As we approach the Thanksgiving holiday, it would be an epic understatement to say that 2020 has been a most unusual year. In our family my birthday on March 12 comes first in the calendar and my son Alex’s on November 19th comes last. Flashing back to March 12th, I hosted a party at Standard Club (now closed after 150 years in business) with a group of twenty friends for a basketball and buffet celebration. Seemingly out of the blue the NBA season had been put on hold the night before and minutes before tip-off the Big Ten tournament was cancelled all do to the novel coronavirus, and the market was in a free fall. The debate at lunch was how long we would be shut down, with the over-under being two weeks. Eight months later we celebrated Alex’s birthday on zoom and lamented that it was unlikely that we could gather together before my next birthday in March of 2021. In that eight-month period over 250,000 Americans died, the economy contracted dramatically, bankruptcies and unemployment surged, the national debt ballooned, and yet the market rebounded over 40% and the S&P 500 reached a record high this past Monday. For the second-straight week it was positive COVID-19 vaccine news that sparked the rally as Moderna said its Phase 3 vaccine trials show a 94.5% efficacy rate. Over the course of the week those gains evaporated and the S&P 500 finished down -0.77%, following soft economic releases, a surge in COVID-19 cases and deaths, and the decision by the Treasury Department let five of the Federal Reserve’s special lending facilities expire at the end of the year. These programs have acted as an insurance policy for the debt markets, and the central bank immediately criticized the decision. The Fed, which typically avoids commenting on sensitive political issues, responded in a statement saying that it “would prefer that the full suite of emergency facilities established during the coronavirus pandemic continue to serve their important role as a backstop for our still-strained and vulnerable economy.”

The yield on the Ten-Year Treasury slipped 6 basis points to 0.83% and the Dollar continued its slow but steady descent. Small cap stocks were the biggest winners with the Russell 2000 gaining 2.37%. At North Star we are thrilled to see the rotation in small caps and value stocks, as small cap value is the core of our investment process. Despite historically being the best performing asset class, the chart below illustrates that SCV has been out of favor for most of the last 5 years, with most of the underperformance coming in 2019 and 2020:

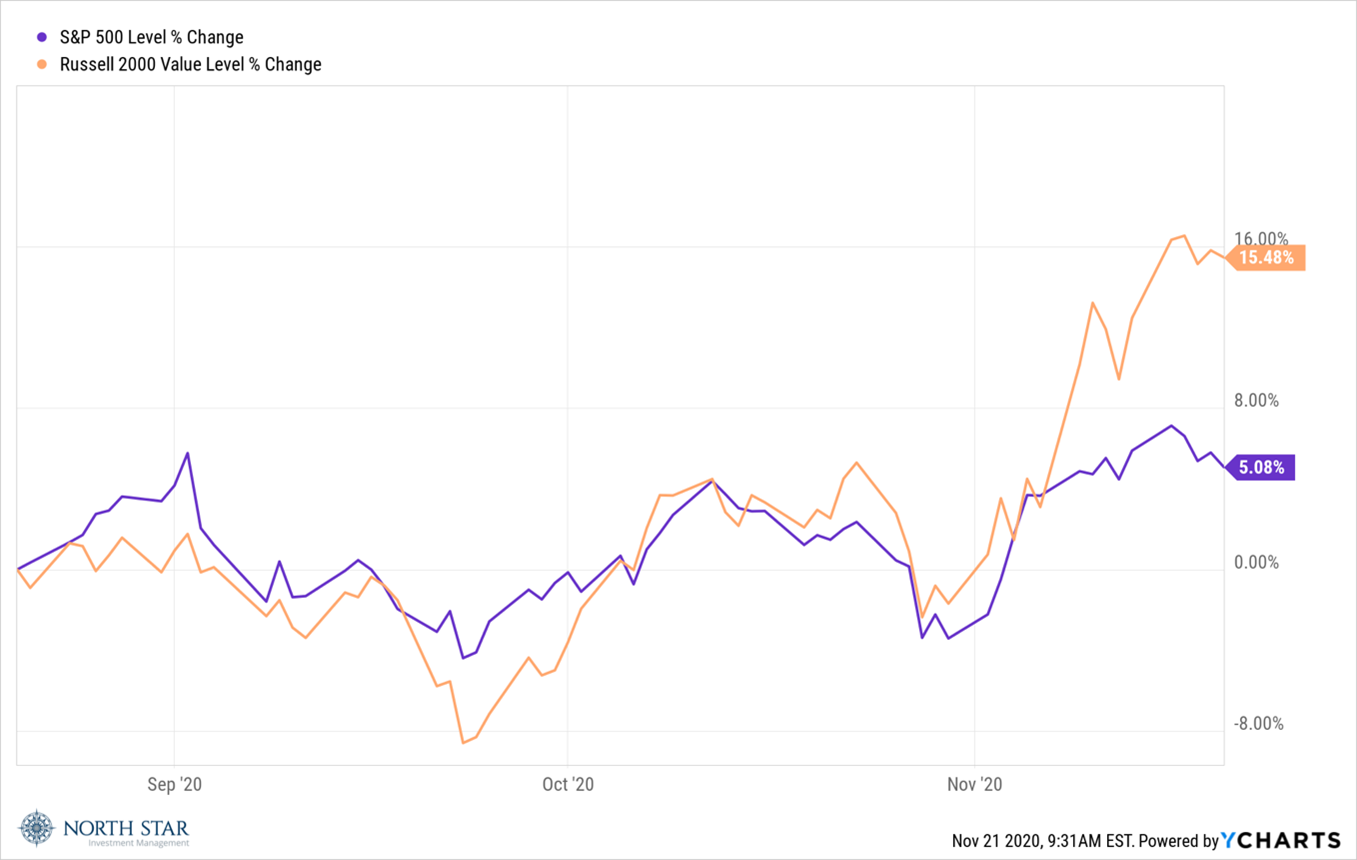

The story has been different the last 3 months, with SCV first keeping pace and then outperforming by almost 10% over the last month:

The same has been true for dividend paying companies. Attached please find a link to our recent white paper “The Case for Small Cap Dividend Paying Securities”. We continue to believe that those stocks as well as TIPS and Gold make sense to be included in one’s investment portfolio.

This Week:

They used to call it “Merger Monday” but the last three weeks it has been “Vaccine Monday”, as the market got another dose of good news after scientists said that the coronavirus vaccine developed by the University of Oxford and the British-Swedish pharmaceutical giant AstraZeneca is up to 90 percent effective when administered at a half-dose and then a full booster dose a month later. The announcement follows upbeat results from two other front-running vaccine candidates, by Pfizer-BioNTech and Moderna, the past two Mondays. The Oxford-AstraZeneca vaccine is likely to be cheaper than those made by Pfizer and Moderna, and it does not need to be stored at subzero temperatures but can be kept in ordinary refrigerators in pharmacies and doctor’s offices.

With earnings season over and a light economic calendar, the focus will likely remain on Virus and Vaccine news during the holiday shortened week. Political noise will remain loud, buy unlikely to move markets.

Stocks on the Move:

+22.1% Acme United Corporation (ACU) supplies cutting, measuring, and safety products for the school, home, office, and industrial markets. The Company produces shears, scissors, rulers, first aid kits, utility knives, manicure products, medical cutting instruments, guillotine paper trimmers, and pencil sharpeners. There was no significant company news this week. ACU is a 3.77% holding in the North Star Micro Cap Fund, a 2.63% holding in the North Star Opportunity Fund and a 0.93% holding in the North Star Dividend Fund.

+22.1% CarParts.com Inc. (PRTS) retails automobile parts online. The Company offers mirror, engine, headlights, brakes, interior and exterior accessories, tools, wheels, lighting, bumpers, and other auto body parts. This week, CarParts.com released a national ad campaign highlighting the company’s new brand identity. “We’re here to make shopping for auto parts hassle-free and budget-friendly, and to help fuel our customers’ journeys.” said Chief Marketing Officer Houman Akhavan. PRTS is a 6.15% holding in the North Star Micro Cap Fund and a 2.73% holding in the North Star Opportunity Fund.

+12.5% ViacomCBS Inc. (VIAC) operates as a multimedia company. The Company provides television and radio stations, produces and syndicates television programs, broadcasting, publishes books, and online content, as well as provides outdoor advertising. This week, there were reports the Company would undergo another round of layoffs which would affect around 100 employees. VIAC is a 3.47% holding in the North Star Opportunity Fund.

+11.7% Orion Energy Systems Inc (OESX) designs, manufactures, and implements energy management systems. The Company’s management system is comprised of high intensity fluorescent lighting system, InteLite intelligent lighting controls, and Apollo Light Pipe. Orion Energy Systems offers energy savings and efficiency gains to commercial and industrial customers. There was no significant company news this week. OESX is a 5.96% holding in the North Star Opportunity Fund and a 5.71% holding in the North Star Micro Cap Fund.

+10.7% Acco Brands Corporation (ACCO) manufactures office products. The Company produces staplers, daily scheduling diaries, shredders, laminating equipment, presentation boards, and air purifiers. ACCO had no significant news this week. ACCO is a 3.13% holding in the North Star Dividend Fund.

+10.2% Evolution Petroleum Corp (EPM) explores for and produces oil and gas. The Company focuses on acquiring established oil and gas fields and applying specialized technology to increase product rates. EPM serves customers in Texas. There was no significant company news this week. EPM is a 2.10% holding in the North Star Dividend Fund and a 0.72% holding in the North Star Micro Cap Fund.

-21.0% Flexsteel Industries, Inc. (FLXS) manufactures and sells wooden and upholstered furniture for the retail, contract, and recreational vehicle (RV) furniture markets. There was no significant company news this week. FLXS is a 2.14% holding in the North Star Dividend Fund.

+10.2% Century Casinos, Inc. (CNTY) operates as an entertainment company. The Company owns casinos, hotels, resorts, and luxury cruise vessels. There was no significant company news this week. CNTY is a 0.79% holding in the North Star Micro Cap Fund.

Have a safe and Happy Thanksgiving!