Last Week:

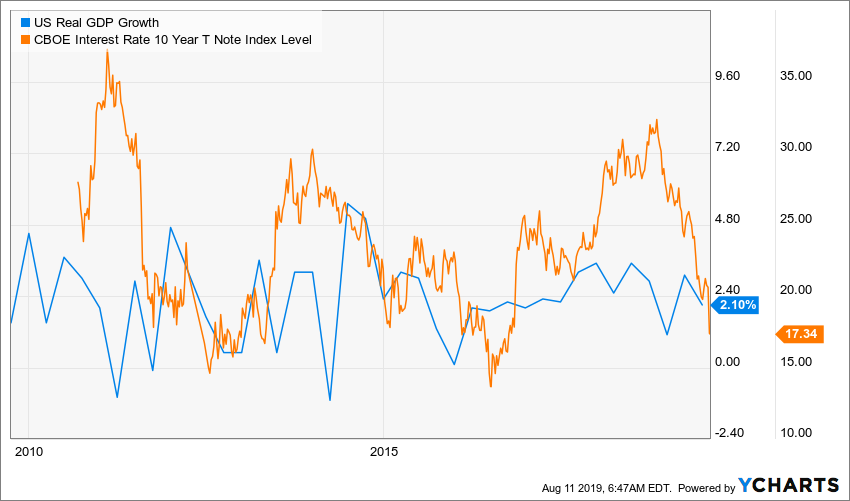

There is much ado about the plummeting interest rate offered by the Ten-Year Treasury. Many experts are interpreting those declining rates at as harbinger of an impending recession. It’s interesting to take note that we have seen this pattern twice before since the Great Recession of 2009. If we add a chart of GDP to this chart, we see that in general the economy has been slowing when the Ten-Year rate was high and rebounding when the rate reached a nadir.

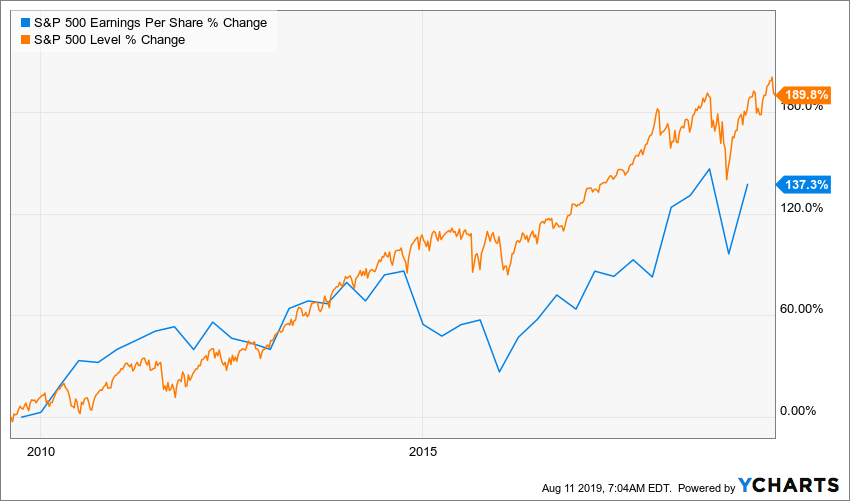

Meanwhile the S&P 500 has steadily made new highs and composite S&P earnings have continued to grow, albeit with occasional quarterly downticks.

It looks like Q2 2019 is going to be one of those downticks as with 90% of companies having reported results the blended decline is -0.7%. If that decline holds up, then it will mark the first time the index has reported two straight quarters of year-over-year declines in earnings since Q1 2016 and Q2 2016. I think it is likely that the market will need to see a resumption of earnings growth in order to make new highs, and that isn’t likely until Q4 at the earliest. On the other hand, with TINA (There Is No Alternative) still at play due to the very low interest rates, the 18x multiple on trailing earnings from the market doesn’t seem particularly expensive.

China trade dominated the narrative, and for the second straight week led to lower equity prices as the S&P 500 slid 0.46% and the Russell 2000 shed 1.34%. Trading was very volatile, with a steep sell-off Monday followed by a sharp rally Tuesday which was more than erased Wednesday morning but recouped Wednesday afternoon. Wow. The global slowdown exasperated by the trade friction was blamed during the selloffs, with the lower oil prices and shrinking bond yields cited as supporting evidence, the rallies had no coherent explanation. Some trading firms must have had a lot of fun.

This Week:

Traders will be most likely focusing on the U.S.-China trade dialogue, as earnings season is largely over, and the economic calendar is quiet. European politics are quite noisy, with parliamentary leaders in Italy meeting on Monday to meet to discuss the timing for a “no confidence” vote and the Brexit saga continuing to unfold. There’s also unrest in Asia, as flights were cancelled at the Hong Kong International Airport for the remainder of Monday following violent weekend demonstrations

Stocks on the Move:

(AMD) +16.13%: Advanced Micro Devices designs and produces microprocessors and low-power processor solutions for the computer and consumer electronics industries. The company launched the second generation of AMD EPYC, its server CPUs, which boosted investor sentiment. Moreover, AMD also announced that US tech giant Alphabet’s (GOOG) Google platform and Twitter (TWTR) would deploy its new generation of EPYC CPUs. AMD is a 2.61% holding in the North Star Opportunity Fund, and AMD corporate bonds are a 2.67% holding in the North Star Bond Fund.

(MDP) -10.54%: Meredith Corp is an American media company that focuses on publications and marketing services around the home, family, food, and lifestyle markets. There was no news to account for the share price decline. MDP is a 1.18% holding in the North Star Opportunity Fund.

(PLOW) +10.15%: Douglas Dynamics Inc is a manufacturer and upfitter of commercial vehicle attachments and equipment. The product line includes snowplows, sand and salt spreaders for light trucks, and turf-care equipment. The Company generated record second-quarter net sales of $176 million, and record net income of $25 million during the quarter. The strength in the performance this quarter was driven by ongoing positive demand trends, coupled with strong operational performance, particularly within the work truck solutions segment. PLOW is a 3.78% holding in the North Star Dividend Fund.

(GWRS) -10.42%: Global Water Resources Inc operates as a water resource management company that owns, operates, and manages water, wastewater, and recycled water utilities in strategically located communities, principally in metropolitan Phoenix, Arizona. Regulated revenues for the second quarter of 2019 were $9.1 million, which is an increase of $671,000 or 8% compared to Q2 of 2018. This increase is primarily driven by the organic connection growth in addition to the acquisition connection growth from Turner Ranches and Red Rock. Adjusted EBITDA was $4.5 million in Q2 of 2019, which is up $541,000 or 13.7% compared to Q2 of 2018. GWRS is a 2.62% holding in the North Star Dividend Fund.

(AMOT) -14.30%: Allied Motion Technologies Inc designs, manufactures and sells precision and specialty motion control components and systems. Revenue of $92.6 million was up $12.6 million, or 16%, and reflects growth across all of the Company’s served markets. Operating income increased 22% to $7.6 million as operating margin improved 40 basis points to 8.2%. Backlog reached a record level, increasing 20% over the prior-year period and 2% from the sequential first quarter. The time to convert the majority of backlog to sales is approximately three to six months. AMOT is a 1.05% holding in the North Star Micro Cap Fund.