Meta’s Face Plant

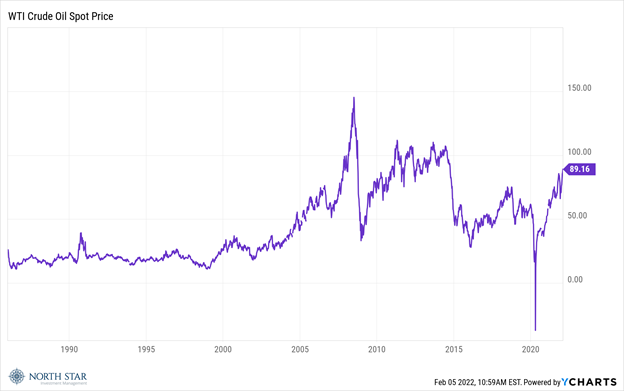

The S&P 500 and Nasdaq Composite bounced back to post their best weekly gains in 2022, advancing 1.5% and 2.4% respectively. Small caps joined the party with the Russell 2000 rising 1.7% although still down 10.8% for the year and 18.0% since reaching a high three months ago. Oil & Gas stocks fared the best rallying 4.8% as WTI Crude Oil spurted up over $90/barrel, its highest level since the summer of 2014. We remain underweighted in the extremely volatile Energy sector based on our conviction that the long-term trend will be a shift into renewables and other more environmentally friendly energy sources. We would also caution momentum traders to be mindful of the steep declines that WTI has suffered following similar spikes in the past as illustrated in the chart below:

Industrial stocks performed the worst for the week, slipping -0.4%. Our recent episode of our Small Cap Bootcamp series, “Hidden in Plain Sight: ESG Positive Opportunities with Small Cap Industrials,” addresses the bargains that have resulted from these recent trading trends.

It was a big week for earnings reports from the high-profile mega caps with Meta Platforms (FB) face planting -26.0% on Thursday, while Amazon.com Inc (AMZN) surged 13.5% on Friday. Interestingly, albeit just coincidental, the equity market cap loss in Meta Platforms shares was quite like the $200 billion equity market cap gain in Amazon shares. The former represents the largest single day dollar loss for any company and the latter the biggest single day gain. Overall, there was a continuation of strong earnings with 76% of companies exceeding forecasts with 56% of companies now having reported results for the fourth quarter. Following these positive surprises, the index is now on track for earnings growth of 29.2% compared to an earnings growth rate of 24.3% last week and an earnings growth rate of 21.3% at the end of the fourth quarter (December 31, 2021). The forward 12-month P/E ratio is 19.7, which is above the 10-year average 16.7 but below the forward P/E ratio of 21.3 recorded at the end of the fourth quarter (December 31, 2021), as prices have decreased while EPS estimates have increased over the past month. Generally, reports of 4Q21 sales and earnings have been fairly strong, but stock performance has been dependent on outlooks for 2022; stocks of companies showing an ability to manage input cost inflation and supply chain challenges have meaningfully outperformed companies expressing caution about margin outlooks for 2022.

The current multiple on the S&P still seems reasonable given interest rates that remain very low versus historic averages; however, those rates are certainly “normalizing”. Indeed, last week the Ten-Year Treasury yield reached its highest level since August 2019 after jumping 15 basis points to 1.93%, following an extremely strong jobs report on Friday. That report showed that the U.S. added 467,000 jobs in January – more than double the consensus estimate, as over one million people entered the workforce, and wages increased sharply. Along with the big upside surprise for January, massive revisions sent previous months considerably higher. December, which initially was reported as a gain of 199,000, went up to 510,000. November surged to 647,000 from the previously reported 249,000.

Those employment gains came despite the surge in Covid-19 cases during the winter. Perhaps the best news is the recent sharp downturn in the number of new cases, with approximately a 40% decline in new cases and a 15% decline in hospitalizations during the last week. We applaud the resilience of the economy during the pandemic and are excited to imagine the post-pandemic possibilities.

