Last Week:

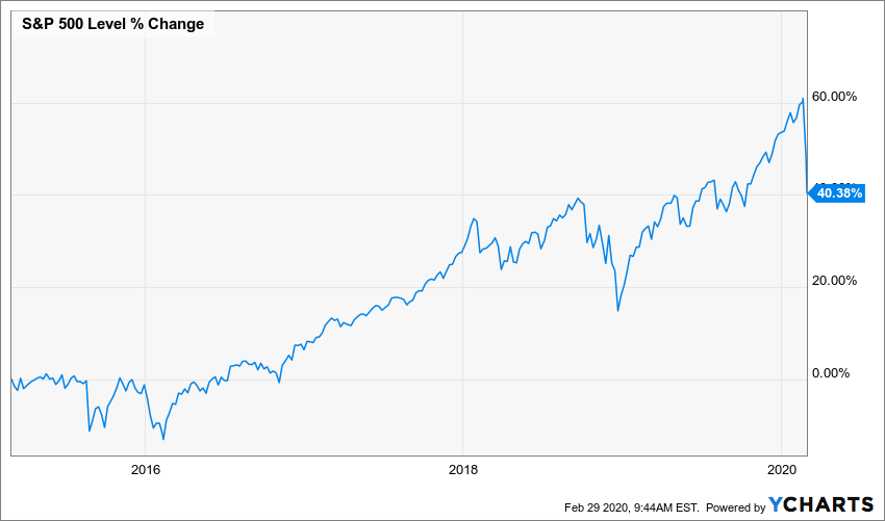

The Stock market suffered its worst losses since the 2008 financial crisis with the S&P 500 plunging 11.49%. The decline wiped out all the gains from the last leg of the rally that started in early October. I’m not a chartist, but it is interesting to note that the decline took the market simply back down to its 3, 5, or 10-year trend line. Here is the 5 year for example:

Not to diminish the reality of the pain, but in this context the decline seems less extraordinary. The adage that the market goes up like an escalator and down like an elevator once again proved to be true. The global spread of the coronavirus was the elevator operator who pushed the down button. The optimism over a resumption in earnings growth in 2020 based on the unwinding of the tariff drag and continued global monetary stimulus (easy money) had driven equity valuations to historically elevated levels on an absolute basis, with the forward P/E on the S&P 500 reaching 19x just 10 days ago when the market reached a record high. Baked in to the “E” was approximately 7% earnings growth in 2020. Those forecasts have been slashed already, and in reality there is not enough information yet to reasonably quantify the economic impact of the outbreak. The bad news is the expected decline in forward earnings may equal or exceed the recent decline in stock prices, thus leaving equity valuations still at elevated levels despite the lower prices.

Perhaps even more remarkable was the action in the bond markets, where the benchmark 10-year Treasury note tumbled all week long before settling 17 basis points down to a fresh record low of 1.13%, while the two-year yield plunged 22 basis points to 0.88%. As such, the spread between the earnings yield and the 10-year rate widened. That spread has supported equity prices for the last 10 years, as “TINA” (there is no alternative) has been the underpinning for stocks. Once this crisis passes, investors will most likely be confronted with the same decision between stocks and very paltry yields on bonds and cash alternatives.

Analysts have been focusing on the 2003 SARS outbreak as the most similar precedent to the current crisis. Severe Acute Respiratory Syndrome (SARS) was first discovered in Asia in February 2003. The outbreak lasted approximately six months as the disease spread to more than two dozen countries in North America, South America, Europe, and Asia before it was stopped in July 2003. The market dropped sharply and then recovered during that period. Unfortunately there are more differences than similarities in these two cases. First, SARS infected more than 8,000 people causing 774 deaths, while the coronavirus has already infected close to 90,000 people, and the death toll is approaching 3000 and rising. The second difference arises from the fact that global firms are much more reliant on Chinese factories today than they were at the time of the SARs outbreak; China now accounts for 16% of global GDP up from 4% back then.

This Week:

Updates on the spread of the coronavirus and its impact on global economies will dominate the news flow and dictate the mood of the markets. That mood will certainly be somber going into trading, as on Saturday data released indicated that a gauge of Chinese manufacturing sank to a record low in February. The Fed to the rescue? Friday afternoon the Fed took the unusual step of releasing a statement indicating that policy makers will use their tools “and act as appropriate to support the economy”. Whereas monetary policy can’t cure the virus, aggressive measures probably would help buffer the economic impact in the short-run and support the markets.

