Last Week:

Chairman of the Federal Reserve is near the top of my list of extraordinary stressful jobs that I would hate to have. Currently, it would fall somewhere between a war-zone surgeon and an undercover narcotics officer on the Chicago Police Department. Poor Jerome Powell probably listens to the opening of Eric Clapton’s song “Pretending” every morning and wonders “how many times must we tell the tale”, and then “how many times do we have to fall” after the market stumbles whenever the Fed tries to come clean about the need normalize monetary policy. Legendary investor Paul Tudor Jones turned up the heat on Chairman Powell prior to last week’s FOMC meeting calling it “disingenuous” to call inflation transitory, adding that he would “go all-in on the inflation trades” if the Federal Reserve is nonchalant this week regarding rising consumer prices.” He added that if it course corrects, then you’re going to “get a taper tantrum.” At the meeting on Wednesday, the Fed did indeed raise its expectations for inflation considerably, saying the headline figure could reach 3.4%, marking a full percentage point higher than its forecast in March. The central bank also brought forward the time frame on when it will next raise rates. The so-called dot plot of individual FOMC member expectations pointed to two hikes in 2023 after Powell said in March that he saw no increases until at least 2024. Yet in what strikes me as another verse of “Pretending”, the Fed Chair said the projections should be “taken with a big grain of salt” and reiterated his view that much of the price pressure was “transitory”. In regard to tapering its bond-buying program, Powell suggested that one “can think of this meeting that we had as the ‘talking about talking about’ meeting” and suggested, “that we retire that term, which has served its purpose.”

The stock market, which didn’t react to the last two months of very hot inflation readings, got the message and had its worst week since February with the S&P 500 falling 1.9% and the Russell 2000 sinking 4.2%. Tech stocks fared the best, with the Nasdaq slipping only 0.28%. The dollar rallied sharply gaining 2%, while gold had a terrible week dropping 5.9%. The yield on the Ten-Year Treasury was down 1 basis point to 1.45%.

We still believe that the economy is very strong, and that very slowly normalizing interest rates will not derail the recovery. As such, we continue to favor the companies that will benefit from “reflation” and believe there remain good bargains in small caps and in the Financial sector. On the fixed-income side, short-term TIPS (Treasury Inflation-Protected Securities) remain a core holding, and we view the recent weakness in gold as an opportunity to build a position as a hedge against the risk of future dollar debasement.

This Week:

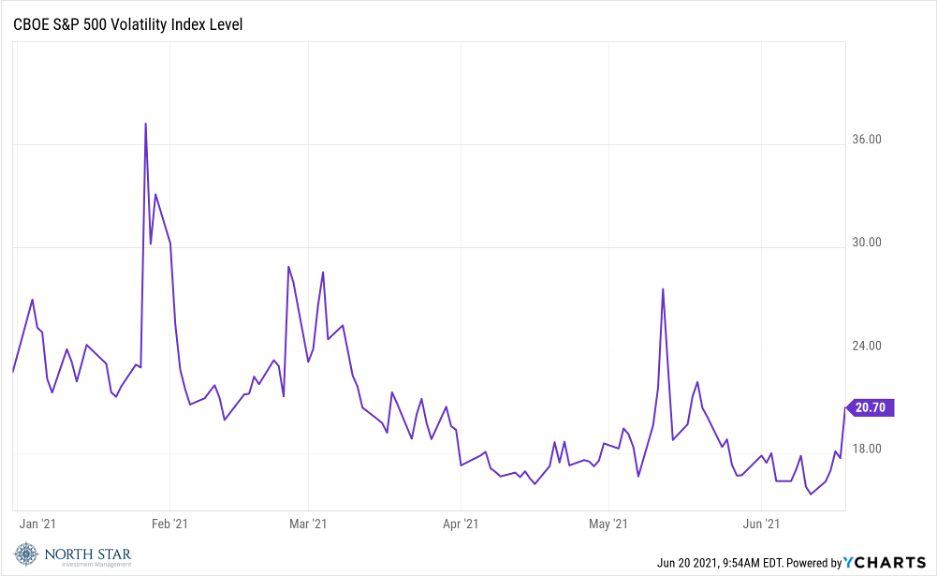

We think that trading on Monday could set the tone for the next month, as much of the losses last week were incurred on Friday and felt like traders unwinding positions before the weekend. It would be concerning if the selling continued in the new week, particularly if it is accompanied by a further increase in the “Fear Index” (VIX). So far in 2021, the spikes in the VIX have been short-lived, lasting only a few days, and any selloffs in the market have been used as buying opportunities for courageous investors.

