On the Up and Up

Inflation looks like it is running, as the lyrics from AC/DC go, “hot” and demanding we “pay the price” for this “problem child.”

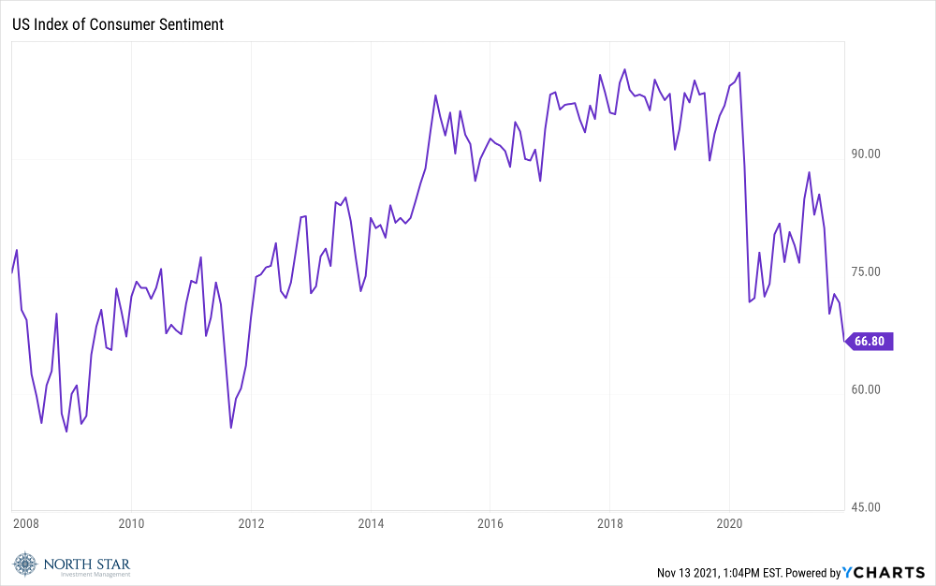

The stock market finished lower for the week with those escalating inflation fears and related slumping consumer confidence dominating the headlines. The October consumer price index released Wednesday showed inflation had jumped 0.9%, bringing the year-over-year increase at 6.2%, the highest level in 30 years. On Friday the University of Michigan’s preliminary consumer sentiment index decreased to 66.8 from 71.7 in October, its lowest level in a decade due to the growing belief among consumers that no effective policies have yet been developed to reduce the damage from surging inflation. The November figure trailed all projections in a Bloomberg survey of economists which called for an increase to 72.5. At North Star, we view consumer sentiment as an important forward-looking predictor of the health of the economy, and we will be closely monitoring developments in the coming months. In the coming weeks, we look forward to listening for whether the Fed decision-makers will consider the state of consumer sentiment in its process of normalizing monetary policy. If low consumer sentiment drives more dovish sentiment, equities would likely rally further, along with real estate and other real assets like gold. Otherwise, and assuming continued inflationary pressures, the bond market will likely continue its recent path toward higher yields. As stated in Barron’s this weekend, “Inflation is not a problem until the bond markets says it is a problem.”

As the graph above illustrates, consumer sentiment is now registering at levels below the nadir reached in the early months of the pandemic. The other two instances of significant declines came at the beginning of the 2008 financial crisis, and in 2011 when S&P downgraded U.S Government debt during a debt-ceiling standoff.

The S&P 500 declined -0.31%, the Nasdaq dropped -0.69%, and the Russell 2000 sank -1.04%. Gold rallied +2.80% to reach its highest level since Father’s Day, while the U.S. Dollar advanced 0.8%. Bond prices weakened, driving the yield on the Ten-Year Treasury up 13 basis points to 1.58%. If the current inflation rate proves not to be “transitory,” then those bond yields will likely need to rise substantially.

Retail is Back….Or is it?

The nation’s leading retailers will be reporting third-quarter results early in the week, and on Tuesday the Census Bureau will release retail sales for October. Expectations are for a 0.8% month-over-month increase. The cover story in the most recent Barron’s was “Retail Revival: Expect a record holiday season as mall stores stage a surprising comeback.” That expected revival and the plunging consumer sentiment would seem to strike a dissonant chord.

October Capacity Utilization, Industrial Production, and Leading Indicators are all expected to have modestly improved from the previous month.

Stocks on the Move

+13.1% BGSF Inc (BGSF) provides workforce solutions. The Company recruits commercial and professional staff in information technology, accounting and finance, light industrial, and real estate fields. There was no significant company news last week; however, the North Star Research Team met with management on Thursday and felt encouraged by the progressive company culture, consistent dividend payments, and digital transformation agenda.

BGSF is a 3.4% position in the North Star Dividend Fund.

-15.4% Tesla Inc (TSLA) designs, manufactures, and sells high-performance electric vehicles and electric vehicle powertrain components. The Company’s portfolio includes solar generation and storage products, more than five fully electric cars, and a growing global network of industrial-grade vehicle chargers called “Superchargers.” Tesla plunged last week after CEO Elon Musk sold over $5.0B worth of stock in a series of prices ranging from $1,056.03 to $1,104.15.

TSLA is a 0.8% position in the North Star Opportunity Fund.

+14.7% Blue Bird Corporation (BLBD) designs and manufactures school buses and commercial buses for school districts, large national fleets, businesses, government agencies, and non-profit organizations. Blue Bird’s gains last week were fueled by high hopes for EV stocks as world leaders met in Scotland to discuss ongoing and new climate initiatives.

BLBD is a 2.2% position in the North Star Micro Cap Fund and a 0.5% position in the North Star Opportunity Fund (added last week).

+13.5% Build-A-Bear Workshop Inc (BBW) is an interactive and entertainment mall-based retailer that invites guests of all ages to create their own customized stuffed animals with clothing, shoes, and accessories through a bear-making process. There was no significant company news last week.

BBW is a 2.6% position in the North Star Micro Cap Fund.

-11.8% Hamilton Beach Brands Holding Company (HBB), through its subsidiaries, markets and designs electric household and specialty houseware appliances, as well as commercial products for restaurants, bars, and hotels. Last week, Hamilton Beach Brands declared a $0.10/share quarterly dividend, in-line with previous payouts.

HBB is a 0.8% position in the North Star Micro Cap Fund.

+12.3% Q.E.P. Co Inc (QEPC) manufactures, markets, and distributes tools and related products for the home improvement market. The Company’s brand names include QEP, O’Tool, and Roberts. Products include trowels, floats, tile cutters, wet saws, spacers, nippers, and pliers that are marketed for the use in surface preparation and installation of ceramic tile, carpet, marble, and drywall. There was no significant company news last week.

QEPC is a 1.9% position in the North Star Micro Cap Fund.