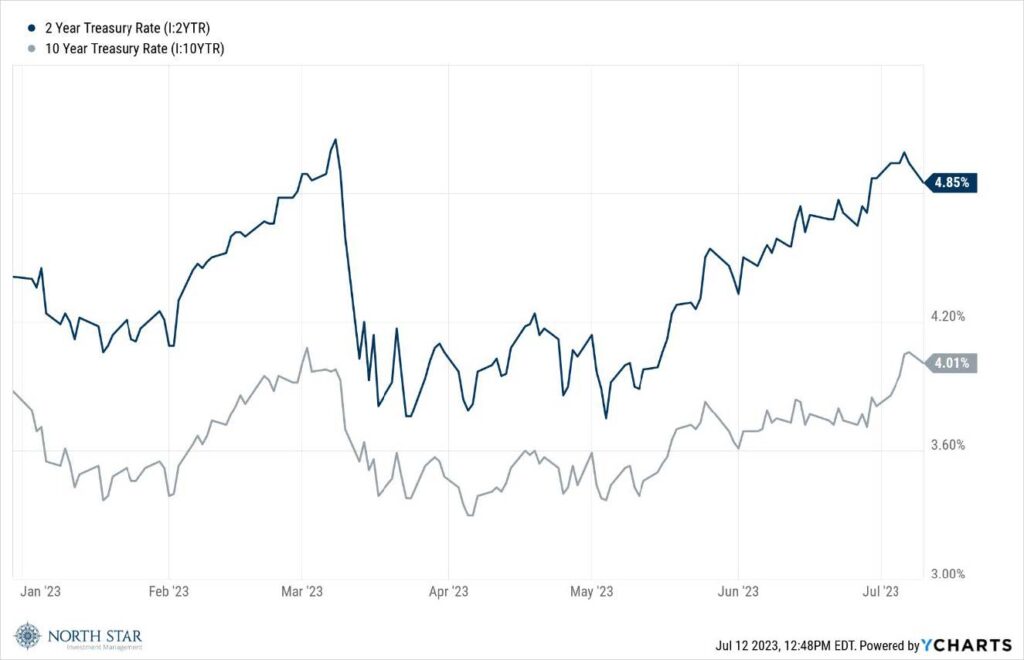

The economic data continues to show a resilient economy combined with easing inflationary

pressures. The recent positive performance of equity indices seems to reflect the “no recession”

camp while the widening 10-year yield minus 2-year yield indicator stubbornly, and even

increasingly, seems to reflect that bond market is anticipating a slowdown in the economy. Going

forward, investors will continue to be focused on corporate earnings and the pace and path of

Federal Reserve interest rate decisions.

