Rams Brought It Home

If the trading week had ended at lunch on Thursday, then we could have cheerfully turned our attention to the Rams, Bengals, and Snoop Dogg. St. Louis Fed President James Bullard, perhaps still upset that the Rams had moved to Los Angeles, threw cold water on the party Thursday afternoon by calling for an acceleration of interest rates hikes. The 10-year Treasury yield broke above 2% for the first time since 2019, and the stock market plummeted. Comforted by the comments by less hawkish Fed officials, a nice bounce back rally developed Friday morning, but the selling returned and intensified as rising fears of a Russian invasion of Ukraine and the weakest consumer sentiment report in over a decade unnerved investors. The University of Michigan’s consumer sentiment index came in at 61.7 for February, an 8.2 percent drop from January, almost 20 percent lower than last February, and the lowest figure since October 2011. The current conditions index dropped to 68.5 from 72 the previous month, while the futures expectations index nosedived to 57.4 from 64.1. We view the futures expectation index as a better predictor of direction of the market.

Corporate earnings remained a bright spot, with the growth rate for the fourth quarter now 30.3%, compared to an earnings growth rate of 29.2% last week and an earnings growth rate of 21.3% at the end of the fourth quarter (December 31, 2021). Once again it is the future expectations that are most important, and those forecasts call for a significant slowdown in the growth rate to 5-8% during 2022. If interest rates rise slowly and steadily, and the earnings forecast prove accurate, then stocks currently represent reasonably good value at around 20 times 2022 earnings.

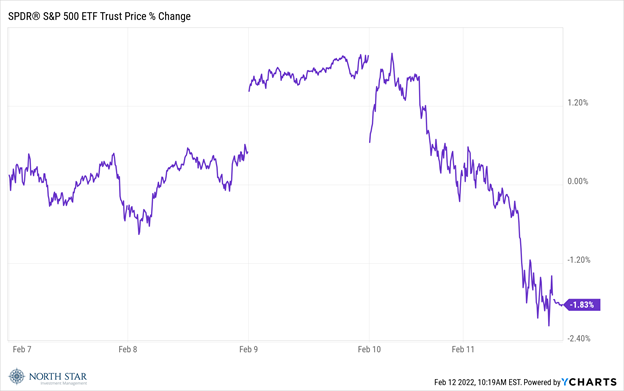

The benchmark 10-year yield fell back to about 1.95% on Friday, still up 25 basis points for the week – that’s a 15% increase. The 2-year Treasury yield has doubled this year, increasing 19 basis points during the week to reach 1.50%. After the roller coaster ride, the S&P 500 shed 1.8% and the Nasdaq Composite retreated 2.2%. Small-caps outperformed, with the Russell 2000 gaining 1.39%. The Dollar, Oil, and Gold all rallied, seemingly in response to the geopolitical tensions.

Final Innings

Developments in the Russia/Ukraine conflict will dominate the news flow. We hope that war is avoided, not just for health of the markets, but also for the future of humanity.

Earnings season enters the final innings, with 62 S&P 500 companies reporting results.

The economic calendar next week features the Bureau of Labor Statistics producer price index report on Tuesday, with the consensus estimate calling for a 9.3% year-over-year increase. Any indication that the rise in producer prices is abating would be extremely well received by the financial markets. On Wednesday retail sales data will show whether the drop in consumer sentiment resulted in constrained spending as the Census Bureau will be reporting retail sales data for January.

Monetary policy will remain in the headlines, with Chicago Federal Reserve Bank President Charles Evans, New York Federal Reserve Bank President John Williams, St. Louis Federal Reserve Bank President James Bullard, and Cleveland Federal Reserve Bank President Loretta Mester all giving speeches. The FOMC minutes are due out on Wednesday and will be carefully scrutinized for any further policy insights.

Stocks on the Move

Despite all the volatility, we only had 3 double-digit movers during the week, and all 3 to the upside.

+18.5% Blue Bird Corporation (BLBD) designs and manufactures school buses and commercial buses for school districts, large national fleets, businesses, government agencies, and non-profit organizations. Last week, Blue Bird reported Q1 GAAP earnings (loss) of -$0.15 which beat by $0.17 and revenue of $129.22M which beat consensus estimates by $19.37M. Management has now put through 15% in total pricing to offset inflation and supply chain cost challenges, with the most recent 4% increase effective March 1st.

BLBD is a 1.8% position in the North Star Micro Cap Fund and a 1.6% position in the North Star Opportunity Fund.

+14.8% Evolution Petroleum Corporation (EPM) explores for and produces oil and gas. The Company focuses on acquiring established oil and gas fields and applying specialized technology to increase production rates. Last week, EPM reported GAAP EPS of $0.20, revenue of $22.34M which beat by $4.53M, and the Company also raised its quarterly dividend by 33% to $0.10/share. EPM also announced the acquisition of non-operated assets in Williston Basin (North Dakota) for $25.9M as well as a non-operated interest, Jonah Field (Wyoming), for $29.4M. Both acquisitions are immediately contributing to cash flow and further diversifies the Company into natural gas which promotes a balanced commodity mix to provide dividend security.

EPM is a 2.0% position in the North Star Micro Cap Fund and a 4.5% position in the North Star Dividend Fund.

+10.2% Build-A-Bear Workshop Inc (BBW) is an interactive and entertainment mall-based retailer that invites guests of all ages to create their own customized stuffed animals with clothing, shoes, and accessories through a bear-making process. There was no significant company news last week.

BBW is a 3.6% position in the North Star Micro Cap Fund.

The stocks mentioned above may be holdings in our mutual funds. For more information, visit nsinvestfunds.com.