Consensus Pessimism Drives Our Optimism

We are beginning to embrace the saying that “no news is good news” since the market has been reacting negatively to both good news and bad news. This suggests a pessimistic consensus among financial markets participants, and any consensus rarely lasts in the financial markets. The economic data was quite positive with job openings data that exceeded consensus expectations, a stronger-than-expected ISM manufacturing PMI report, and the employment report that largely matched the forecast while exhibiting some softening (briefly viewed as a Goldilocks report and spurring a short-lived handsome rally). There was also a healthy dose of bad news with another Covid-19 outbreak shutting down the 23-million-person Chinese city of Chengdu, Russian energy giant Gazprom delaying the reopening of Nord Stream pipeline, and mounting tensions between Taiwan and China, topping the list.

The Equity markets suffered hefty losses, with the S&P 500 falling 3.3%, the Nasdaq sliding 4.2%, and the Russell 2000 sinking 4.7%. Stocks have now posted a three-week losing streak after a four-week run of gains. Utilities were the best performing sector with a loss of 1.6%, while Technology stocks suffered nearly a 5% decline with the semiconductor companies faring the worst following a move by the U.S. government to ban sales of the most advanced chips to China. The Dollar continued to push higher, while Gold declined 2.1%, and Oil tanked 6.7%. The yield on the 10-year Treasury increased 16 basis points to 3.19%, however the 10-2 spread narrowed 13 basis points to -0.2% (do we dare call this as “good news”?).

All of the above-mentioned financial markets moves suggest a building consensus that stagflation is likely developing. According to Investopedia, stagflation is “an economic cycle characterized by slow growth and a high unemployment rate accompanied by inflation.” Falling equities in response to tough Fed speak on inflation, rising yields consistent with such Fed speak, defensive equities such as utilities outperforming other equities, a strong U.S. dollar (the world’s reserve currency), and the ongoing inverted yield curve all suggest a consensus positioning among financial markets participants that the Fed is likely to induce some level of economic recession. While we agree such an outcome is possible, rarely has a strong consensus viewpoint and fairly uniform investor positioning proven correct.

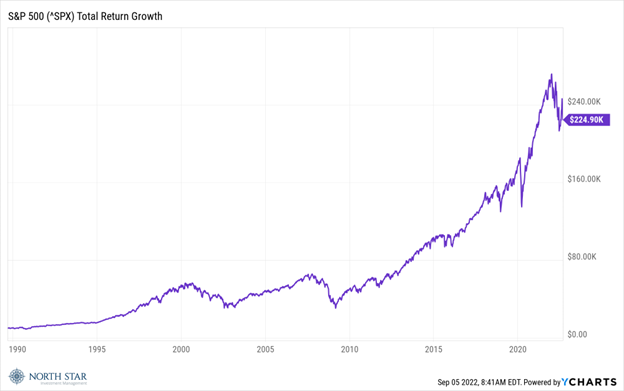

2022 has certainly been a challenging year in the financial markets. Despite the blood, sweat, and tears it has brought, it is worth remembering the tremendous returns that the market has provided investors over the last 50 years, despite the times when the spinning wheel goes down. As the chart below illustrates, $10,000 invested in the S&P 500 in 1990 would be worth around $225,000 today. It is also worth noting that declines, like we recently experienced, are an unpleasant yet somewhat regular part of the equation. History suggests that staying the course (ride the painted pony) would be the optimal strategy. Additionally, the recent wave of selling has created what looks like some tremendous bargains, particularly in the small-cap universe. Please feel free to contact North Star or your designated advisor if you are interested in our small-cap strategies.

Interlude

The economic calendar is very light during the holiday shortened trading week. We would welcome a “no news” interlude, if possible, although that seems unlikely with the Fed releasing the beige book on Wednesday which summarizes current economic conditions, and Chairman Powell still out on the conference circuit giving speeches.

Monetary policy across the pond will be in focus as the European Central Bank is expected to hike rates 75-basis-points, although there is still some speculation of a 50-point increase. The Euro is trading at less than parity with the Dollar, partially because of the interest rate differential.

