Last Week:

These are confusing times. A global financial markets meltdown has been triggered by a virus that to date has resulted in over 6700 fatalities. It’s a nasty disease that recent data suggests is very contagious and has a much higher fatality rate than known diseases such as the flu. Some media reports are forecasting horrifying worst-case scenarios that suggests the possibility of half the country being infected with 200,000 to 1.7 million deaths.

Let’s call timeout! We don’t know what’s going to happen. It could be now with the government and public taking this health risk seriously that we follow the trajectory of China and South Korea, where aggressive actions led to a relatively short duration of the outbreak. Whereas the media is serving a valuable function by communicating the best practices to flatten out the curve of the spread, they also understand the power of a frightening storyline to keep people viewing. As far as the markets are concerned, beware of the trading machines which create and profit from spikes in volatility and the vulnerability of humans to succumb to the fear/greed pendulum.

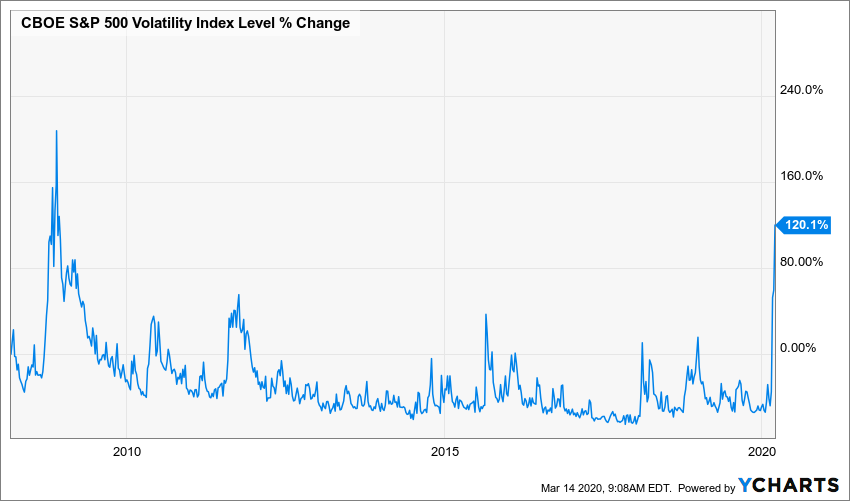

Volatility is a trader’s best friend. After a lengthy period of low volatility, we have just experienced the biggest surge since the financial crisis. History would suggest that this volatility will persist for a period of several weeks or months. These are times to make sure your equity allocation is consistent with your risk tolerance, and to make a shopping list to buy great companies if they trade at bargain prices.

Yields on U.S. Government bonds reached their lowest levels ever on Monday at 0.39%, before rising to finish the week at 0.95%. The Dollar surged 4.1% to reach within one percent of its 2020 high. Gold declined 8.9%, erasing its entire gain for the year, as holders apparently needed to sell to create liquidity.

The oil shock from last weekend was the other big story creating chaos. WTI hit a low on Monday of $31.13, down almost 50% for 2020, before bouncing modestly to finish at $31.73. It was a rare week when both energy and airline stocks got pummeled. Fueled by the oil-price war and virus concerns, the market opened down 7% on Monday, triggering a 15-minute trading halt. The 11-year bull market officially ended on Thursday, which was the worst day since Black Monday in October 1987. It also happened to be my birthday, which I celebrated with a group of my basketball friends as the market crashed and the NCAA tournament was cancelled (besides that, Mrs. Lincoln, how did you enjoy the play?). It’s worth noting that after the crazy swings, the S&P 500 finished down 8.86% for the week, a level which it reached Monday morning. Small cap stocks continued to get punished, losing 16.34% for the week.

This Week:

The spread and response to the COVID-19 will continue to dominate the news. Over the weekend the House passed an economic relief plan backed by President Trump to deal with the economic hardships caused by the spreading coronavirus. The package includes free testing for everyone who needs it, and two weeks of paid sick leave to allow people with the virus to stay home. Separately, travel restrictions were extended to include the U.K. and Ireland. On Sunday the Fed cut its benchmark interest rate by a full percentage point to near zero and promised to boost its bond holding by at least $700 billion, as well as taking other actions to buffer the economy from the impact of the coronavirus.

In a repeat of last Monday, S&P futures are limit down prior to trading. Let’s keep in mind that last week the market finished very close to where it settled in after the opening, despite the wild swings the rest of the week. The news flow could be better or worse than expectations, nobody knows. This crisis will ultimately pass.

Developments in the energy market could also move markets, as the game of chicken between Saudi Arabia and Russian enters its second full week.

Stocks on the Move:

Everything was on the move like unanchored ships in a sea-storm.