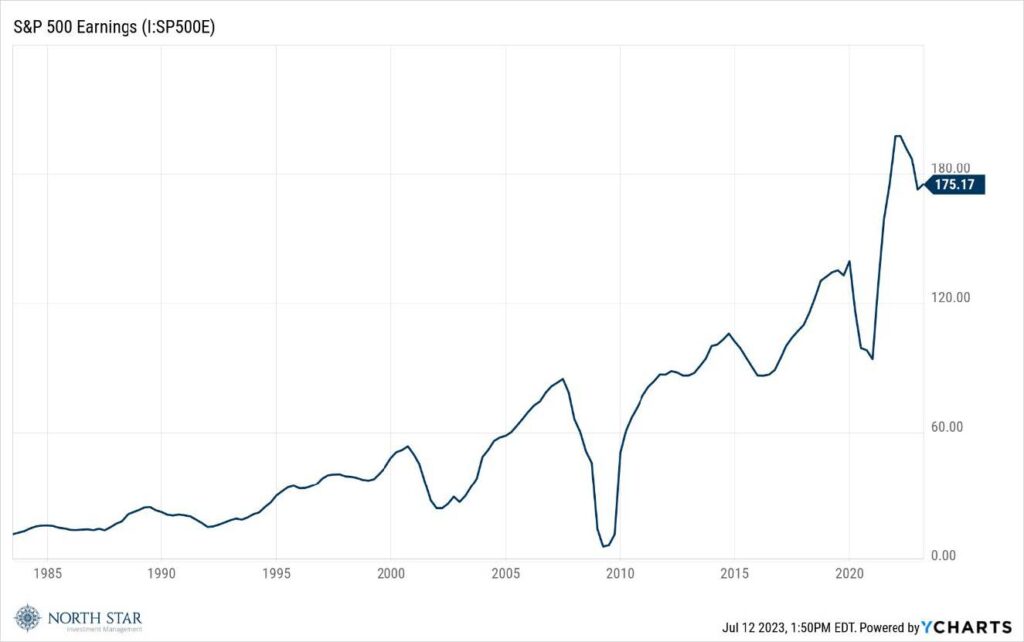

Corporate profits in the 2ⁿᵈ quarter are forecasted to have declined 6.8%, which would mark the

third consecutive quarter of declines, and the largest decline since the 2ⁿᵈ quarter of 2020 when

the pandemic closed the economy. The good news is that profits are expected to rebound in the back

half of the year, and as believers in capitalism, one can feel confident that corporate profits

will continue their long history of excellent

growth.

The following charts are indicators that North Star uses to measure the general health of the

economy:

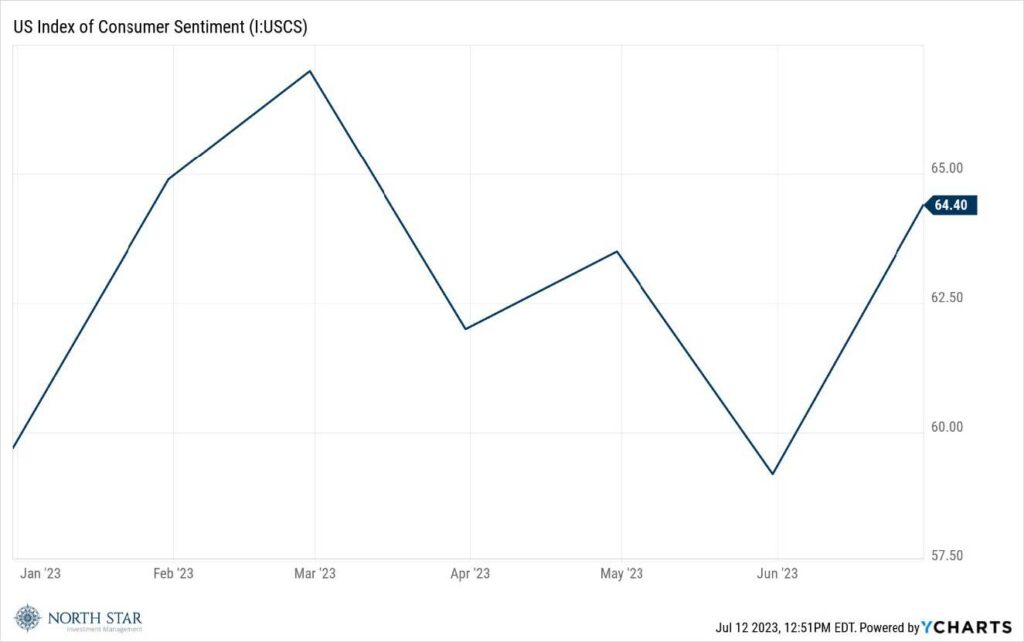

Consumer confidence remained subdued.

