Last Week:

President Donald Trump and Chinese Vice Premier Liu He finally signed a phase-one trade deal on Wednesday. The eight-part deal includes protections for trade secrets and intellectual property, mechanisms for enforceability, and commitments by Beijing to increase purchases of U.S. goods and services by $200 billion over the next two years and broadens U.S. companies’ access to China’s markets. The bad news is that tariffs on $370 billion of Chinese imports still stand—roughly two-thirds of what the U.S. buys from China—with Trump indicating that they would come off when phase two (the more complex issues) is completed. The “trade war” over the last two years caused a drag on global growth and headwinds for the market. The brilliant spin of the “phase-one” strategy generated optimism that has helped propel stocks to new heights, with the S&P 500 closing up another 1.97% to another record level, and with the Dow Jones Industrial Average quickly approaching 30,000.

Earnings season is off to a ho-hum start, with the forecasted decline in fourth quarter earnings widening to 2.1% from 2.0% due to weakness in the Energy sector. The Financial sector has dominated the headlines, with the beats and misses essentially canceling each other out.

There was also a mixed bag of U.S. economic data, with housing starts surging an unexpected 16.9% to a 13-year high, while industrial output and consumer sentiment slipped a bit.

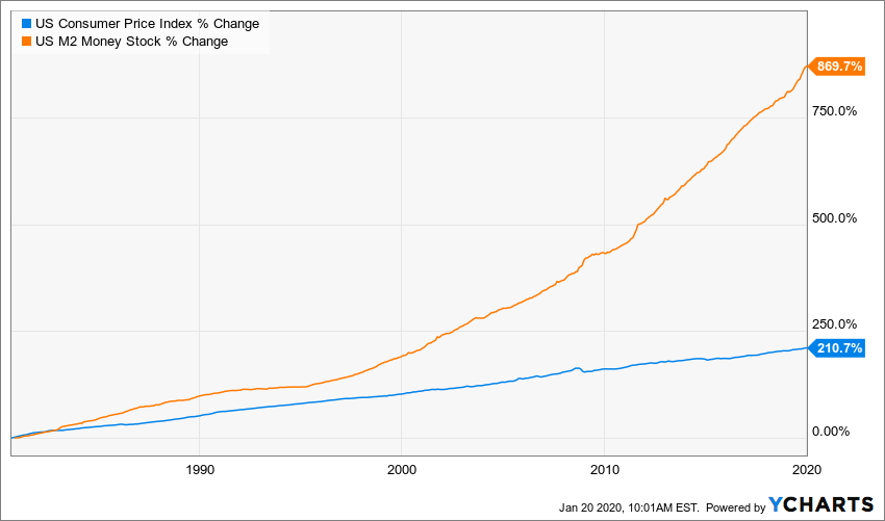

Interest rates remained stable at very low levels as the yield on the Ten-Year Treasury inched up 2 basis points to 1.84%. For another week the punch bowl remained filled to brim with global liquidity, and the financial party raged on. My University of Chicago roots leads me to wonder what would Milton Friedman think.

Inflation is always and everywhere a monetary phenomenon.

— Milton Friedman, 1963.

Where’s the beef? (Inflation)

This Week:

Earnings season will continue with 58 S&P 500 companies (including six Dow 30 components) scheduled to report results for the fourth quarter. The bar has been set low enough for companies to exceed expectations, although there will still be no growth in composite earnings.

The impeachment trial starts in Washington with an accelerated timetable. It is widely believed that President Trump will not be convicted, and the stock market has largely ignored the entire process.

The World Economic Forum in Davos will sharing the headlines, but also is unlikely to have a material effect on the markets. The official theme is “Stakeholders for a Cohesive and Sustainable World”.

The economic calendar is light, with the flash PMIs on Friday as the key data point.

Asian markets are under pressure due to concerns over the Coronavirus. The mysterious respiratory virus has caused six deaths with 291 confirmed cases.

Stocks on the Move:

GWPH +10.6%: GW Pharmaceuticals PLC, founded in 1998, is a biopharmaceutical company focused on discovering, developing and commercializing novel therapeutics from its proprietary cannabinoid product platform in a broad range of disease areas. The company exceeded fourth-quarter estimates for Epidiolex sales, notching $108 million in revenue for the CBD drug. Bank of America Securities analyst Tazeen Ahmad maintained a Buy rating on GW Pharma with a $224 price objective. GWPH is a 1.32% holding in the North Star Opportunity Fund.

OESX + 29.2%: Orion Energy Systems, Inc. is a provider of LED lighting and turnkey energy project solutions designed to reduce energy consumption and enhance business performance and efficiency. Analysts are suggesting that Orion is well positioned to gain market share away from Acuity Brands, Inc., the industry’s largest company. OESX is a 3.71% holding in the North Star Micro Cap Fund and a 5.49% holding in the North Star Opportunity Fund.

PETQ: +20.5%: PetIQ, Inc., a leading pet medication and wellness company, announced that the Company had opened 20 new wellness centers for a total of 80 wellness centers across 22 states and 5 host retail partners in 2019. “We are pleased with our 2019 class of wellness center openings, which met our timeline and budget,” commented Susan Sholtis, PetIQ’s President. “Our stringent operating criteria, which was put in place last year, ensures alignment with our retail host partners and leverages our collective knowledge of each location’s customer base from our network of community clinics and surrounding demographic profile.” Additionally they executed a definitive agreement under which PetIQ will acquire Capstar (CSTR)®, the #1 oral over-the-counter (“OTC”) flea treatment product in the United States, from Elanco Animal Health, Inc. (“Elanco”) (NYSE: ELAN). PETQ is a 1.50% holding in the North Star Opportunity Fund.