Last Week

Traders on the NYSE floor could don their Dow 40,000 hats as Wall Street enjoyed another record-breaking week. The most significant market-moving news came on Wednesday with the release of the consumer price index for April. The data showed an increase at a slower-than-anticipated rate of 0.3% for the month, while the core CPI cooled for the first time since October 2023. A benign retail sales report the same day renewed investors’ optimism that Federal Reserve interest rate cuts are on the horizon. The push over 40,000 came on Thursday, with stellar earnings from Dow component Walmart providing a boost. The S&P 500 added +1.5%, and the Nasdaq Composite jumped +2.1%, with both indexes reaching new record highs. Small caps enjoyed a 1.7% advance; however, the Russell 2000 remains approximately 15% below its November 2021 high. There are bargains in small-cap land, with higher estimated earnings over the next several years and lower valuation multiples.

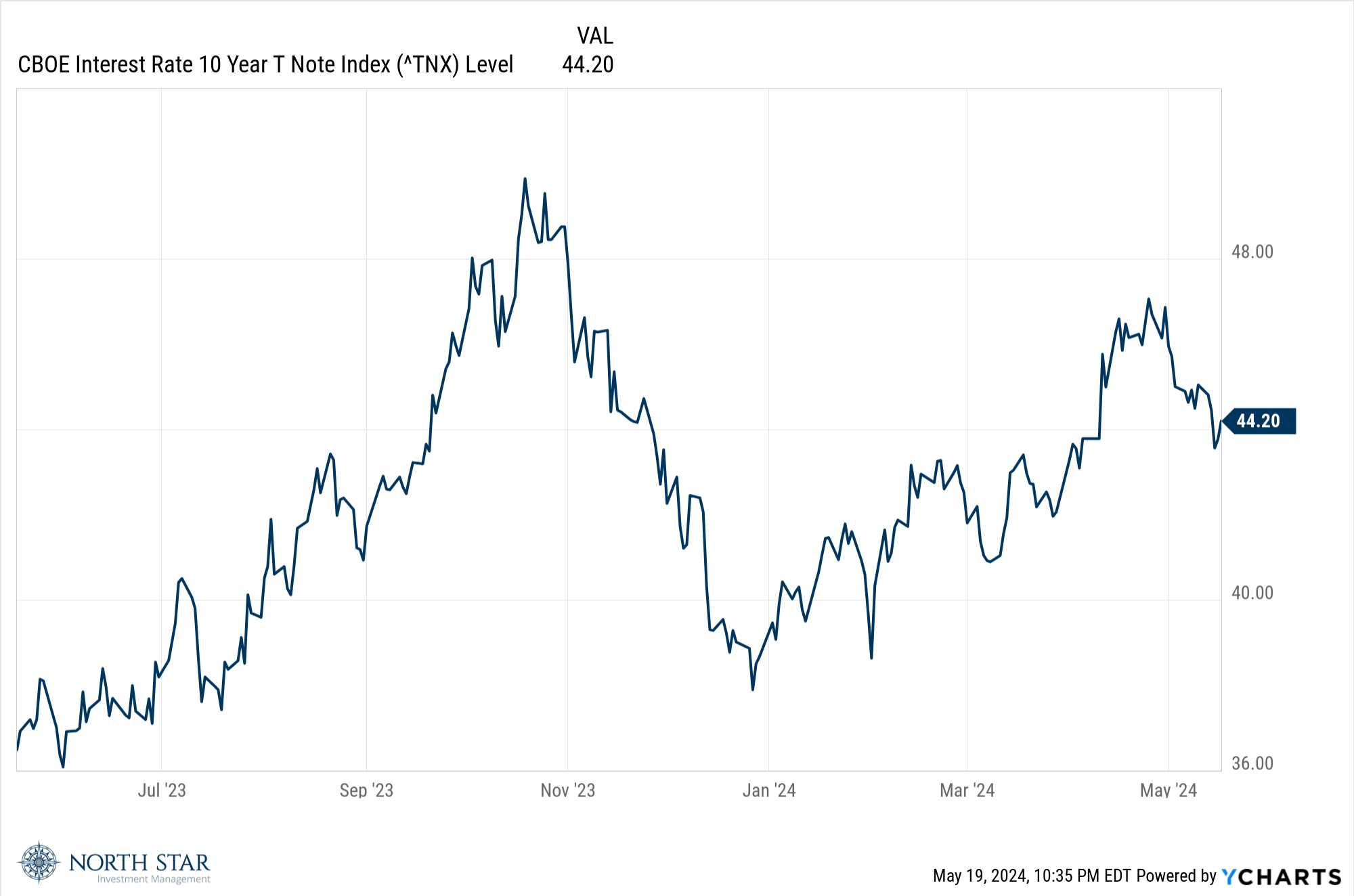

Many small caps have an additional catalyst that may emerge – small-cap companies tend to finance their debt using bank credit lines that fluctuate with prevailing interest rates, which has hurt pretax income growth in the past two years of rising interest rates. The opposite could develop if economic data shows signs of slowing or outright contraction in some sectors, such as capital equipment spending, as Deere (DE) pointed out last week, and significant renovation projects, as Home Depot (HD) pointed out recently. Several other companies have similarly stated the slowing of consumer and business spending on purchases typically paid for with lengthy financing terms. This suggests that the era of favorable real interest rates (well above the inflation rate) is likely behind us, which would bode well for small caps. The bond market seemed to agree last week, as bond investors benefitted from the dovish economic data, with the yield on the 10-year Treasury retreating eight basis points to 4.42%, pretty much the midpoint of its range over the last year.

The relatively stable 10-year rate combined with rising corporate earnings has provided the foundation for stock prices’ steady climb.

Crude oil and gold both moved higher as the dollar slipped slightly lower. Advancing issues outnumbered decliners by a factor of 2-1 on moderately heavy volume. The meme stocks were back in the news, with GameStop and AMC soaring and then plunging. Gamblers who enjoy long shots might consider betting on the White Sox as an alternative.

This Week

Fedspeak will remain in focus with Fed chair Jerome Powell set to deliver commencement remarks to Georgetown University Law Center via prerecorded video on Monday (Chairman Powell has Covid and is working from home). Additionally, the minutes of the Federal Reserve’s April/May monetary policy meeting will be released on Wednesday.

Although the earnings season is over, there will be a few high-profile reports. Nvidia is scheduled to announce fiscal first-quarter earnings on Wednesday, with extremely high expectations. Additionally, quarterly reports from retail majors such as Macy’s, Target, and Lowe’s will be another gauge of the consumer’s health.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.