Last Week:

The glass is half empty: For Q2 2020, the blended earnings decline for the S&P 500 is -35.7%. If -35.7% is the actual decline for the quarter, it will mark the largest year-over-year decline in earnings reported by the index since Q4 2008 (-69.1%).

The glass is half full: 84% of S&P 500 companies have reported a positive EPS surprise and 69% have reported a positive revenue surprise. If 84% is the final percentage, it will mark the highest percentage of S&P 500 companies reporting a positive EPS surprise since FactSet began tracking this metric in 2008.

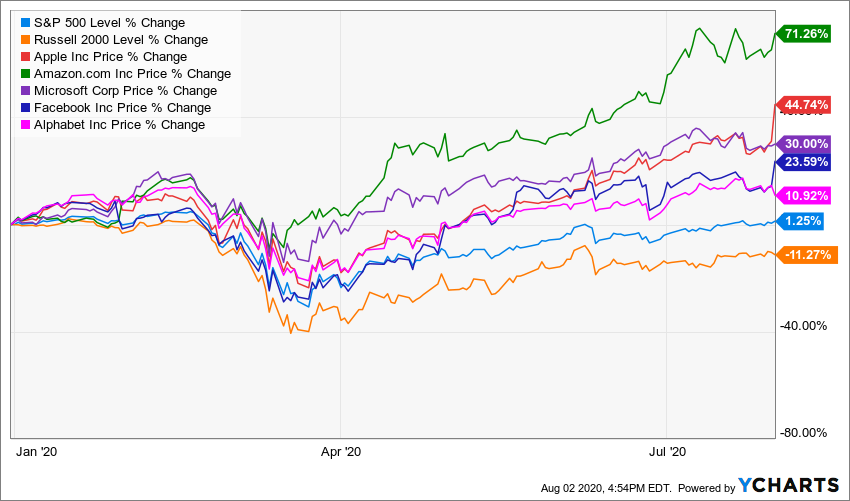

The S&P 500 gained 1.73% to move back into positive territory for 2020, with Big Tech continuing to dominate the action. Of the FAAMG companies, Facebook, Amazon, and Apple were particularly strong on Friday after reporting strong second quarter results after the market closed on Thursday. The (sad?) trend of social media obsessed Americans shopping on their iPhones 24/7 has clearly been accelerated by COVID-19. The market value of those five companies now comprises nearly 22% of the S&P 500 and combined are up roughly 36% on average, and therefore have contributed around +8% to the market’s return this year. Stated differently, the rest of the S&P 500 has produced a loss of around -6.7%, while the Russell 2000 is -11.27% YTD. Because the outperformance of the FAAMG has been correlated with their strong revenue and earnings growth trends, there is some fundamental support for the strong stock performance among these mega-cap tech names. Nevertheless, the statistical impact of these 5 stocks on market indices is real and therefore further market indices gains may be dependent on these names. ON A CLEARLY POSITIVE NOTE, the relative underperformance of non-FAAMG stocks suggests investors are differentiating between the remarkable growth of the FAAMG names and the balance of the equity markets – maybe the markets ARE rational.

Never before has the index been so concentrated nor performance so dominated by a handful of holdings. These are great companies; however, they are trading at extremely elevated P/E multiples, particularly when you consider the trillion dollar plus market capitalizations they are commanding. Caveat Emptor Robin Hood traders and complacent indexers. This movie is not going to have a happy ending. In the meantime, near zero percent interest rates continue to fuel the speculative fire, as the Ten-Year Treasury slipped 5 basis points to 0.54%. Federal Reserve Chairman Jerome Powell reiterated his call for fiscal stimulus while pledging unlimited monetary policy support during this “extraordinarily uncertain” economy. Back on Capitol Hill, Republicans and Democrats are $2.3 trillion apart on the next relief bill, and the extra $600 a week for unemployment insurance recipients expired. It was reported that GDP contracted at a whopping 32.9% during the second quarter, but the resilient stock market and blockbuster earnings from the Big Tech companies seems to have taken the pressure off Congress to act in the swift bipartisan fashion exhibited 4 months ago.