The economic calendar is pretty busy with existing-home sales data expected to continue to trend lower due to lack of supply of houses, while both the Manufacturing and Services Purchasing Managers’ indexes should remain near record highs.

Stocks on the Move:

Companies with news…

-11.4% Turtle Beach Corporation (HEAR) operates as a sound technology company. The Company designs and markets audio peripherals for video game consoles, personal computers, and mobile devices. It was reported last week that May 2021 videogame hardware sales ticked up 5, but accessory sales dropped 8% during the month compared to May 2020. Despite these fluctuating numbers, Turtle Beach announced new Xbox products at the E3 conference including the Recon Controller and VelocityOne Flight Simulation Control System.

HEAR is a 5.3% position in the North Star Micro Cap Fund and a 2.6% position in the North Star Opportunity Fund.

-10.0% ACCO Brands Corporation (ACCO) manufactures office products. The Company produces staplers, daily scheduling diaries, shredders, laminating equipment, and presentation boards. Last week, ACCO Brands was added to the Russell Microcap Index after regular rebalancing that will be effective on June 28th.

ACCO is a 1.7% position in the North Star Micro Cap Fund and a 2.7% position in the North Star Dividend Fund.

-11.2% John Wiley & Sons Inc (JW.A) publishes print and electronic products. The Company specializes in scientific, technical, and medical books and journals, as well as professional and consumer books and subscription services. Wiley also provides textbooks and educational materials. Last week, John Wiley & Sons reported Q4 2021 earnings of $0.73 per share, which beat by $0.13, and revenue of $536 million, up 12.9% year-over-year. Management is continuing to focus on digital products and tech-enabled services in the research, professional learning, and educational industries.

JW.A is a 1.8% position in the North Star Dividend Fund.

-10.7% Build-A-Bear Workshop Inc (BBW) is an interactive and entertainment mall-based retailer that invites guests of all ages to create their own customized stuffed animals with clothing, shoes, and accessories through a bear-making process. Last week, the company cooled off after seeing slowed momentum from meme stock trading in the retail sector.

BBW is a 2.4% position in the North Star Micro Cap Fund.

-10.4% Century Casinos Inc (CNTY) operates as an entertainment company. The Company owns casinos, hotels, and luxury cruise vessels. Last week, Century Casinos announced it reopened all four of its Alberta, Canada locations. This announcement followed the May reopening of casinos in Poland.

CNTY is a 1.2% position in the North Star Micro Cap Fund.

-16.4% Ethan Allen Interiors Inc (ETH) designs, manufactures, sources, sells, and distributes a range of home furnishings and accessories. Through its portfolio of ten furniture factories, one sawmill, one lumberyard, as well as 300 Ethan Allen Stores, the Company offers a variety of products including beds, dressers, tables, chairs, buffets, entertainment units, home office furniture, and wooden accents. Last week, the North Star Research Team met with Company management; Ethan Allen’s unique vertically integrated supply chain, strong balance sheet, and redefined product programs should set the Company up for solid growth over the next few years.

ETH is a 1.4% position in the North Star Micro Cap Fund.

Companies without news…

-10.7% Sprott Inc (SII) provides investment management services. The Company offers portfolio management, broker-dealer activities, and consulting services to clients. Its offerings primarily involve equity strategies, ETFs, and physical bullion trusts that give institutional and individual investors exposure to precious metals.

SII is a 1.7% position in the North Star Dividend Fund and a 1.2% position in the North Star Opportunity Fund.

-11.7% Bar Harbor Bankshares (BHB) operates as a bank in Maine. The Bank offers education funding, retirement, investment planning, insurance, risk management, and online banking services.

BHB is a 0.9% position in the North Star Micro Cap Fund and a 2.1% position in the North Star Dividend Fund.

-11.6% Pitney Bowes Inc (PBI) sells, finances, rents, and services integrated mail and document management systems. The Company offers a full suite of equipment, supplies, software, and services for end-to-end mail stream solutions.

PBI is a 0.8% position in the North Star Dividend Fund.

-13.0% Telephone and Data Systems Inc (TDS) is a diversified telecommunications company. The Company operates primarily in the cellular (U.S. Cellular), local telephone, and personal communication services markets.

TDS is a 3.0% position in the North Star Dividend Fund.

-14.1% Trinity Industries Inc (TRN) manufactures transportation, construction, and industrial products. The Company’s products include tank and freight railcars, inland hopper and tank barges, highway guardrail and safety products, ready-mix concrete, and other products.

TRN is a 0.9% position in the North Star Dividend Fund.

We hope that everyone was able to shake off last week’s rotten market and enjoy Father’s Day. A special shout out to my dad, R.J. Kuby. I definitely won the lottery prize having R.J. as a father!