The U.S. economic calendar has some high-profile data, such as the ISM manufacturing index on Monday, but those releases will have limited impact as past data will seem outdated given the changed landscape.

March 3 is Super Tuesday with the greatest number of U.S. states holding primary elections and caucuses. The outcome could affect the markets.

Stocks on the Move:

Normally we list the companies whose share price changed more than 10% during the prior week. This week we will highlight just the 6 biggest percentage movers.

WEN -21.1%: Wendy’s Co is a quick-service restaurant franchisor, operating restaurants under the brand name Wendy’s. The fast food chain reported a Q4 adjusted EPS of $0.08 that slumped from $0.16 a year ago and slightly missed the $0.09 average estimate from analysts polled by Capital IQ. Revenue, meanwhile, climbed to $427.2 million from $397.8 million a year earlier, beating the $423.7 million mean. “We delivered a very strong year of sales growth and have laid the foundation in 2019 to set the Wendy’s® brand up for future success,” President and Chief Executive Officer Todd Penegor said. “We have momentum in our business as evidenced by our accelerating sales growth in the second half of the year, which sets us up well going into 2020. Our focus remains on efficient, accelerated growth behind our three major growth pillars: entering the breakfast daypart, growing our digital business, and expanding our International footprint. We are well positioned to drive growth in 2020 and I’m more confident than ever that we will achieve our vision of becoming the world’s most thriving and beloved restaurant brand.” WEN is a 0.98% holding in the North Star Opportunity Fund and WEN corporate bonds are a 2.80% holding in the North Star Bond Fund and a 1% holding in the North Star Opportunity Fund.

ZAGG -20.1%: Zagg, Inc. is a U.S. based company that is primarily engaged in designing, producing, and distributing product solutions for mobile tech accessories for smartphones and tablets. Its products consist of screen protectors, keyboards for tablet computers and mobile devices, earbuds, mobile power solutions, cables, headphones, Bluetooth speakers, and others. There was no company specific news to account for the share price decline. ZAGG is a 1.01% holding in the North Star Micro Cap Fund.

GWPH -18.6%: GW Pharmaceuticals PLC is a biopharmaceutical company focused on discovering, developing and commercializing novel therapeutics from its proprietary cannabinoid product platform in a broad range of disease areas. The company’s lead product candidate is Epidiolex, which is a liquid formulation of pure plant-derived cannabidiol used for the treatment of a number of rare childhood-onset epilepsy disorders. Total revenue for the quarter ended December 31, 2019 was $109.1 million compared to $6.7 million for the quarter ended December 31, 2018, and the net loss for quarter ended was $24.9 million compared to a net loss of $71.9 million. “2019 was an exceptional and transformative year for GW, led by the successful launch of Epidiolex in the US and approval in Europe. The positive impact this medicine has had on thousands of patients and their families provides a compelling foundation for continued growth in 2020,” said Justin Gover, GW’s Chief Executive Officer. “We also expect 2020 to be an important year for our growing and developing product pipeline beyond Epidiolex as we build on our world leadership in cannabinoid science. We are focused on advancing nabiximols in the U.S. in several indications and clinical programs with other potential products whilst continuing to bring Epidiolex to more patients in the US and Europe.” GWPH is a 1.24% holding in the North Star Opportunity Fund.

BGSF -18.6%: BG Staffing, Inc. provides workforce solutions to a variety of industries through its various divisions in IT, Cyber, Finance & Accounting, Creative, Real Estate (apartment communities and commercial buildings), and Light Industrial. Recessionary concerns hit the shares of all the companies in the staffing industry. BGSF is a 2.69% holding in the North Star Dividend Fund and a 1.50% holding in the North Star Opportunity Fund.

LRN +18.6%: K12, Inc. is an American online educational company. The company offers alternative programs to traditional on-campus schooling. K12 also operates state-funded virtual charter schools around the United States. The educational programs for K-12 students are usually monitored by parents and provide virtual classroom environments where teachers meet with students online, by phone, or in-person. The appeal of online education captured investors interest as school closings were announced in response to the coronavirus outbreak. LRN is a 1.73% holding in the North Star Micro Cap Fund.