Cheer Over Fear

With the holiday season approaching, the market produced one of its best weekly returns since Valentine’s Day, as buyers saw silver linings in all the otherwise cloudy news. Showing cheer rather than fear, investors shrugged off the consumer price index report that showed a rise of 0.8% last month, just above the consensus estimate of 0.7%. In the 12 months through November, CPI increased 6.8%, which was the biggest year-on-year rise since June 1982. Despite that surge in inflation, U.S. consumers’ moods brightened unexpectedly in early December with an outsized increase in sentiment among lower-income households.

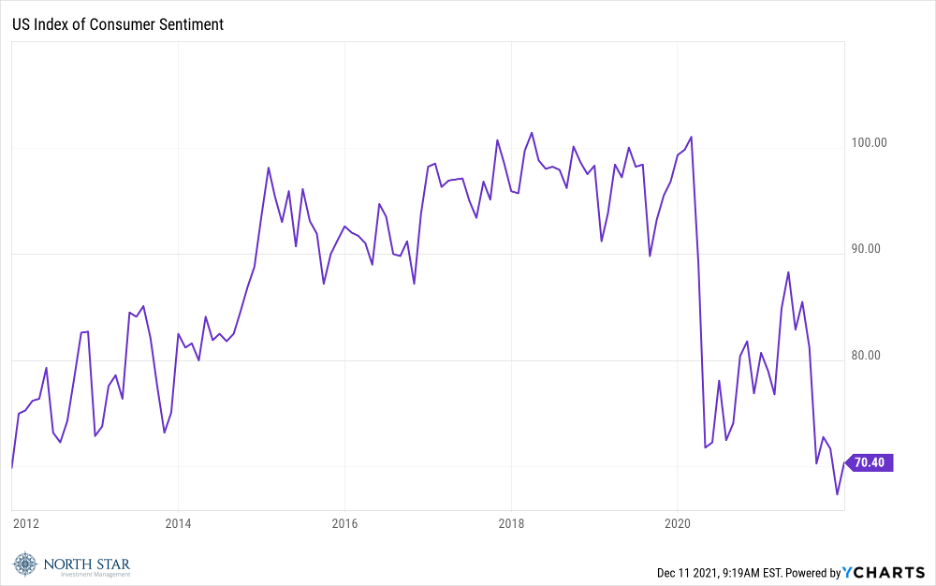

The University of Michigan’s Consumer Sentiment Index rose to 70.4 this month from a final November reading of 67.4, which had been the lowest since November 2011, and a median estimate of 67.1 by economists polled by Reuters. The increase in headline sentiment was powered entirely by a 23.6% improvement among households in the lower one-third of the survey’s income distribution, the biggest monthly increase for that group since 1980. Sentiment slipped further for the middle and upper thirds.

As the chart above illustrates, despite the unexpected bounce last month, consumer sentiment is still below the level reached in March 2020 when the economy was shutting down with the onset of the pandemic.

Speaking of the pandemic, according to CDC Director Dr. Rochelle Walensky the data on the first 43 Omicron variant cases in the U.S. shows nearly 80% of the cases were in fully vaccinated people. Significantly, nearly everyone who has been found to be infected by the variant has experienced mild symptoms. While Omicron has primarily presented itself in vaccinated individuals, experts agree that unvaccinated individuals are contributing to the rapid mutation of the coronavirus. Once again, despite the concerning spike in cases, the silver lining is that vaccinated people appear to have some resistance to the disease.

The S&P 500 jumped 3.82% to close at another record high, while the Russell 2000 advanced 2.43% to finish 1.9% below its all-time high. The Tech sector was the top performer, with only the Telecom sector finishing in the red. Both Gold and the Dollar were unchanged, while Crude Oil gushed up 8.1% and the yield on the Ten-Year Treasury regained the previous week’s decline rising 14 basis points to 1.49%.

On the Chicago Sports scene, the Bears played a great first half Sunday night in Lambeau Field versus the Green Bay Packers. Unfortunately, there was also another half to play.

Focus on the Fed

The Federal Reserve meeting will be in focus, as Chairman Jerome Powell already suggested at a Congressional hearing that it might be appropriate to speed up the pace of tapering asset purchases. Traders will be watching the dot plots for projected interest rate increases in 2022 and 2023, as well as any hints regarding how Omicron risk factors into the rate and tapering equations. On the economic calendar, reports are scheduled on producer price inflation, retail sales and industrial production. The earnings calendar is extremely light.

Stocks on the Move

+66.1% Del Taco Restaurants Inc (TACO) owns and operates a chain of restaurants. The Company offers nachos, desserts and shakes, salads, kid’s meals, and drinks. Last week it was announced that Jack in the Box (JACK) will acquire Del Taco for $12.51 per share in a cash transaction valued at approximately $575M.

At the announcement of the takeover, TACO was a 2.7% position in the North Star Micro Cap Fund. North Star has since exited the position.

+10.8% Apple Inc (AAPL) designs, manufactures, and markets personal computers and related personal computing and mobile communication devices along with a variety of related software, services, peripherals, and networking solutions. Apple products and services include iPhones, Mac computers and iPad tables, as well as the App Store, Apple Music, the Apple Watch, and other wearable devices. Apple has entered entertainment with the Apple TV+ streaming service. Apple’s gains last week came from positive analyst comments as well as excitement surrounding the Company’s launch into AR/VR products.

AAPL is a 3.8% position in the North Star Opportunity Fund.

+10.6% Callaway Golf Company (ELY) designs, manufactures, and sells golf clubs and gold balls, apparel, gear, other equipment, and accessories. Last week, it was disclosed the CEO and CFO each participated in significant insider buying.

ELY is a 0.7% position in the North Starr Opportunity Fund.

+10.3% NAPCO Security Technologies Inc (NSSC) manufactures electronic security devices, fire detection products, access control systems, and digital lock equipment used in residential, commercial, institutional, and industrial installations. Last week, NAPCO announced a 2-for-1 stock split.

NSSC is a 2.3% position in the North Star Micro Cap Fund.

+13.6% Compass Diversified Holdings (CODI) is an investment holding company. The Company acquires controlling interests in profitable small to middle market businesses in niche industries as well as works with management to pursue growth opportunities and provide strategic support. Last week, the Company hosted an Investor Day that highlighted the Company’s long-term value creation and enhanced ability to capitalize on new acquisition opportunities.

CODI is a 3.0% position in the North Star Dividend Fund and a 2.2% position in the North Star Opportunity Fund.

-11.6% 1-800-Flowers.Com Inc (FLWS) is an e-commerce provider of floral products and gifts. The Company’s product offerings include fresh-cut and seasonal flowers, plants, floral arrangements, home and garden merchandise, and gift baskets. There was no significant company news last week.

FLWS is a 2.3% position in the North Star Micro Cap Fund.

+10.3% Green Brick Partners Inc (GRBK) operates as a homebuilding and land development company. The Company develops residential homes, complexes, and communities. Green Brick Partners invests in a range of real estate investments, as well as provides land and construction financing to its controlled builders. There was no significant company news last week.

GRBK is a 2.3% position in the North Star Micro Cap Fund.

+15.4% Q.E.P. Co Inc (QEPC) manufactures, markets, and distributes tools and related products for the home improvement market. The Company’s brand names include QEP, O’Tool, and Roberts. Products include trowels, floats, tile cutters, wet saws, spacers, nippers, and pliers that are marketed for the use in surface preparation and installation of ceramic tile, carpet, marble, and drywall. There was no significant company news last week.

QEPC is a 2.1% position in the North Star Micro Cap Fund.