Last Week:

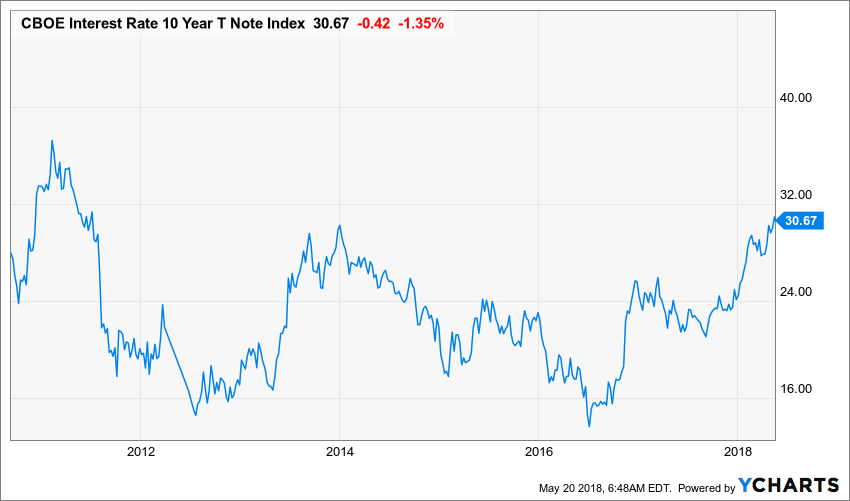

The Ten-Year Treasury yield moved comfortably over 3%, rising 10 basis points to levels not seen since 2011, without any reaction from the stock market, as the S&P 500 declined a modest 0.54%. Smaller stocks continued their recent outperformance, with the Russell 2000 gaining 1.23% to a new all-time high. It’s not clear whether progress is being made on the trade issues, but the recent interpretation of the tea leaves looks promising. Conversations with the Chinese appear to be focusing on extracting a commitment for China to increase their imports from the U.S., although the $200 billion “deal” quickly devolved into a game of he said (tweeted) Xi said. Over the weekend, Treasury Secretary Steve Mnuchin said “We’re putting the trade war on hold. So right now, we have agreed to put the tariffs on hold while we try to execute the framework.” Stay tuned.

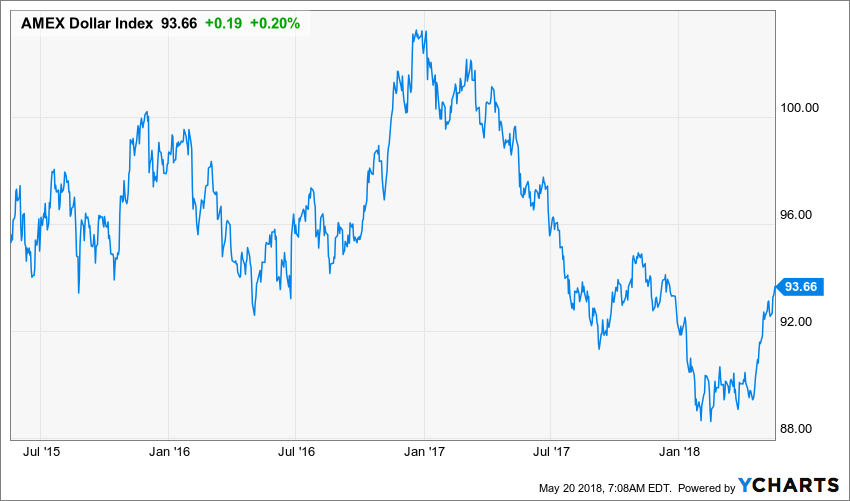

The Dollar continued its month-long rebound, posting over a 1% gain for the week. Whereas a strong currency is a headwind for exporters, we still contend that it demonstrates global confidence in the underlying economy and is important particularly given the massive debt issuance the U.S. government has planned over the next few years. On balance, we are encouraged by this recent strength in the greenback.

This Week:

Trade talk will likely dominate the narrative early in the week, with Wednesday’s release of the May FOMC meeting also in focus. The economic calendar is light, with April durable goods and May Michigan consumer-sentiment index on Friday as highlights.