The glass is half empty: Without further stimulus business failures and unemployment is likely to surge.

The glass is half full: Our children and grandchildren might not be responsible for another $3 trillion of debt if Congress does not provide more fiscal stimulus. Additionally, political realities suggest that a compromise deal will be reached relatively soon.

Warning: The dollar continued its recent decline while gold reached new record levels. GLD, PHYS, and FXE are ETFs that would likely benefit if there is further dollar weakness.

This Week:

It will be the last busy week of earnings season, with 129 S&P 500 companies reporting results for the second quarter.

On the economic calendar, Friday’s release of the jobs report for July will be in focus. Economists forecast a gain of two million jobs with the unemployment rate falling to 10.5%.

COVID-19 deaths and new cases, as well as advancements in therapeutics and vaccines will remain of the upmost importance.

Stocks on the Move:

AMD + 11.6%: Advanced Micro Devices, Inc. designs and produces microprocessors for the computer and consumer electronics industries. The Company’s share price surged to close at a fresh record Wednesday after the chip company’s strong second quarter and outlook signaled a sea change in the semiconductor market following Intel Corp.’s announced delays of next-generation chips last week. AMD is a 3.50% holding in the North Star Opportunity Fund and AMD corporate bonds are a 2.50% holding in the North Star Bond Fund.

AAPL +14.7%: Apple, Inc. designs a wide variety of consumer electronic devices, including smartphones (iPhone), tablets (iPad), PCs (Mac), smartwatches (Apple Watch), and TV boxes (Apple TV), among others. The Company announced quarterly results that significantly beat expectations and declared a 4-1 stock split. “Apple’s record June quarter was driven by double-digit growth in both Products and Services and growth in each of our geographic segments,” said Tim Cook, Apple’s CEO. “In uncertain times, this performance is a testament to the important role our products play in our customers’ lives and to Apple’s relentless innovation. AAPL is a 2.50% holding in the North Star Opportunity Fund.

QCOM +18.8%: Qualcomm develops and licenses wireless technology and also designs chips for smartphones. The company’s key patents revolve around CDMA and OFDMA technologies, which are standards in wireless communications that are the backbone of all 3G and 4G networks. The firm is poised to be a leader in 5G network technology as well. The company topped analysts’ fiscal third quarter expectations and announced that it had come to a settlement agreement with Chinese communications giant Huawei Technologies Co. Qualcomm reported adjusted earnings of 86 cents per share on sales of $4.89 billion. Analysts had expected earnings of 72 cents per share on revenues of $4.8 billion. Moreover, Qualcomm said that the settlement with Huawei will add about $1.8 billion to its top line and $1.38 in earnings per share during the current quarter. “With the signing of the Huawei agreement, we are now entering a period in which we have multi-year license agreements with every major handset OEM,” Qualcomm CEO Steve Mollenkopf told investors. QCOM is a 1.42% holding in the North Star Opportunity Fund.

UPS +20.6%: UPS is a global leader in logistics, offering a broad range of solutions including transporting packages and freight; facilitating international trade, and deploying advanced technology to more efficiently manage the world of business. The Company announced second-quarter 2020 consolidated revenue increased to $20.5 billion, a 13.4% increase from the second quarter of 2019. Net income was $1.8 billion for the quarter; adjusted net income was $1.9 billion, 8.8% above the same period in 2019. Operating profit was $2.2 billion, and adjusted operating profit was $2.3 billion, up 7.4% compared to last year’s second quarter. “Our results were better than we expected, driven in part by the changes in demand that emerged from the pandemic, including a surge in residential volume, COVID-19 related healthcare shipments and strong outbound demand from Asia,” said Carol Tomé, UPS chief executive officer. “UPSers are keeping the world moving during this time of need and I want to thank our team for their hard work and outstanding efforts to serve our customers, our communities and each other.” UPS is a 1.25% holding in the North Star Opportunity Fund.

