Last Week:

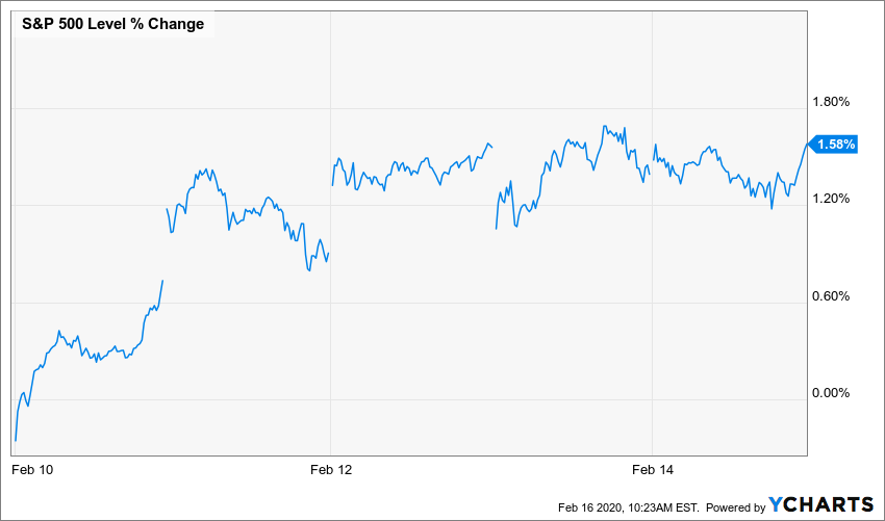

The rally resumed as the S&P 500 gained 1.58% to close at another new record high. Most of the action took place on Monday and the first hour of trading on Tuesday, as stocks recovered their losses from the previous Friday and then tacked on an additional 1% for good measure. Corporate earnings continued to top expectations with the blended growth rate increasing to 0.9% from 0.6% the previous week. The forward 12-month P/E ratio increased to 18.9, which is above the 5-year average and above the 10-year average, as a result of prices continuing to rise faster than earnings. The coronavirus remains a wildcard as to whether those forward earnings will materialize as expected. FactSet did an excellent review of how companies have been addressing that issue during quarterly conference calls. FactSet searched for the term “coronavirus” in the conference call transcripts of the 364 S&P 500 companies that conducted fourth quarter earnings conference calls from January 1 through February 13. They noted that 138 (or 38%) cited the term “coronavirus” during the call with 47 companies stating during their earnings call that it was too early (or difficult) to quantify the financial impact or were not including any impact from the coronavirus in their guidance. On the other hand, 34 companies included some impact from the coronavirus in their guidance or modified guidance in some capacity due to the virus. In short, given the large number of companies that did not update or modify guidance due to the impact of coronavirus, it is possible that there will be an increase in the number companies issuing negative guidance later in the first quarter as these companies gain clarity on the impact of the coronavirus on their businesses.

Initial Claims for Unemployment came in at 205,000 versus consensus 212,000. Claims have now held under 300,000 for 258 consecutive weeks. Inflation data was largely in-line with expectations leaving little concern for rate hikes. The January Consumer Price Index (CPI) rose 0.1% m/m and 2.5% y/y. Core inflation, excluding food and energy, rose 0.2% m/m and 2.3% y/y. Retail sales for January rose 0.3%, as expected, continuing the trend of modest discretionary spending. The preliminary February University of Michigan Consumer Sentiment Index (100.9 versus consensus 99.2) revealed a continuation of positive consumer attitudes.

The yield on the Ten-Year Treasury dropped one basis point to 1.58%. The U.S. Dollar climbed to its highest level since last summer, while both gold and oil also gained.

This Week:

U.S. markets were closed on Monday in observance of Presidents Day and my wife’s birthday. It was also Michael Jordan’s birthday. I’m surprised that the NBA didn’t extend the All-Star festivities for another day to celebrate.

Earnings season winds down with 51 S&P 500 companies scheduled to report results for the fourth quarter.

The impact of the coronavirus will remain in focus. Over the weekend China provided medium-term funds to banks and cut interest rates to cushion its economy from the outbreak. European and Chinese shares advanced Monday morning in response to that action. On the other hand, Nasdaq futures tumbled with stocks in Europe and Asia after Apple cut its revenue guidance before the market open on Tuesday because of the coronavirus.

The economic calendar is pretty busy, with Wednesday’s reports on inflation worth keeping an eye on. The expectation is that both CPI and PPI remain tame.

Stocks on the Move:

AMD +11.2%: Advanced Micro Devices Inc. designs and produces microprocessors for the computer and consumer electronics industries. Shares continued their recent assent as strong earnings from Nvidia reinforced analysts’ confidence in the outlook for the gaming and data center markets. AMD is a 2.70% holding in the North Star Opportunity Fund and AMD corporate bonds are a 2.43% holding in the North Star Bond Fund.