Stocks on the Move:

Farmer Bros. Co. (FARM)+9.4%: The Company was highlighted as a possible takeover target of Cott Corporation (COT) by RBC analyst Nik Modi. Farmer Bros. is a national coffee roaster, wholesaler and distributor of coffee, tea and culinary products serving restaurant and convenience store chains, hotels, casinos, hospitals, and gourmet coffee houses, and grocery chains. FARM is a 2.1% holding in the North Star Micro Cap Fund.

Pioneer Power Solutions, Inc. (PPSI)-10.2%: Total revenue for the three-month period ended March 31, 2018 decreased to $23.5 million, down 6.3% compared to $25.1 million for the first quarter of 2017. The Company’s Adjusted EBITDA for the quarter ended March 31, 2018 was $1.3 million compared to $2.4 million in the same quarter last year. Management reaffirms its expectations for the Company to generate high-single-digit growth in revenues from continuing operations and to increase Adjusted EBITDA for the full year of 2018 compared to 2017. Nathan Mazurek, Pioneer’s Chairman and Chief Executive Officer, said, “Our first quarter was unsatisfactory in terms of both sales and profitability. Results were negatively impacted by a less than optimal mix in both our liquid-filled and dry type transformer businesses and continued weakness in the equipment portion of our critical power business.” “Fortunately, the long-term trends remain favorable,” continued Mr. Mazurek. “Backlog and quotation activity reflecting all our end markets remains robust, and we fully expect our revenue and profitability to move higher during the next several quarters. We continue to believe that Pioneer is well positioned for long-term profitable growth.” Pioneer Power Solutions Inc manufactures, sells and services a broad range of specialty electrical transmission, distribution, and on-site power generation equipment for applications in the utility, industrial, commercial and backup power markets. PPSI is a 1.0% holding in the North Star Micro Cap Fund and a 1.8% holding in the North Star Opportunity Fund.

Salem Media Group, Inc. (SALM)+19.5%: The Company’s shares rebounded, possibly in reaction to reasonably good earnings report the week earlier, in which earnings matched expectations and revenues slightly exceeded the consensus forecast. I had a post earnings call on Monday afternoon with Evan D. Masyr, Executive Vice President & Chief Financial Officer, and came away feeling comfortable about the current cash flow and debt profile of the Company, particularly as it relates to their commitment to pay dividends at the current rate. Salem Media Group is a domestic multimedia company with integrated operations including radio broadcasting, digital media, and publishing. The Company has three operating segments, Broadcast, Digital Media, and Publishing. SALM is a 1.6% holding in the North Star Dividend Fund.

Boot Barn Holdings, Inc. (BOOT)+12.4%: Net sales increased to $170.8 million in the fourth quarter of fiscal year 2018 (13 weeks), from $163.0 million in the fourth quarter of fiscal year 2017 (14 weeks). Net sales increased due to a 12.1% increase in same store sales, the sales contribution from 9 stores added over the past twelve months, and sales from the Country Outfitter site that was acquired in February 2017. Sales growth was partially offset by sales from the 14th week in the prior-year period. Net income was $6.9 million, or $0.24 per diluted share, in the fourth quarter of fiscal year 2018 (13 weeks), compared to $2.6 million, or $0.10 per diluted share, in the prior-year period (14 weeks). Jim Conroy, Chief Executive Officer, commented, “I am equally excited about the business in April and May as our double-digit same store sales growth has continued. We are looking forward to fiscal 2019 and the opportunities we have to drive profitable growth, re-accelerate store expansion, build out our multi-brand e-commerce strategy, and further develop our exclusive brands.” Boot Barn Holdings operates specialty retail stores that sell western and work boots and related apparel and accessories. The Company operates retail locations throughout the U.S. and sells its merchandise via the Internet. BOOT is a 2.2% holding in the North Star Micro Cap Fund.

Myers Industries, Inc. (MYE)-19.2%: Announced the pricing of an underwritten public offering of 4,000,000 shares of its common stock at a price to the public of $18.50 per share. Myers intends to use the net proceeds from the offering to fund growth of its business, including through selective acquisitions, to repay a portion of its outstanding indebtedness and for other general corporate purposes. Myers Industries is an international manufacturer of polymer products for industrial, agricultural, automotive, commercial and consumer markets. Myers is also a distributor of tools, equipment and supplies for the tire, wheel and under-vehicle service industry in the United States. MYE is a 2.6% holding in the North Star Dividend Fund.