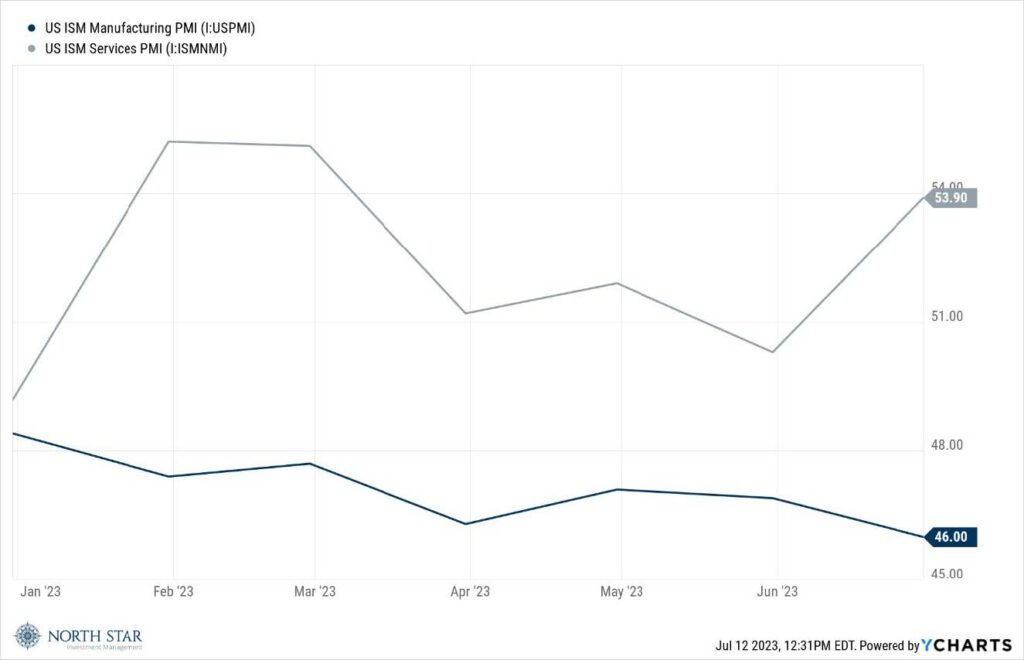

Manufacturing remained weak while services showed greater strength.

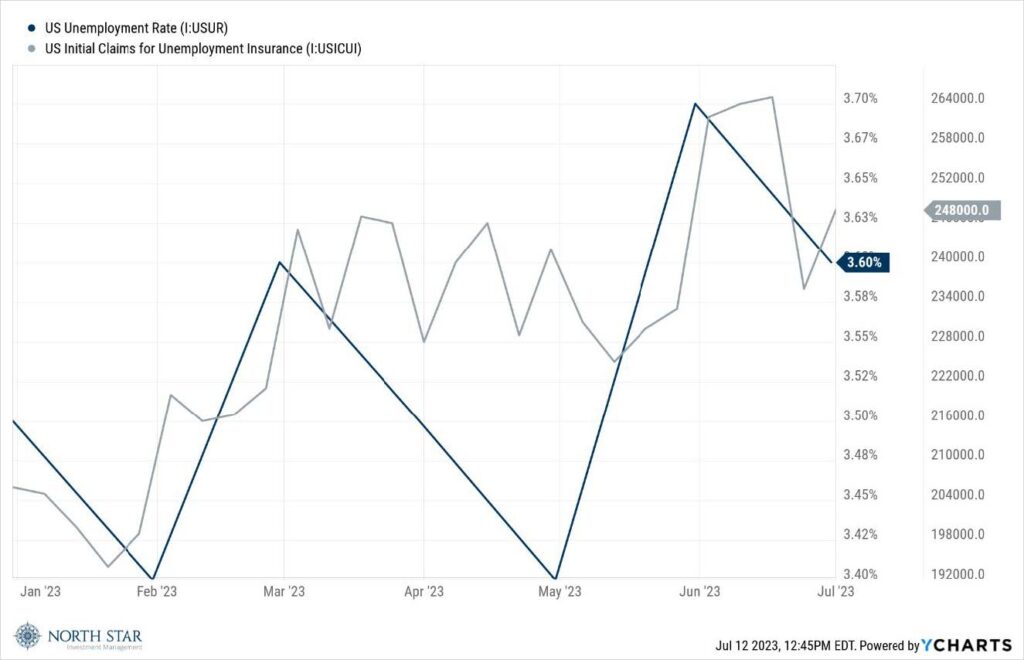

The jobs market has cooled off, but still is exhibiting shortages of workers and some wage

pressure.