LEE -17.8%: Lee Enterprises Inc. is a local news publication company in the United States. Its products include daily and Sunday newspapers, weekly newspapers and classified and few other specialty publications. The Company filed for a $500 million mixed shelf offering. The prospectus covers the sale from time to time of shares of common stock, preferred stock, debt securities, depositary shares, warrants, and subscription rights and units. Charles Munger didn’t help the mood for newspaper stocks at a speech during the annual meeting of Daily Journal Corp, the Los Angeles newspaper publishing company he chairs, though he is better known for his more than four decades as a Berkshire vice chairman. “What’s happened is that technological change is destroying daily newspapers in America,” Munger said. “They’re all dying.” LEE is a 0.94% holding in the North Star Opportunity Fund and LEE corporate bonds are a 2.7% holding in the North Star Bond Fund.

OESX +17.1%: Orion Energy System Inc. is a provider of LED lighting and turnkey energy project solutions designed to reduce energy consumption and enhance business performance and efficiency. Orion designs, manufactures, markets and manages the installation and maintenance of LED solid-state lighting systems, along with integrated smart controls. Orion systems utilize patented design elements to deliver industry-leading energy efficiency, enhanced optical and thermal performance and ease of installation, providing long-term financial, environmental, and work-space benefits to a diverse customer base, including nearly 40% of the Fortune 500. Orion’s third quarter revenue rose 110% to $34.2M, compared to $16.3M in the prior year period , and net income rose to $2.3M, or $0.07 per diluted share, versus a net loss of ($0.7M), or ($0.02) per share. Mike Altschaefl, Orion’s CEO and Board Chair, commented, “Our fiscal 2020 performance to date reflects the continued successful execution of a nationwide turnkey design-build-install LED lighting system retrofit and controls project for a major national account. As anticipated, we expect to complete initial awards for this project in our current fiscal fourth quarter. In addition, installations for our recently announced $18 to $20 million project expansion for this same customer are slated for completion during our fiscal fourth quarter and our fiscal 2021 first quarter ending June 30, 2020. Our expanded senior sales team is remaining focused on our turnkey solutions offerings and this unique and wholistic approach is resonating very strongly with customers. Our sales team has developed a range of large national account opportunities on which we are working to advance to formal awards over the next several months. In addition, our new senior sales executives have begun to make meaningful contributions to our sales pipeline as they become comfortable in our customer-centric culture and gain an understanding of our product quality advantages and the custom capabilities and turnkey services that we are able to bring to customers.” OESX is a 4.81% holding in the North Star Micro Cap Fund and a 5.69% holding in the North Star Opportunity Fund.

HCSG +11.0%: Healthcare Services Group Inc. is a provider of housekeeping and facility-management services to the healthcare industry. The company operates two business segments: housekeeping and dietary. HCSG reported for the three months ended December 31, 2019 revenue of $447.0 million, net income of $18.9 million, or $0.25 per basic and diluted common share, and cash flow from operations of $13.4 million. Additionally, the Company’s Board of Directors declared a quarterly cash dividend of $0.20125 per common share, the 66th consecutive increase since the initiation of dividend payments in 2003. Ted Wahl, Chief Executive Officer, stated, “During the quarter, we were focused on managing the base business and effectively deploying our account managers to new opportunities. That focus paid off, as we delivered solid facility-level results and made progress on reassigning account managers to new facilities. While our Q4 payroll costs remained temporarily higher as we continue to have excess management capacity, we expect these costs to decrease in the coming quarters.” HCSG is a 2.66% holding in the North Star Dividend Fund.

ZAGG +14.6%: Zagg Inc. is primarily engaged in designing, producing, and distributing product solutions for mobile tech accessories for smartphones and tablets. Its products consist of screen protectors, keyboards for tablet computers and mobile devices, earbuds, mobile power solutions, cables, headphones, Bluetooth speakers, and others. InvisibleShield®, a ZAGG Brands company and the leading global innovator in screen protection, announced Ultra VisionGuard®+ and Ultra Clear+ for the all-new Samsung Galaxy® S20, S20+ and S20 Ultra smartphones. Featuring advanced clarity and premium glass-like feel, Ultra VisionGuard+ combines anti-microbial technology that kills 99.99% of surface bacteria and germs, and Eyesafe® technology to safeguard against overexposure to high-energy visible (HEV) blue light. Ultra Clear+ has the same anti-microbial treatment, while delivering unbeatable strength to protect Samsung’s latest smartphones. ZAGG is a 1.10% holding in the North Star Micro Cap Fund.