A Million Reasons

In her 2016 hit ‘Million Reasons,’ Lady Gaga sings:

“I’ve got a hundred million reasons to walk away

But, baby, I just need one good one to stay.”

That one line captures how easy it is to find recent data points that support pessimism, and yet historical long-term equity market returns remain an excellent counterpoint to the recent negative sentiment among equity market participants. This past week offered not quite a MILLION reasons to walk away, but there were quite a few that has got the “sell in May” crows crowing a few weeks early. It was tough sledding for the financial markets during the holiday-shortened trading week. In the equity markets, tech stocks were hit the hardest, with the Nasdaq Composite 2.6% lower, while the S&P 500 fell 2.1% and the Dow Jones down 0.8%. Bucking the trend were the small-caps, as the Russell 2000 posted a 0.5% gain for the week. We continue to highlight the intriguing bargains that we see in our small-cap funds following a year of solid earnings growth and sagging stock prices. Inflation concerns were the primary driver of the negativity in the markets, as both the CPI and PPI reports showed prices posting record advances in March. In the Economy section of this week’s Barron’s there is an insightful article that argues that the 11.2% year-over-year surge in PPI suggests that consumer prices still have a way to go before reaching peak inflation. At North Star we remain cautiously optimistic that we are close to a peak, although the recent Covid-19 related manufacturing shutdowns in China have slowed the easing of the supply chain issues while the escalation of Russia’s assault on Ukraine have disrupted global food and energy supply, and subsequently prices.

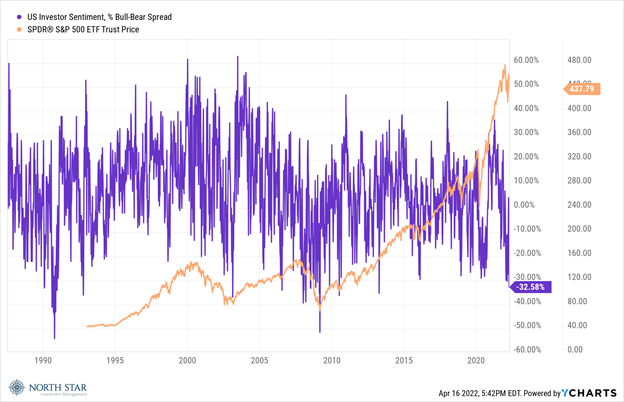

The 10-year U.S. Treasury yield reached another multiyear high on Thursday, climbing 14 basis points to 2.83%. A silver lining to that increase was that the 2-year rate was unchanged resulting in the 10-2 spread yield steepening to a positive 36 basis points. We view this steepening favorably since many traders view an inversion of that spread to be a signal of an impending recession. The steep decline in the U.S. Investor Sentiment Index highlights the magnitude to which the bearish recession scenario has grown in popularity. Whereas we may not be at peak inflation yet, perhaps we are at peak pessimism?

The chart above illustrates that the current level of bearishness has historically been near peak pessimism and has normally been followed by higher stock prices.

Earnings season got off to a shaky start as the major banks reported a mixed bag of first quarter earnings, sending most bank stocks lower. The Health Care stocks joined the Tech and Financial sector as the bottom performers, while Telecoms fared the best. Consumer stocks posted modest declines, despite a surprise record jump in the future expectations component of the University of Michigan Consumer Sentiment survey, albeit off a very depressed base. We have been concerned about the extremely depressed reading in that survey over the last several months, as we believe it offers predictive information about the financial markets. However, companies we have spoken to in recent weeks seem to contradict the recent low Consumer Sentiment survey readings, mainly due to: (1) strong interest in building inventory of parts and components and product in light of recent supply chain stresses; (2) improved logistics and supply chain conditions such as fewer ships waiting to unload at major ports; and (3) early signs of peaking in gas prices and fuel-related costs such as freight costs. As 1Q22 earnings season is underway and continues for the next two weeks, these topics likely will be key factors for near-term equity market sentiment.

The dollar, gold , and crude oil all rallied during the week. The strength in the dollar should be deflationary, although could also slow exports and lead to an expanded trade deficit.

Expansionary Economy

First quarter earnings reports will be in focus, with 69 S&P 500 companies reporting results.

The economic calendar is light with housing data expected to show a slowdown resulting from the rise in mortgage rates. The Philadelphia Fed manufacturing survey and latest PMI prints will also be released, both are forecasted to be unchanged from the previous month indicating an expanding economy.

Developments in the Russia/Ukraine war will be of the utmost importance, with an intense new Russian assault in Eastern Ukraine anticipated. Pray for peace.

Covid-19 challenges remain, and particularly relevant as it pertains to manufacturing in China.

The NBA playoffs start with the Bulls seeing their first post season appearance since 2017. Unfortunately, their first-round opponent is the reigning NBA champions, Milwaukee Bucks. There is peak pessimism in Chicago concerning the Bulls chances to survive the series.

Stocks on the Move

-10.1% Innovative Industrial Properties Inc (IIPR) owns and leases industrial real estate assets. The Company focuses on the acquisition, disposition, construction, development, and management of industrial facilities leased to tenants in the regulated medical-use cannabis industry. There were two headlines on IIPR last week: 1) Innovative Industrial announced a $25M acquisition of a Maryland cultivation and processing property and 2) short activist investor Blue Orca Capital released a new report calling the company a “high-risk cannabis bank.” IIPR responded calling the note “flawed and demonstrating a basic lack of understanding of commercial real estate generally, the regulated cannabis industry, and IIP’s straightforward, simple business model.” North Star believes Innovative Industrial is a quality REIT serving a niche industry.

-12.0% AstroNova Inc (ALOT) designs, develops, manufactures, and distributes a broad range of specialty printers and data acquisition and analysis systems, including both hardware and software. Its target markets are apparel, automotive, avionics, chemicals, computer peripherals, and communications. Last week, AstroNova reported a FQ4 2022 loss of $0.10 per share and FY2022 net income of $0.12 per share. The Company reiterated new order trends that suggest continued strong product demand as evidenced by a $27.8M backlog at the end of the quarter. Quarterly profits were hampered by short-term supply chain challenges and poor revenue mix, as well as a $0.07 per share write-off related to the Company’s legacy ERP system.

+15.0% Value Line Inc (VALU) produces investment related periodical publications. The Company also provides investment advisory services to mutual funds, institutions, and individual clients. All total, Value Line collects data and provides analysis on around 7,000 stocks, 18,000 mutual fund and 200,000 options. There was no significant company news last week.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.