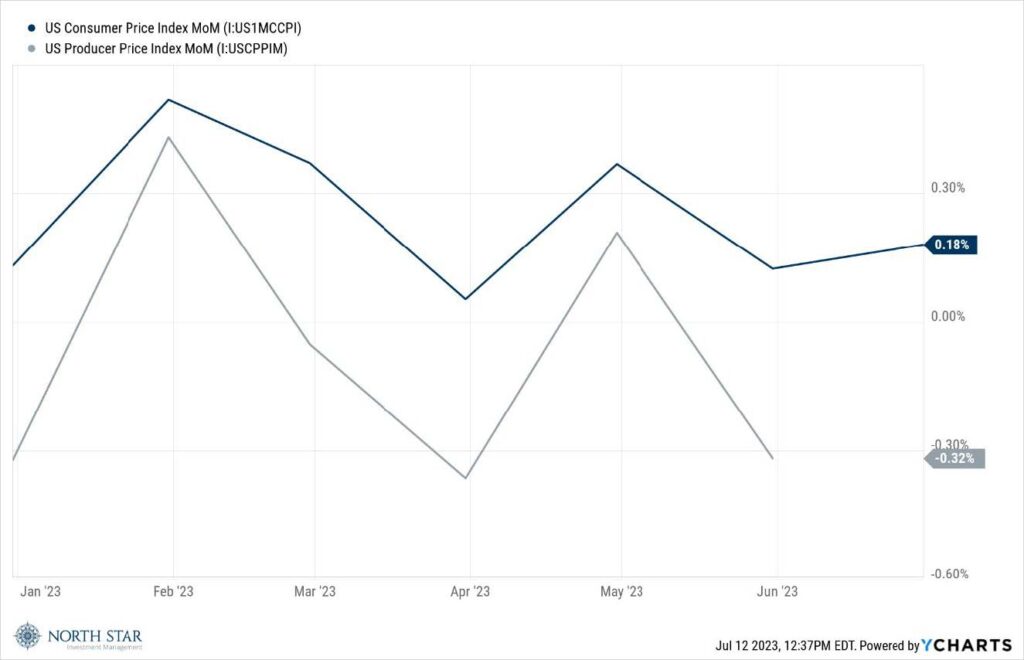

Inflation was the story of the first half of 2022, as the downward trend in both CPI and PPI has

been apparent for the last 12 months.

