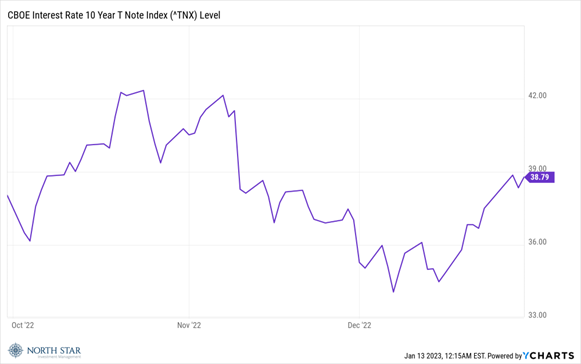

The S&P 500 Total Return Index increased 7.6% for the quarter but finished down 18.1% for the year. The Bloomberg U.S. Aggregate Intermediate Bond Index increased 1.9% during this period and finished down 13.0% for 2022. The yield on the 10-year Treasury remained in a relatively narrow band, essentially finishing the quarter at the same level as it started. Short-term rates, on the other hand, steadily increased leading to the largest yield inversion on record.

Inflation’s surge to a 40-year high in the first half of 2022 led the Federal Reserve to rapidly raise interest rates, leading to a historic selloff in bonds and a bear market for stocks during the first three quarters. The Markets remained volatile during the final quarter, but finished higher as many of the storm clouds dissipated, even though investors continued to focus on future rate increases and the likelihood of a recession. On a positive note, the inflation data for the fourth quarter showed that the dramatic deceleration of inflationary pressures that began in July had continued, with the month-over-month CPI actually declining in December.

Unlike the first three quarters of 2022, when all four major indices saw quarterly declines, performance was mixed during the fourth quarter as the Dow Jones Industrial Average rose sharply, while the S&P 500 and Russell 2000 were solidly higher. Like most of 2022, however, the Nasdaq lagged and fell slightly in the fourth quarter. Expectations for higher rates, slowing economic growth and underwhelming earnings weighed on the tech sector in the fourth quarter, which was the case for much of 2022.

Small-cap stocks showed some resilience in the fourth quarter with the Russell 2000 index registering a solid gain as investors’ hopes for a peak in inflation and ultimately interest rates, led to some buying in the segment. We continue to see tremendous opportunities in small caps with the Russell 2000 trading at a significant discount to its historic P/E multiple.

Value stocks dramatically outperformed growth all year and that trend continued in the fourth quarter. Softening earnings weighed on tech stocks in the final three months of the year, while concerns about slowing economic growth combined with rising interest rates hit the high multiple tech stocks. Value stocks, on the other hand, were viewed as more attractive in the market environment of 2022 due to lower valuations and exposure to business sectors that are considered more resilient than high-growth parts of the market.

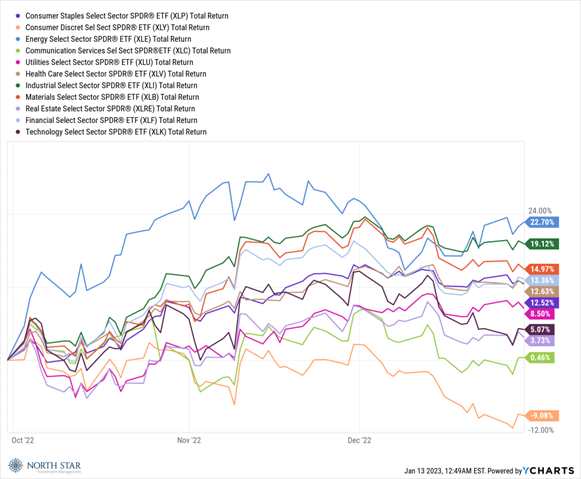

On a sector level, 10 of the 11 S&P 500 sectors finished the fourth quarter with a positive return, although only 2 of the 11 ended 2022 with gains. The Energy sector posted a 22.7% gain for the quarter, followed by the Industrial sector with a 19.1% rise. Those two sectors were bolstered by progress on the post-Covid economic reopening in China which increased demand expectations, while a falling dollar was an added tailwind for commodities including oil and gas.

The high-growth sectors, such as tech and communication services lagged in the fourth quarter, with communication services being only fractionally positive while the consumer discretionary sector posted a negative return on concerns about an impending recession and plummeting consumer confidence.

Sector selection proved to be of the utmost importance during the quarter, as markets were extremely sensitive to the macro environment.

With interest rates and stock valuations back to more normal levels, the stage seems to be set for healthier markets in 2023.