The S&P 500 Total Return Index gained 6.2% for the quarter while the Barclays U.S. Aggregate Bond Index declined 1.6% during this period.

The stock market’s strength during the quarter was driven by more hopeful expectations for the economy in 2021. Over the course of the quarter, estimates for 2021 GDP consistently increased from 4% to over 6.5%. Corporate earnings reports during the quarter handily exceeded estimates, finishing 24% EPS. There was also a record number of upward corporate earnings guidance revisions, with expectations now calling for over 20% S&P 500 EPS growth for the first quarter. Small cap stocks which are typically more economically sensitive, outperformed larger stocks. The Russell 2000 more than doubled the return of the S&P 500, gaining 12.9%, while the Micro Cap Index fared even better, advancing 23.99%. Bond yields increased (and prices decreased) due to heightened inflation expectations, but the very accommodating Federal Reserve pledged to maintain its policy of near-zero short-term interest rates, given its forecast for employment and inflation conditions. The yield on the Ten-Year Treasury steadily increased from 0.91% to 1.75%, without negatively impacting equities. There were a couple of brief spikes in volatility early in the quarter, but the VIX (the “fear” index) declined 10% to finish at its lowest level since the onset of the pandemic. The record number of new SPACs, as well as the wild rides for “meme” stocks are testaments to the “risk on” attitude that prevailed.

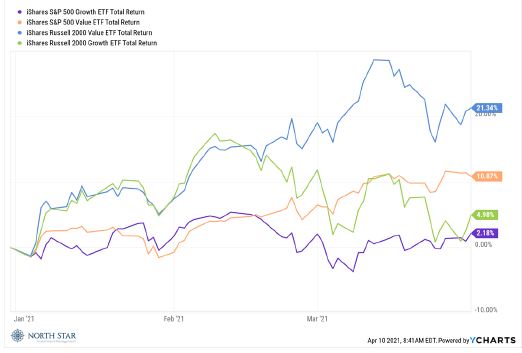

In addition to the outperformance of small caps and the thirsty for speculation, the rotation to “Value” from “Growth” across all market caps was the other dominant trading theme, as the chart above illustrates Value stocks approximately quintupled the returns of Growth stocks. The Energy and Financial sectors were key contributors to that shift.

The markets will continue to be focused on the trajectory of the pandemic as the race between vaccinations and COVID-19 variants will drive the robustness of the economic recovery. Our friends in the Capitol are trying to do their part. In addition to monetary policy, fiscal policy will also provide a strong tailwind. On March 11, President Joe Biden signed the $1.9 trillion American Rescue Plan of 2021, with checks up to $1400 hitting most Americans bank accounts in the following weeks. The bill will also extend a $300 per week unemployment insurance boost until Sept. 6 and expand the child tax credit for a year. It will also put nearly $20 billion into Covid-19 vaccinations, $25 billion into rental and utility assistance, and $350 billion into state, local and tribal relief. On the last day of the quarter, President Biden introduced to American Jobs Plan of 2021. The plan requests $2 trillion over eight years to modernize the nation’s infrastructure. This infrastructure plan includes roads, bridges, and ports, but also addresses resiliency, the climate crisis, broadband access, waterways, and housing. To pay for the plan, the president suggests a corporate tax hike over 15 years, among other modifications to the tax code.