BGS +10.2%: B&G Foods, Inc. sells and distributes high-quality, branded shelf-stable and frozen foods across the United States, Canada and Puerto Rico. B&G Foods’ diverse portfolio of more than 50 brands include Back to Nature, B&G, B&M, Cream of Wheat, Dash, Green Giant, Las Palmas, Le Sueur, Mama Mary’s, Maple Grove Farms, New York Style, Ortega, Polaner, Spice Islands and Victoria. The Company reported terrific results as net sales for the second quarter of 2020 increased $141.3 million, or 38.1%, to $512.5 million from $371.2 million for the second quarter of 2019. The increase was primarily attributable to materially increased net sales resulting from increased demand for the Company’s products due to the COVID-19 pandemic. The Company’s net sales also benefited from the Clabber Girl and Farmwise acquisitions, which were completed on May 15, 2019 and February 19, 2020, respectively. “At B&G Foods we remain committed to the health and safety of our employees and doing our part to keep our nation supplied with food during this difficult time,” stated Kenneth G. Romanzi, President and Chief Executive Officer of B&G Foods. Mr. Romanzi continued, “Thanks to the tremendous efforts of our employees, we were able to achieve both of these goals during the second quarter. We had an outstanding second quarter in terms of net sales, net income, adjusted EBITDA and cash flow as our portfolio of brands served consumers very well as they continued to cook and eat more at home.” BGS is a 2.62% holding in the North Star Dividend Fund and BGS corporate bonds are an 3.68% holding in the North Star Bond Fund.

RCKY +25.0%: Rocky Brands, Inc. Is a designer, manufacturer, and marketer of premium quality footwear and apparel. The company’s family of brands includes Rocky, Georgia Boot, Durango, Lehigh, Creative Recreation, and the licensed brand Michelin footwear. Second quarter net sales were $56.2 million compared to $62.0 million in the second quarter of 2019. The Company reported second quarter net income of $2.4 million, or $0.33 per diluted share compared to net income of $3.2 million, or $0.42 per diluted share in the second quarter of 2019. Adjusted net income for the second quarter of 2020, which excludes expenses related to the temporary closure of the Company’s manufacturing facilities due to COVID-19, was $3.2 million, or $0.44 per diluted share. Jason Brooks, President and Chief Executive Officer, commented, “Our business exhibited increasing strength as the quarter progressed despite the ongoing challenges created by COVID-19. The work we’ve done over the past several years strengthening our brands and product lines, enhancing our marketing programs and building out our digital capabilities has allowed us to capitalize on the accelerated shift in consumer spending online brought on by the pandemic. Between our branded websites and online marketplaces, total digital sales increased triple digits on a percentage basis in the second quarter driven by existing customers and a dramatic increase in new customer acquisition. Meanwhile, the strong relationships we have forged with our key wholesale accounts helped us weather the slowdown at brick and mortar retail from reduced traffic and store closures. As lockdown restrictions began to ease in many areas of the country midway through the second quarter, we experienced a significant pick up in weekly sell-through at retail. Given the circumstances, we are pleased with our recent performance and encouraged as this momentum has carried into July. While there is still uncertainty about the ultimate impact that COVID-19 will have on our industry and the overall economy, I am confident that our business model and balance sheet, which featured over $25 million in cash and cash equivalents and no debt at the end of the second quarter, have Rocky Brands well positioned to navigate the current headwinds and emerge from the pandemic poised for long-term success.” RCKY is a 2.75% holding in the North Star Micro Cap Fund and a 3.74% holding in the North Star Dividend Fund.

FLWS +12.3%: 1-800 Flowers.com Inc .is a provider of gourmet food & gift baskets, consumer floral, and BloomNet wire service. Gourmet food & gift baskets and consumer floral jointly account for the majority of the company’s total revenue. There was no company specific news to account for the share price increase. FLWS is a 4.56% holding in the North Star Micro Cap Fund.

