Last Week:

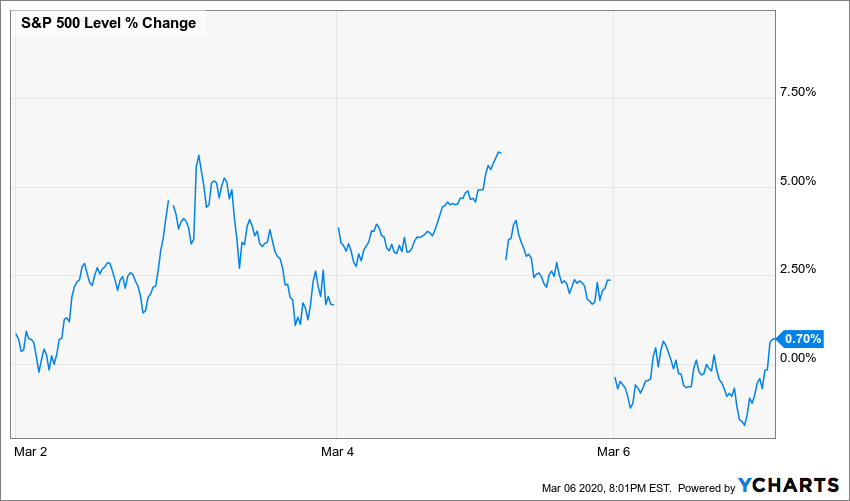

If you spent the last week off the grid (hopefully not on a cruise ship) and returned to civilization over the weekend, then you probably would be encouraged to see that the S&P 500 posted a 0.70% gain. “Thank goodness, a quiet recovery after the wild sell-off the previous week” you might conclude. Well, not exactly:

The market experienced 4-5% daily swings every day, with a 2.3% rally in the final hour providing the lift to take the index into the green for the week.

The rally early in the week seemed to have been ignited by the rumor and then reality of an emergency interest rate cut, as the Federal Reserve on Tuesday cut rates by half a percentage point, an attempt to limit the economic and financial fallout from the coronavirus. The U.S. central bank has not made a cut like this since late 2008, shortly after the collapse of Lehman Brothers.

The magnitude of these wild swings is hard to explain, except to note that when computers trade at high velocity it is usually in one direction (buying begets buying and selling begets selling).

Small cap stocks fared much worse, with the Russell 2000 sliding 4.56% and the Russell 2000 Value even worse with a 5.41% decline.

I experienced a déjà vu on Thursday, listening to Larry Kudlow’s reassuring advice. “We don’t actually know what the magnitude of the virus is going to be, although frankly, so far, it looks relatively contained,” Kudlow told CNBC on Friday. “The vast majority of Americans are not at risk of this virus.”

Kudlow also said “America should stay at work,” arguing that the private sector is “going to solve this disease” and again reiterating, “I will still argue to you that this is contained. It can’t be airtight, but … in a relative sense, relative to our population, relative to ordinary flus … I think it is relatively contained.”

It was 1987, I was a young broker at Bear Stearns and Kudlow was the newly appointed chief economist. The markets were volatile and Kudlow gave a terrific reassuring speech at a company-wide event. The next week the market crashed. It’s worth noting, however, that within two years the market was once again setting new records, before increasing ten- fold over the next 30 years. As they say, history doesn’t repeat itself, but it does rhyme. These periods of volatility reinforce the importance of adopting a long-term perspective and establishing the appropriate allocation to equities consistent with one’s risk tolerance.

In the bond market, yields on U.S. Treasury bonds continued their record-breaking declines during the week. On Friday the yield on the 10-year Treasury note was down for the 12th straight day, its longest losing streak on record. It settled at 0.709% on Friday afternoon, an all-time low, after dipping below 0.700% in the morning.

U.S. employment increased more in February than economists expected, figures released on Friday morning showed. The Department of Labor reported that employers expanded payrolls by 273,000 jobs in February, while revisions to data from previous months added 85,000 more jobs to the tally. The jobless rate ticked down to 3.5 percent. Of course that data represents a picture of the U.S. economy before the coronavirus impact took hold. Economists predict that March could be significantly weaker as the general uncertainty could mean companies hold back on hiring.

Gold posted its largest weekly gain in more than four years, gaining 7% to reach $1673. The all-time high was $1895 per troy ounce set in 2011. The Dollar declined 1.4% to reach its lowest level of 2020.

This Week:

The spread of the coronavirus and its economic impact will continue to dominate the headlines and market movement. Business conferences, trade shows, cultural events, and sporting contests are affected, as organizers take precautionary steps to battle the spread of the disease.

The disintegration of the OPEC + alliance triggered a collapse of oil prices over the weekend. Saudi Arabia announced plans to increase oil output to a record 12 million barrels a day, and offered unprecedented discounts to customers. Brent prices dropped as much as 30% by Monday morning, reaching a low of $31.02 per barrel. The potential damage of that steep decline to the high-yield market as well as to the budgets of oil-dependent nations combined with the coronavirus panic sent global equity markets into steep sell-off, with U.S. equity futures limit down prior to the opening.

Stocks on the Move:

As I indicated earlier, it was a tough week for small cap value stocks. In general these movements were related to investor perception over how the companies would be affected by the coronavirus, rather than any company specific news. There were 21 stocks that moved double digits, if you are interested in the specifics, please contact us.