Last Week:

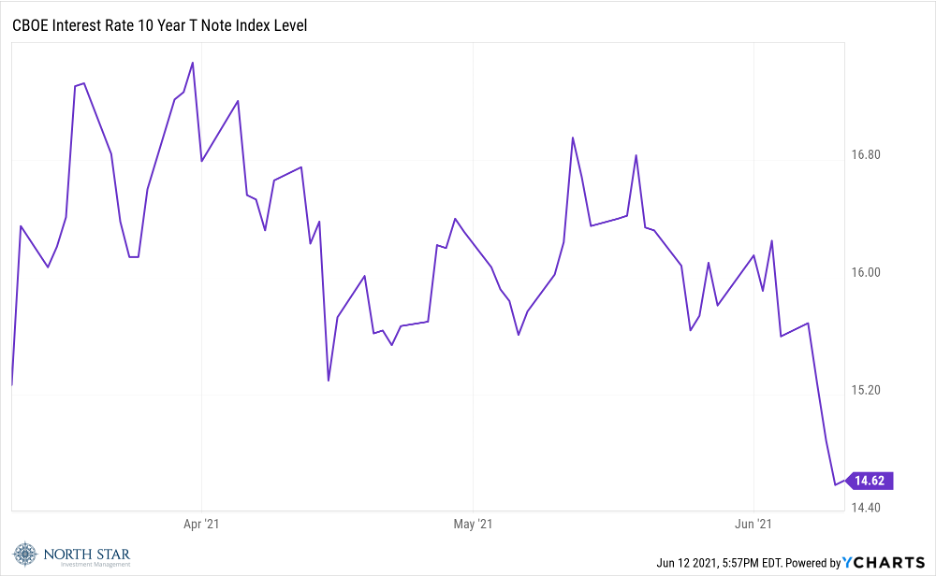

Since the end of April when Fed Chair Jerome Powell dismissed inflation pressures as being temporary, “transitory” has become the new bullish buzzword for the stock and bond markets. The 5% year-over-year increase in the consumer price index reported on Thursday was the biggest jump since August 2008, but apparently not big enough to disrupt the transitory thesis, as both markets rallied on the news. The S&P 500 gained 0.41% and finished the week at a record high. For the second week in a row, it was the curious combination of small caps and tech stocks faring the best, with the Nasdaq advancing 1.86% and the Russell 2000 jumping 2.16%. Prior to the last few weeks those two equity sectors took turns leading the overall market, with the former faring best when the economic outlook seemed most challenged and the latter when confidence in the reopening rebound was highest. The bond market has been signaling an upcoming slowdown for the last 3 months, with the yield on the Ten-Year Treasury declining 11 basis points just in the last week to settle at 1.46%, its lowest level since the beginning of March.

The bond market could be suggesting that an agreement on multi-trillion dollars of additional fiscal stimulus might not be achievable given the lack of bipartisan support. On Thursday a group of 10 senators did announce they reached a deal on a $1.2 trillion infrastructure package, but it still faces serious obstacles from skeptics in both parties. A substantial hurdle is finding a way to pay for the spending, given the unpopularity of raising taxes.

The U.S. Dollar remained steady. In fact, it has been essentially unchanged so far in 2021 after declining almost 10% during 2020. We continue to view any material weakness in the dollar as a warning sign for all the financial markets. Gold, our preferred hedge, was down fractionally for the week, and is unchanged for 2021 after rising 10% in 2020.

Our (my) preferred baseball team, the Chicago White Sox, had a great week, winning series against the Blue Jays and the Tigers to widen their lead in the AL Central. As COVID-19 restrictions were lifted at the end of May, capacity increased to 60 percent at Guaranteed Rate Field or 24,300 fans and will go to 100% on June 25th. Now we just need to find 40,000 dedicated White Sox fans in this city of 3 million people.

This Week:

The two-day FOMC meeting that will conclude with a policy statement on Wednesday will be in focus. Any talk of tapering will unnerve the market while sticking to the view that higher prices are transitory will comfort investors. Other economic reports of interest include the latest retail sales report, the producer price index update and industrial production numbers.

The COVID-19 trends have been very favorable in the U.S. However, there is reason for concern as the vaccination rates have slowed down. Globally the pandemic rages on. In Russia, officials scrambled on Saturday to slow the spread of a new wave of the coronavirus, ordering workers in Moscow to take next week off and pleading with the populace to make use of widely available vaccines. It is also evident that the number of cases and deaths in India is alarming and has been significantly understated.

Stocks on the Move:

+11.3% Turtle Beach Corporation (HEAR) operates as a sound technology company. The Company designs and markets audio peripherals for video game consoles, personal computers, and mobile devices. There was no significant company news last week.

HEAR is a 5.8% position in the North Star Micro Cap Fund and a 2.8% position in the North Star Opportunity Fund.

+14.3% Evolution Petroleum Corporation (EPM) explores for and produces oil and gas. The Company focuses on acquiring established oil and gas fields and applying specialized technology to increase production rates. There was no significant company news last week. The North Star Research Team met with management two weeks ago and were encouraged by their newly acquired Barnett Shale assets which will give the Company access to natural gas and support future dividend payments.

EPM is a 1.2% position in the North Star Micro Cap Fund and a 3.1% position in the North Star Dividend Fund.

+16.7% 1-800-Flowers.Com Inc (FLWS) is an e-commerce provider of floral products and gifts. The Company’s product offerings include fresh-cut and seasonal flowers, plants, floral arrangements, home and garden merchandise, and gift baskets. There was no significant company news last week – coincidentally the North Star Portfolio Managers received a gift basket from Harry & David, a subsidiary of 1-800-Flowers, and were extremely pleased to see consumers gravitating toward their high-quality offerings.

FLWS is a 3.3% position in the North Star Micro Cap Fund.

Happy 2nd Birthday to my granddaughter Sweet Baby Jane, who is already displaying great athletic and musical prowess.