Wage Games

Earnings season continues with 83 S&P 500 companies reporting results.

Russian troops remain amassed on the border of Ukraine, but most experts seem to believe that an invasion is unlikely during the Olympics.

Market participants will be paying close attention to the CPI report on Thursday, with the forecast suggesting a 7.3% increase, which would mark the highest rate of inflation since 1981. A reading at that level or higher could pressure the Fed to raise rates 50 basis points in March, rather than the currently anticipated 25 basis point hike.

The University of Michigan releases its Consumer Sentiment Survey for February on Friday. The last few months’ readings have been registering at the lowest levels in over a decade, as inflation has been weighing heavily on the mood of consumers. Perhaps an uptick is in order, given last week’s surprising jobs report wage games.

Stocks on the Move

+14.1% Advanced Micro Devices Inc (AMD) operates as a semiconductor company worldwide. Its products include microprocessors, chipsets, discrete and integrated GPUs, data center and professional GPUS, and development services. AMD released Q4 2021 results consisting of $0.80 per share on $4.8B in revenue, topping analyst estimates by $0.04/share and almost $28M in revenue. Additionally, the company’s gross margins reached 50% during the period driven by “richer product mix.”

AMD is a 3.7% position in the North Star Opportunity Fund.

+11.8% BGSF Inc (BGSF) provides workforce solutions. The Company recruits commercial and professional staff in information technology, accounting and finance, light industrial, and real estate fields. BGSF declared a $0.15/share quarterly dividend on Thursday, representing a 25% increase from prior distributions of $0.12/share.

BSGF is a 3.4% position in the North Star Dividend Fund and a 1.2% position in the North Star Opportunity Fund.

+15.4% United Parcel Service Inc (UPS) delivers packages and documents throughout the United States and in other countries/territories. The Company also provides global supply chain services and less-than-truckload transportation; primarily in the United States, UPS’s business consists of air and group pick-up and delivery networks. UPS reported a Q4 beat on Tuesday with earnings of $3.59/share beating by $0.49/share and revenue of $27.77B beating by $700.0M. The company also raised its quarterly dividend to $1.52/share, a 49% increase from prior distributions of $1.02/share.

UPS is a 1.6% position in the North Star Opportunity Fund.

-17.9% Pitney Bowes Inc (PBI) sells, finances, rents, and services integrated mail and document management systems. The Company offers a full suite of equipment, supplies, software, and services for end-to-end mail stream solutions. Pitney Bowes sunk last week as the company released Q4 2021 earnings of $0.06/share which missed by $0.05/share. The company achieved its fifth consecutive year of consolidated revenue growth; however, “supply chain challenges and shifts in consumer buying behavior led to lower volumes,” as stated by CEO Marc Lautenbach in the quarterly call.

PBI is a 0.5% position in the North Star Dividend Fund.

+10.9% Turtle Beach Corporation (HEAR) operates as a sound technology company. The Company designs and markets audio peripherals for video game consoles, personal computers, and mobile devices. The company announced a partnership with its ROCCAT line of headsets for MrBeast’s new snack company, Feastables. MrBeast has 88 million subscribers on YouTube and is widely known in the gaming community for his “outrageous stunts and philanthropic efforts.”

HEAR is a 4.2% position in the North Star Micro Cap Fund and a 1.9% position in the North Star Opportunity Fund.

+10.2% Sono Group N.V. (SEV) manufactures and sells electric cars with integrated solar cells and panels. In addition, the Company monetizes its variable battery technology for integration in numerous types of vehicles, including buses, trucks, camper vans, trains, and boats, as it aims to reduce carbon emissions and provide clean and affordable transportation for the masses. There was no significant company news last week.

SEV is a 0.4% position in the North Star Opportunity Fund.

The stocks mentioned above may be holdings in our mutual funds. For more information, visit nsinvestfunds.com.