New Year New Highs

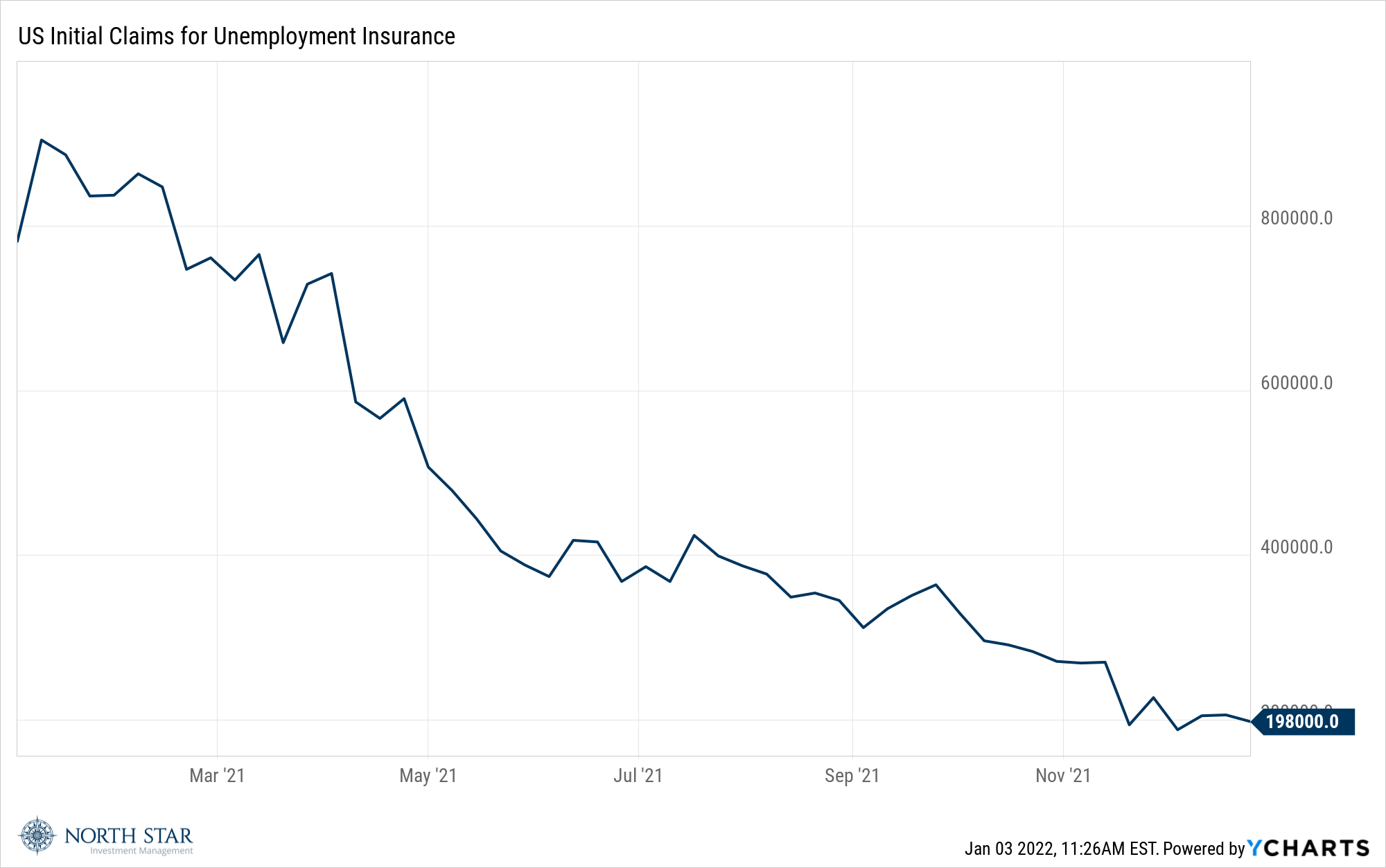

The S&P 500 advanced 1.12%, reaching record highs on Monday and Wednesday. For 2021, the Index set 70 all-time highs, the most in a single year since 1954. Small caps finished the year quietly, edging up 0.34%, while the Nasdaq gained 0.56%. The Ten-Year Treasury yield inched up 2 basis points to end the year at 1.51%, essentially at its same level as in early March. We believe that the stability of interest rates at very low levels, despite the surge in inflation, has provided the foundation to justify the elevated valuation multiples enjoyed in the stock market. The rebound in the jobs market also provided a nice tailwind. In fact, claims for unemployment benefits dropped to a new, multi-decade low last week, the Labor Department reported Thursday. Whereas the pandemic has created wildly unpredictable and volatile jobs data, the steady decline in the weekly new claims for unemployment has been consistent.

