Last Week:

The S&P 500 inched up 0.58% on extremely light volume to close at another record high. Small and Mid cap stocks drifted fractionally lower, and the yield on the Ten-Year Treasury slipped 5 basis points to 1.87%. There were a few reasons for good cheer. On the domestic front, holiday retail sales boomed according to MasterCard-SpendingPulse. On the trade front, China said it planned to cut tariffs on 859 products by January 1, including pork, pharmaceuticals, and some high-tech components.

I think that the policy reversal by the Fed in 2019 and resulting decline in both short and long-term interest rates were the engine that fueled the equity market rally. Caveat Emptor. At risk of being a Cassandra (mixing Roman and Greek references), it seems unlikely that formula can be repeated in 2020. It would be great to have 20-20 foresight rather than hindsight, but with imperfect vision into the future I would suggest that corporate profits need to show at least mid-single digit growth in order for the rally to be sustained. The good news is that rolling back the tariff costs combined with improving global economies provide a decent backdrop for improved earnings. The bad news is that the market is trading at a P/E that is approximately 20% higher than the long-term average, we added another trillion dollars to the national debt in 2019 and the myriad of potential black swans remain festering in the background.

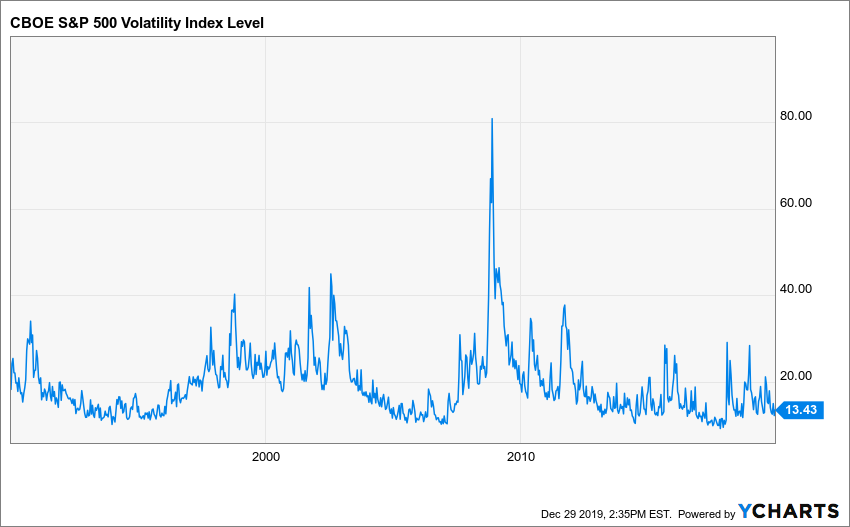

To be clear, we don’t forecast a bull or bear market in 2020. Perhaps a lion market? Lions spend 20 hours a day snoozing, but when they move they move quickly. We monitor a number of variables that we believe might give an early warning that nap time is over (U.S. Dollar, St. Louis Fed Financial Stress Index, Consumer Confidence, New Claims for Unemployment). There have been no danger signs yet. Perhaps the “Fear Index” (CBOE S&P 500 Volatility Index) tells the story best.

For another week, the only fear was the fear of missing out on the rally. It’s almost New Year’s Eve and no one has taken away the punch bowl, so let’s celebrate a fantastic 2019.

This Week:

There could be some profit-taking as taxes on those gains won’t be due until April 2021. Trading will likely continue to be very light with the markets being closed on Wednesday to celebrate the New Year. The Department of Labor reports initial jobless claims on Thursday. We continue to monitor that reading for any early signs of weakness in the economy.

Biggest Weekly Percentage Movers:

LEE +13.9%: Lee Enterprises, Inc. is a leading provider of high quality, trusted, local news, information and a major platform for advertising in 50 markets. Shares rebounded after declining over 30% the previous two weeks since reporting quarterly revenues that were viewed as disappointing, despite that the company continues to generate free cash flow and pay down substantial debt each quarter. LEE is a 0.82% holding in the North Star Opportunity Fund and LEE corporate bonds are a 2.40% holding in the North Star Bond Fund.