Any positive developments concerning the 2022 terrors of the pandemic and the war would be warmly embraced.

Stocks on the Move

-12.0% Advanced Micro Devices Inc (AMD) operates as a semiconductor company worldwide. Its products include microprocessors, chipsets, discrete and integrated GPUs, data center and professional GPUS, and development services. As mentioned earlier in the blog, chip giant AMD fell last week after the U.S. government ordered the semiconductor company to halt sales in China and Russia. Wall Street analysts call the move a “structural risk” to the company.

-11.2% The Mosaic Company (MOS) is one of the world’s leading producers and marketers of concentrated phosphate and potash fertilizers and feed ingredients for the global agriculture industry. Mosaic erased its gains from the previous week after announcing July revenue and sales volumes with sales volume generally down and only the fertilizer unit revenues up as a result of strategic pricing actions due to the macro environment surrounding gas prices and ammonia production.

+13.9% Napco Security Technologies Inc (NSSC) manufactures electronic security devices, fire detection products, access control systems, and digital lock equipment used in residential, commercial, institutional, and industrial installations. NAPCO rallied last week after announcing a 22% year-over-year increase in sales for its fiscal fourth quarter, with gross margins for recurring service revenue remaining “robust” at 86% at the end of the fiscal year. The company has $46.8M in cash and no debt. The record quarter and year was attributed to strong navigation of the supply chain environment, high demand for NAPCO’s products and services, and the rebound of demand for school security jobs.

-19.6% Build-A-Bear Workshop Inc (BBW) is an interactive and entertainment mall-based retailer that invites guests of all ages to create their own customized stuffed animals with clothing, shoes, and accessories through a bear-making process. BBW sunk last week despite record-setting FQ2 results (revenue of $100.68M; GAAP EPS of $0.38), reaffirmed FY23 guidance, and the announcement of a $50M stock buyback.

-17.1% 1-800-Flowers.com Inc (FLWS) is an e-commerce provider of floral products and gifts. The Company’s product offerings include fresh-cut and seasonal flowers, plants, floral arrangements, home and garden merchandise, and gift baskets. FLWS plunged last week after weak FQ4 2022 results with a non-GAAP loss of $0.34 per share missing estimates by $0.09 and quarterly revenue flat around $485.9M. The Company also revised its FY23 guidance down. In general, 1-800-Flowers.com Inc has been the only North Star holding to see slowing consumer demand in addition to severe cost issues. FLWS management believes the Company will gradually be able to restore margins and improve logistics as consumer confidence eventually rebounds.

-12.0% Duluth Holdings Inc (DLTH) is a lifestyle brand of men’s and women’s casual wear, workwear, and accessories sold primarily through the Company’s own omnichannel platform. The Company’s products are marketed under the Duluth Trading names, with the majority of products being exclusively developed and sold as Duluth Trading branded merchandise. Last week, DLTH reported Q2 earnings of $0.07 per share and revenue of $141.5M which missed consensus estimates by $0.08 and $14.7M, respectively. The company also lowered its FY22 outlook. Management attributed the miss to inflationary impacts on consumer spending.

-20.4% Turtle Beach Corporation (HEAR) operates as a sound technology company. The Company designs and markets audio peripherals for video game consoles, personal computers, and mobile devices. There was no significant company news last week, however the stock likely declined with the broader Technology sector.

-31.4% Value Line Inc (VALU) produces investment related periodical publications. The Company also provides investment advisory services to mutual funds, institutions, and individual clients. All total, Value Line collects data and provides analysis on around 7,000 stocks, 18,000 mutual fund and 200,000 options. There was no significant company news last week.

-12.7% Weyco Group Inc (WEYS) imports and distributes men’s footwear, including mid-priced leather dress and casual shoes, sold under the Florsheim, Nunn Bush, and Stacy Adams brands. It also offers casual footwear for women and children under the BOGS and Rafters labels. There was no significant company news last week.

The stocks mentioned may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.