Last Week:

My commentary from the previous week finished on an upbeat note, “The tone on trade improved over the weekend after President Trump said that Tim Cook made a “very compelling argument” that the tariffs on Chinese imports gave Samsung an edge over Apple. Trump also tweeted that “We are doing very well with China, and talking!” The market rallied on Monday and held those gains until Friday morning when the Tweet hit the fan. The day was off to a reasonably good start as Jerome Powell reinforced expectations for a rate cut in September, but apparently upset President Trump in the process by saying that the U.S. economy faces “significant risks” due to “trade policy uncertainty” which the central bank has limited ability to counteract. In response a tweet followed from the White House “My only question is, who is our bigger enemy, Jay Powell or Chairman Xi?”. Any possible sense that the Chinese might be off the hot seat was swiftly squashed as the President then “ordered” U.S. companies to “immediately start looking for an alternative to China.”

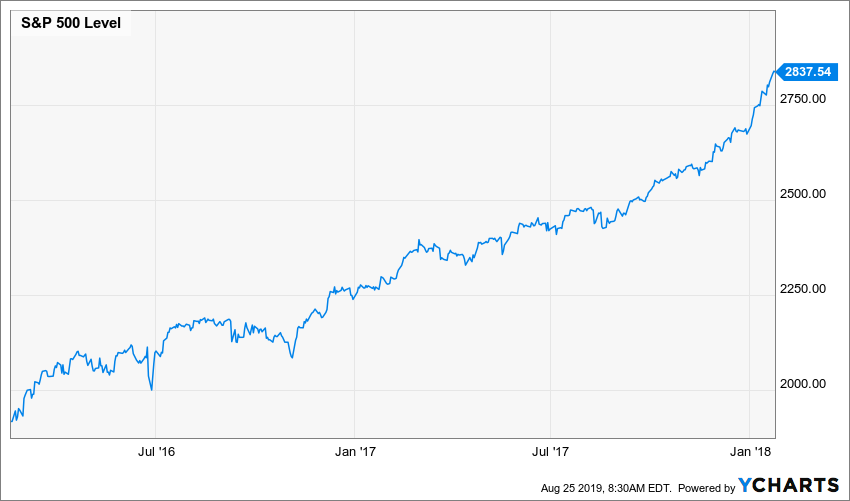

Here is a graph of the S&P 500 in the two years prior to the first imposition of tariffs as a negotiating strategy:

Here’s what’s happened since then:

Economic releases, earnings results, fundamental and technical analysis, anything and everything else has taken a back seat in the near-term and various short-term periods to the twists and turns of the trade war tweets, soundbites and other headlines. I do believe that the trade imbalances with China needed to be addressed, however the market reaction has made it clear that the recent “trade war” strategy is unwelcome. The S&P 500 finished down -1.44%, closing slightly above the recent low set on August 5. The yield on the Ten-Year Treasury slipped one basis point to 1.53%, while the U.S. dollar slid 1% off of its recent high. As always, these volatile and generally lower-price momentum periods for securities offer helpful opportunities to increase investments in businesses with strong long-term fundamentals and growth opportunities; knowing how businesses generate economic profits above their cost of capital provides confidence to invest when technical traders and algorithmic trading systems drive broad capital markets pessimism.

This Week:

Continued volatility is likely as we approach the September 1 imposition of additional tariffs on China. Tuesday’s release of the Consumer Confidence Survey for August might be important as confidence has remained at post-financial-crisis highs for much of the year. Expectations are for a reading of 130, down from July’s 135.7. Too cold a number might rattle the market as the bull case is built on the resilience of the U.S. consumer which makes up 70% of the economy.

Stocks on the Move:

(NCMI) +10.76%: National CineMedia Inc is a holding company that operates a digital in-theatre media network across North America. Two weeks ago the Company reported better than expected earnings and the share price dropped. Perhaps yield-oriented investors noticed the earnings increase and the high and seemingly secure dividend rate and took advantage of the sell-off as a buying opportunity. NCMI is a 2.38% holding in the North Star Dividend Fund and a 2.03% holding in the North Star Opportunity Fund. NCMI Corporate Bonds are a 2.79% holding in the North Star Bond Fund.

(OESX) -11.07%: Orion Energy Systems Inc is a developer, manufacturer, and seller of lighting and energy management systems. After reporting record earnings at the beginning of August, investors seem to be wondering “what’s next?”. Momentum can be a fickle friend as the share price surge gave way to profit-taking. OESX is a 1.65% holding in the North Star Micro Cap Fund and a 3.56% holding in the North Star Opportunity Fund.

(TGT) +22.90%: Target Corp is a leading American general merchandise retailer with 1,844 stores (as of the end of fiscal 2018), offering a variety of products across several categories, including beauty and household essentials (24% of fiscal 2018 sales), apparel and accessories (20%), food and beverage (20%), home furnishings and decor (19%), and hardlines (17%). The Company reported second-quarter results Wednesday morning, which sent shares to a new all-time high. The department store giant not only reported a top- and bottom-line beat but management lifted its full-year earnings outlook higher. Wall Street analysts called the quarter “transformational” and raised the price targets substantially. TGT is a 2.33% holding in the North Star Opportunity Fund.

(ODC) -12.44%: Oil-Dri Corp of America develops, manufactures, and markets sorbent products made primarily from clay. Its absorbent offerings, which draw liquid up, include cat litter, floor products, toxin control substances for livestock, and agricultural chemical carriers. There was no news to explain the share price decline. ODC is a 2.59% holding in the North Star Dividend Fund.

(ARC) -10.6%: ARC Document Solutions Inc is a global document solutions provider. The company’s service offerings include managed print services (MPS), offsite services, archive and information management ( AIM), specialized color printing, Web-based document management applications, and equipment and supplies sales. Its product application involves in several industries such as the architectural, engineering, and construction. The Company’s shares reached their lowest level ever as concerns grew that their business would be susceptible to a slowdown in construction activity. ARC is a 0.48% holding in the North Star Micro Cap Fund.

(SMED) +11.75%: Sharps Compliance Corp is a United States-based provider of waste management services including medical, pharmaceutical and hazardous. Revenue in the fourth quarter of fiscal 2019 was $12.2 million an increase of 23% compared to $9.9 million in the same prior year quarter and operating income of $0.6 million in the fourth quarter of 2019, compared to an operating loss of $0.1 million in the fourth quarter of 2018. David P. Tusa, President and Chief Executive Officer of Sharps, stated, “We closed out fiscal 2019 with a strong fourth quarter, as evidenced by solid revenue growth, both year over year and on a sequential basis, improved gross margins and improved profitability. During the quarter we delivered substantial growth across our three leading solution offerings: route-based, mailback and unused medications; and drove record billings growth across all of our market segments. We believe the fourth quarter reflects the success of our strategy to transform the business from a provider of medical waste management mailbacks only, to a comprehensive solutions provider serving a broad range of customers in the Healthcare and Retail markets. SMEDis a 1.27% holding in the North Star Micro Cap Fund.

(PRTS) +10.43: U.S. Auto Parts Network Inc is an online provider of automotive aftermarket parts and repair information. The shares continued their recent advance as shrewd investors take note of the improvement in their gross margins from the last quarterly report. PRTS is a 2.33% holding in the North Star Micro Cap Fund.