The market was able to overcome the emergence of the highly contagious Omicron variant of the Coronavirus, rising inflation expectations, labor shortages and supply chain bottlenecks during the final quarter of 2021. Despite those headwinds, corporate earnings dramatically exceeded forecasts for the fourth consecutive quarter, and the jobs market continued to improve. In response to that strength in the economy, the Federal Reserve began reversing its pandemic stimulus programs, reducing its monthly purchases of government securities by $15 billion in November, and further reducing those monthly purchases by an additional $15 billion in December. The Ten-Year Treasury yield finished the year at 1.51%, essentially its same level from the beginning of the fourth quarter.

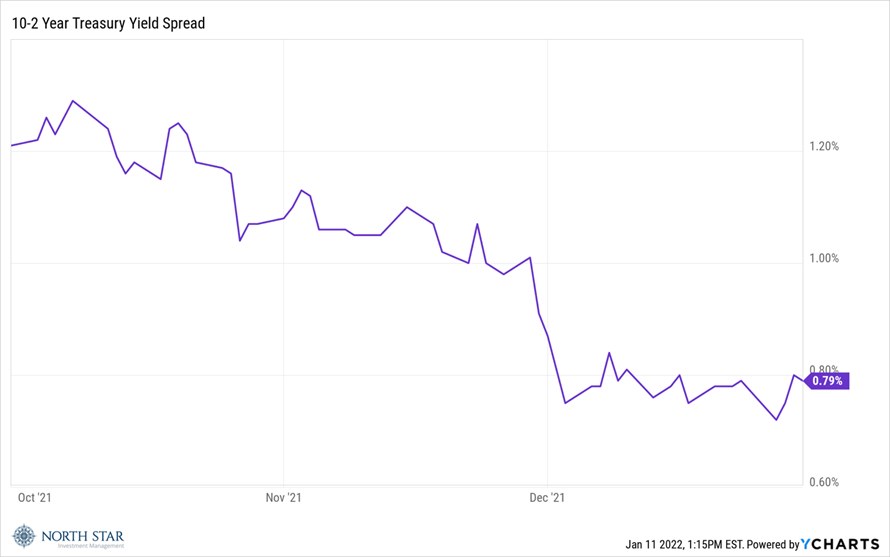

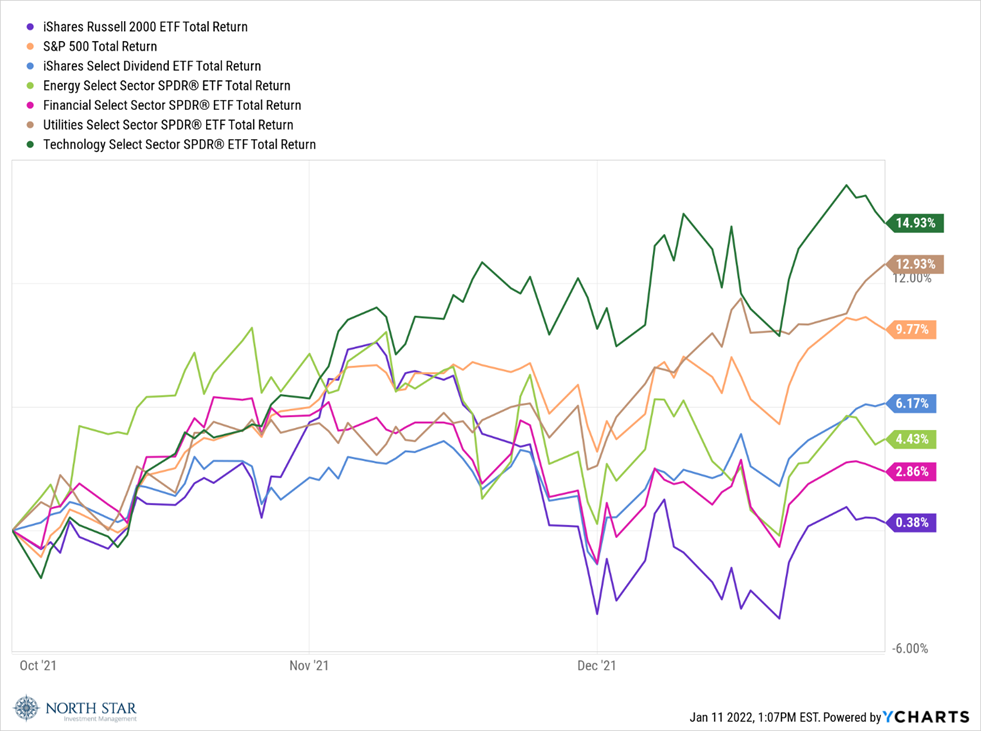

The S&P 500 outperformed the Russell 2000 by almost 1000 basis points, although small cap value stocks fared better than small cap growth stocks, with dividend paying companies performing reasonably well. The mega cap tech companies were the top performers, followed by the Utility sector, a somewhat odd combination. The Financial sector struggled, as the yield curve flattened during the quarter.

Despite remaining relatively constant during the fourth quarter, the Ten-Year rate did increase by 60 basis points during the year. We anticipate an even higher increase in 2022 with less accommodative monetary policy and persistent inflation. Companies trading at lower valuation multiples with higher and rising dividends should fare well in the environment. Value stocks are not being priced based on future growth expectations, so are less vulnerable to rising interest rates. Companies that can raise their dividends greater than their inflation rate provide a nice hedge to those rising costs. During periods of lower overall stock market returns, historically a very high percentage, sometimes 100%, of equity returns come from the dividend stream.