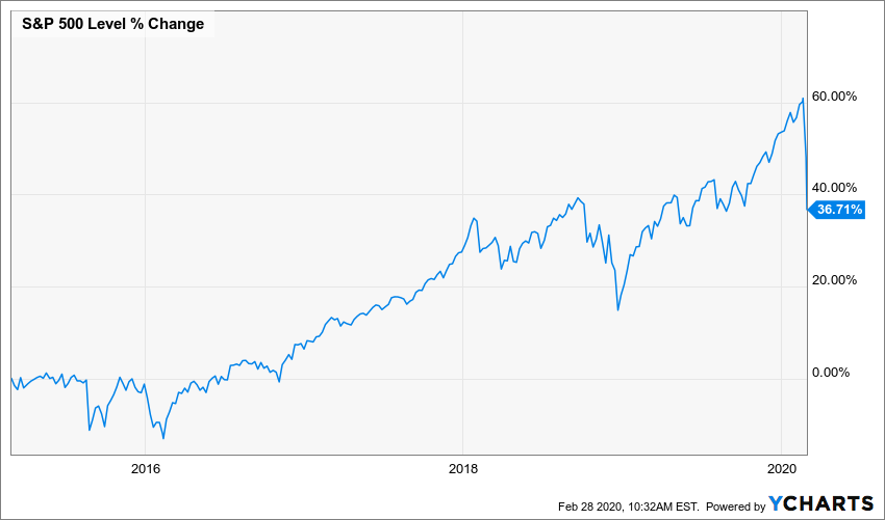

Concerns over the coronavirus have led to the fastest correction in stock market history. As of the opening of trading Friday morning the S&P 500 has declined from 3393 to 2880, or over 15%, from the all-time record high set last Wednesday. Meanwhile the yield on the Ten-Year Treasury has set record lows at 1.17%. This decline is painful and this outbreak unnerving, however it remains important to keep things in perspective. Let’s look at the growth in the S&P 500 over the last five years:

The market has given back the gains made in the 4th quarter of 2019. The future is uncertain, but today’s prices reflect an efficient pricing of all the information available. In the short-term the odds are even between a continued decline or bounce back rally. The swift decline reflects that the optimism of a resumption of growth in corporate earnings in 2020 has evaporated, although some forecasts have simply pushed out that growth to the back half of 2020. At this point everyone is just guessing because we are confronted with a global outbreak of a disease that is not well understood. The data so far suggests it is very contagious, but not particularly lethal except for people in more challenging health conditions. Be prepared for the headlines on the spread of the virus to get worse before it gets better.

Stocks were trading at historically high P/Es prior to this decline, supported by extraordinarily low interest rates that made the earnings yield attractive versus the risk-free rate. We take some comfort in that the recent decline in both equity prices and interest rates have widened that spread to historically high levels.

This episode serves to remind one to keep their allocation to equities consistent with one’s risk tolerance. Regardless of the absolute level of the market, it would make sense to target your equity allocation consistent with your risk tolerance. That might imply either buying or selling equities at these current levels. Please let us know if you would like to discuss whether the current amount of risk in your portfolio is appropriate.

Fear and greed are always the enemies of rational investing. Don’t panic. If history is a guide, this crisis will pass. Over the last 100 years we have had world wars, terrorist attacks, a global financial crisis, and numerous global epidemics of infectious diseases.

If you would like to discuss anything in greater detail, please do not hesitate to contact us.