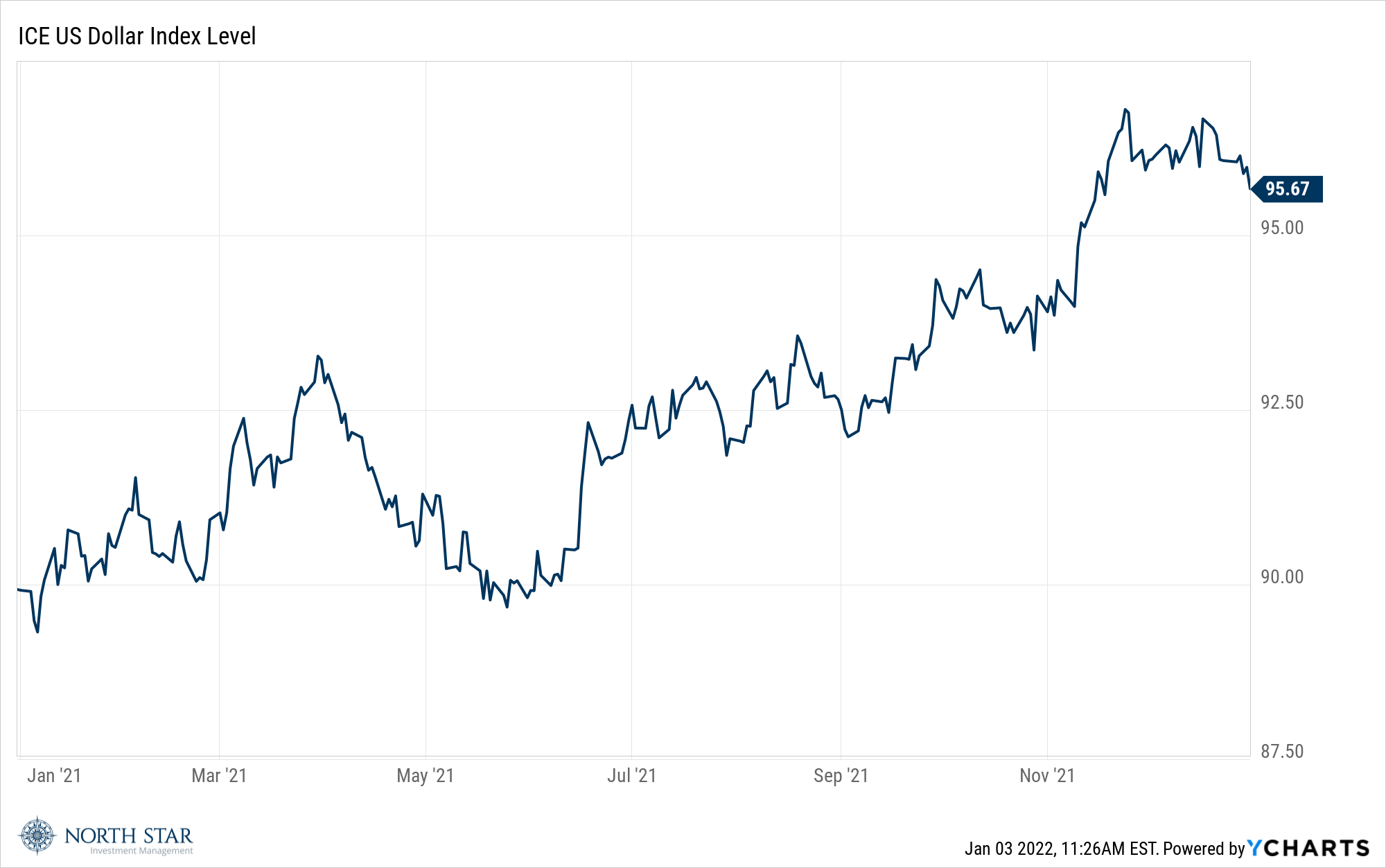

The dollar held steady, near its recent high. We monitor the greenback, as any weakness could offer an early warning for a storm in the U.S. financial markets. As the chart below illustrates, the skies over Wall Street remain (red, white, and) Blue.

Unfortunately, the graph for new Covid-19 cases would show a very steep upward slope with the 14-day change in cases up a staggering 201%. Additionally, the CDC announced last week it would be shortening the recommended quarantine duration from 10 days to five days which we believe could have positive implications for businesses. In the spirit of New Year optimism, we note that Dr. Anthony Fauci predicts that the latest wave of the coronavirus pandemic may hit its peak in the U.S. by the end of January.

The Chicago Bears looked like Super Bowl contenders during their 29-3 victory over the New York Giants on Sunday afternoon at Soldier Field, once again proving that everything is relative.

2020-Too?

It may be a New Year, but the song remains the same. The main theme will be further Covid-19 data, with the release of the minutes from the December FOMC meeting on Wednesday, and the monthly jobs report on Friday providing additional verses. Early trading on Monday morning suggested that Santa Claus rally had some fuel left in its sled, as the S&P 500 opened higher and approached new record highs again.

There is a long list of imponderables that could shift the key of the tune as 2022 unfolds. Most notably, there are the geopolitical risks, with uncertainties surrounding Russia, China, and the Middle East come easily to mind. All is certainly not quiet on the domestic front either, as President Biden’s agenda remains very much challenged.

Stocks on the Move

+13.9% Lawson Products Inc (LAWS) sells and distributes expendable maintenance, repair, and replacement products to OEM’s. The Company’s products include fasteners, screws, nuts, rivets, hoses, lubricants, cleansers, adhesives, files, drills, and welding products. Lawson also supplies automotive electrical wiring, exhaust, and other automotive parts. Last week, Lawson announced a strategic merger with TestEquity and Gexpro Services lead by Luther King Capital Management’s Headwater Investments. The combined holding company is expected to generate estimated pro forma annual revenue of more than $1 billion, accelerate cash flow growth, and further improve the long-term competitive position of each distribution vertical.

LAWS is a 0.9% position in the North Star Micro Cap Fund.

-13.0% Sono Group N.V. (SEV) manufactures and sells electric cars with integrated solar cells and panels. In addition, the Company monetizes its variable battery technology for integration in numerous types of vehicles, including buses, trucks, camper vans, trains, and boats, as it aims to reduce carbon emissions and provide clean and affordable transportation for the masses. There was no significant company news last week.

SEV is a 0.7% position in the North Star Opportunity Fund.

+12.7% Build-A-Bear Workshop Inc (BBW) is an interactive and entertainment mall-based retailer that invites guests of all ages to create their own customized stuffed animals with clothing, shoes, and accessories through a bear-making process. There was no significant company news last week.

BBW is a 3.1% position in the North Star Micro Cap Fund.