SGC +38.8%: Superior Group Of Companies, Inc. is engaged in designing, manufacturing, and distribution of uniforms to major domestic retailers, foodservice chains, transportation, and other service industries. It provides customer-specific uniform eStores, custom Image apparel, corporate identity apparel, career apparel, and accessories including remote staffing solution and call center operations for the medical and health fields also for industrial, commercial, and leisure. The Company reported that for the second quarter ended June 30, 2020, net sales increased 73 percent to $159.4 million, compared to second quarter 2019 net sales of $92.3 million. Pretax Income was $18.9 million compared to $3.7 million in 2019. Net income was $15.2 million, or $1.00 per diluted share, compared to $2.8 million, or $0.18 per diluted share, for the second quarter of 2019. Michael Benstock, Chief Executive Officer, commented, “We are extremely proud to report record operating results for the second quarter and first half of 2020. It is particularly gratifying to see the hard work, flexibility and ingenuity of our team members pay off and to further demonstrate our ability to adapt and thrive in times like these. The intentional diversity of our business segments and our historical emphasis on essential businesses bodes well for the future of each of our segments. While some smaller portions of our business were significantly impacted negatively, we were able to more than offset these shortfalls with the successful pivot to selling personal protective equipment (“PPE”) in addition to our legacy healthcare products, both of which continue to be in high demand during the pandemic. Net sales of PPE were approximately $58.5 million in the second quarter, and we ended the quarter with a very strong backlog, including nearly $52 million of PPE products expected to ship primarily during the third and fourth quarters of this year. We continue to book additional PPE orders on a regular basis.

“As a result of the tremendous cash flow generated from operating activities, we were able to further reduce our outstanding debt an additional $16.1 million in the second quarter and over $34 million in the first half of 2020. Our very strong balance sheet has positioned us very well to be able to capitalize on opportunities as they arise during these times.”

“While we don’t generally provide guidance on individual quarters or years, we are confident that we will continue to see significant increases in our net sales and income in comparison with prior year periods for the balance of the year.”

“We are also pleased to be able to reinstate the regular quarterly dividend and to provide a special dividend equal to the amount that was suspended during the second quarter.” WOW! SGC is a 1.72% holding in the North Star Micro Cap Fund.

CNSL +24%: Consolidated Communications Holdings, Inc. is a leading broadband and business communications provider serving consumers, businesses, and wireless and wireline carriers across rural and metro communities and a 23-state service area. Leveraging an advanced fiber network spanning 45,850 fiber route miles, Consolidated Communications offers a wide range of communications solutions, including: high-speed Internet, data, phone, security, managed services, cloud services and wholesale, carrier solutions. The Company reported solid quarterly results. “I’m pleased to report we had another strong quarter, delivering revenue growth in both broadband and data-transport services, while decreasing operating expenses and increasing Adjusted EBITDA,” said Bob Udell, president and chief executive officer of Consolidated Communications. “Our business remains strong and we continue to operate seamlessly through this unprecedented time. As a critical infrastructure provider, we are laser focused on supporting our residential, business and carrier customers with flexible solutions that meet their unique needs right now – whether at home, at work, at a tower or at a data center. The safety and wellness of our employees and customers remain our number one priority. “For the fifth consecutive quarter, we grew broadband revenue by leveraging our speed improvements,” added Udell. “Additionally, we reduced our debt leverage from 4.33x at the end of 2019 to 4.14x as we further execute on our delever first strategy. Through high-return fiber investments and innovative public-private partnerships, we are delivering results where we invest and executing on a strategy that positions us well for continued growth.” CNSL is a 1.67% holding in the North Star Micro Cap Fund. CNSL Corporate bonds are a 3.58% holding in the North Star Bond Fund and a 1.41% holding in the North Star Opportunity Fund.