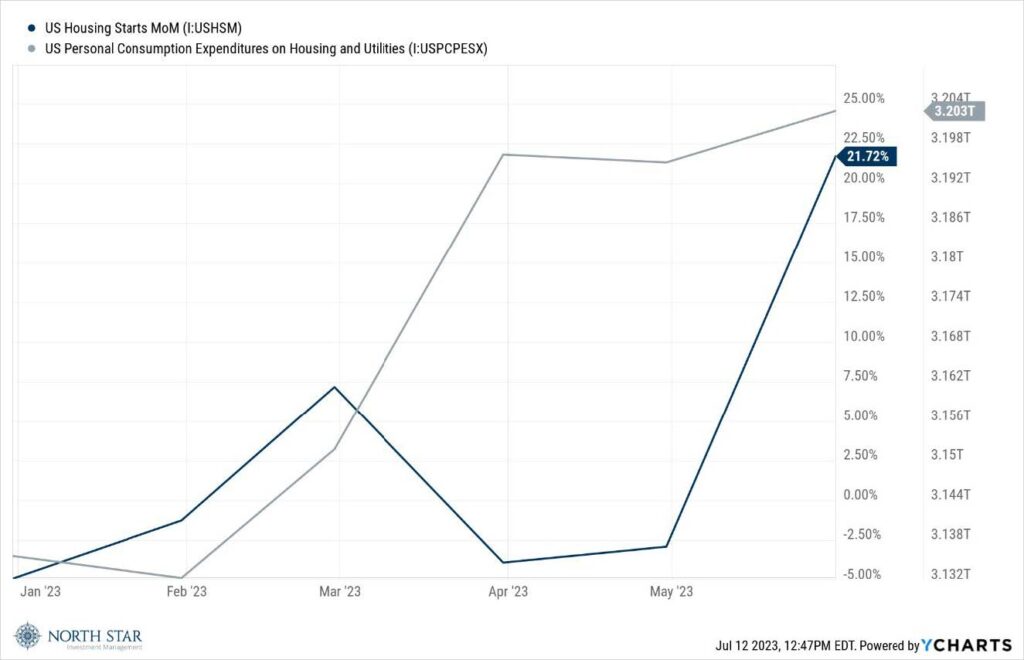

The housing market remains extremely robust with elevated demand despite higher prices and higher

mortgage rates.

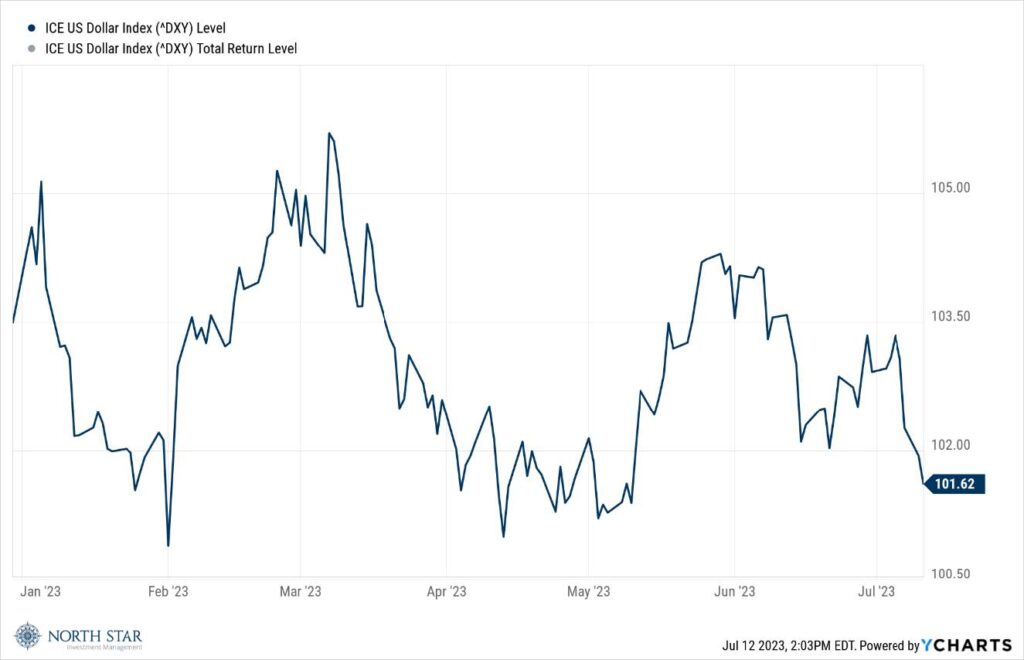

The dollar has been stable, while interest rates, particularly short-term rates determined by the

Fed, have continued to climb.

On balance, we view the data as supporting the case for a “soft landing”, with the inversion of the

yield curve more a function of Fed policy than determined by market forces.

Previous periods of market volatility have demonstrated that trying to time the market is a

difficult and typically underperforming pursuit. For long term investors, simply staying invested

is the most prudent investment strategy. In addition, we encourage investors to manage risk by

staying in their asset allocation range and maintaining a diversified portfolio.

Please visit www.nsinvest.com for Kuby’s Commentary, Eric Kuby’s weekly market review

and outlook.