Last Week

The stock market treaded water until Wednesday afternoon’s extraordinarily hawkish Fed statement and Chairman Powell’s grim press conference opened the selling floodgates. By the closing bell Friday, the S&P 500 was down -4.7%, the Nasdaq -5.1%, and the Russell 2000 -6.6%. The Dollar surged to new highs, Crude Oil sank 7.2%, and the yield on the 10-year Treasury increased 21 basis points to reach its highest level since 2008 at 3.7%. Given the narrative, it is no surprise that the 10-2 spread widened to -0.51%, continuing to signal the intensifying recessionary concerns.

Against this backdrop of doom and gloom, the North Star research team heard quite a different message as we met with the management from five of our portfolio companies. In general, the companies expressed optimism about improving operating margins in 2023 as supply chain disruptions and related cost pressures are easing and forecasted stable demand for their good or services. If, as we believe will be the case, that scenario unfolds, then today’s share prices represent incredible bargains. On the interest rate front, we believe that the 4% yield available on the one-year T-bill is quite attractive as a core holding for the fixed income portion of one’s portfolio. We also believe that Gold (GLD, SII, or NEM) represents a nice hedge against the possibility that the recent spike in the Dollar reverses.

On the Chicago sports scene, the White Sox took a dive like the stock market, and unlike the stock market where there is no finish line, their season has run out of time. There was one ray of sunshine in an otherwise extremely dark week, as the Bears pulled off a thrilling victory Sunday afternoon in Soldier Field.

Fed Rhetoric and Price Stability

“. . . I find it very amusing, a year ago that at that September [Fed] meeting when we had booming commodity prices, housing prices rising at the fastest rate in post-war history, when we had all commodities going up at rapid rates, Fed Chairman Powell and the Fed said we don’t see any inflation, we see no need to raise interest rates in 2022, now when all those very same commodities and asset prices are going down, he sees, you know, stubborn inflation that requires the Fed to stay tight all the way to 2023. Makes absolutely no sense to me.” – Professor Jeremy Seigel, University of Pennsylvania, CNBC interview Friday, September 23, 2022

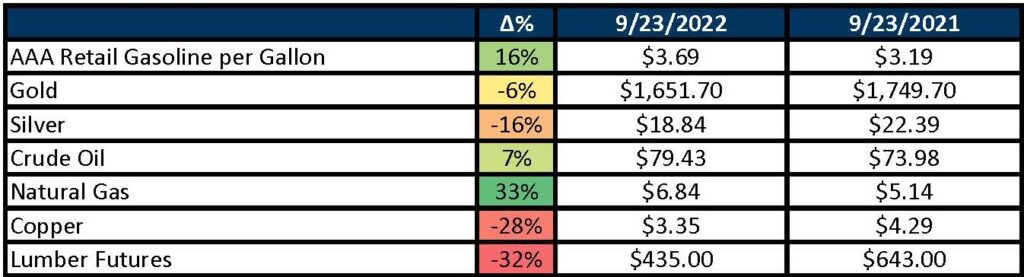

Although we are far from amused, we agree that the Fed rhetoric made no sense a year ago, and even less sense now. So, we thought it would be useful to compare commodity prices as of the Fed’s September 2021 meeting and as of the close this past Friday, September 23, 2022. Of course, the Fed rhetoric and interest rate actions have impacted key commodity price, so kudos to the Fed for that. However, the below table of commodity prices and housing affordability-related data strongly supports Professor Seigel’s analysis and suggests the Fed should be closer to the end of its current tightening cycle than it is willing to publicly admit. With the exception of Natural Gas prices from one year ago, the data certainly suggests price stability. And of course, price declines for these various economic components from the 2022 highs are quite dramatic.

Our view is that the Fed has accomplished its mission regarding its price stability mandate, and we think upcoming macroeconomic data will reinforce this viewpoint, setting the stage for less Fedspeak about its willingness to accept recession as the price of price stability. Additionally, according to Black Knight, a mortgage software, data and analytics firm, home prices declined 0.77% from June to July, which was the first monthly fall in nearly three years. Perhaps even more importantly, those prices likely turned even more negative in August 2022. As such home pricing data trickles into widely followed inflation reports, the consensus expectation of coming inflation trends should moderate. Keep in mind that the shelter component of the August CPI report released on September 13 was a major contributor to the unexpected 0.1% month over month increase in inflation that triggered this recent excruciating double-digit percentage decline in stock prices. Home sales are non-linear and episodic, so the slowdown in home sales and home prices that is happening in the real economy will likely take a few months to show up in reported inflation statistics.

This Week

The economic calendar is busy, with durable goods report for August, and Case -Schiller housing data for July both scheduled for release on Tuesday. As we discussed earlier housing sales is a lagging indicator, and the more up to date evidence such as the NAHB Housing Market Index, which gauges current sentiment, has already seen the swift and dramatic decline that the Fed believes is required. Also on Tuesday, the Conference Board releases its September Consumer Confidence Index, which rebounded modestly in August after reaching a 12-month low in July. Nike results this week might provide us with a glimpse into whether the inventory-reduction efforts of retailers are closer to the 9th inning or the 1st inning – the 9th seems more likely given the coming holiday season.

Friday’s Bureau of Economic Analysis reports on personal income and expenditures for August will be in focus, with particular emphasis on the personal- consumption expenditures price index, which is the Fed’s favored inflation gauge. We would encourage investors to focus more on the month-over-month change, rather than the year-over-year increase that reflects dramatic increases 6 months ago. Once again, we reference Wayne Gretzky’s wisdom to focus on where the puck is going not where it is or where it was previously.

Stocks on the Move

-20.9% Steelcase Inc (SCS) designs and manufactures products used to create high performance work environments. The Company offers products such as office furniture, furniture systems, interior architectural products, technology equipment, seating, and related products and services. Last week, SCS announced second quarter net income of $19.6M or $0.17 per share. Revenue for the period grew to $863.3M but missed analyst expectations of $882.7M. Given the current macroeconomic environment in combination with lower volume order trends for the first three weeks of September, the Company announced it would be severing 180 salaried positions and reducing the quarterly dividend from $0.145 per share to $0.10 per share.

-10.8% BorgWarner Inc (BWA) is a global product leader in clean and efficient technology solutions for combustion, hybrid and electric vehicles. The Company’s products help improve vehicle performance, propulsion efficiency, stability, and air quality. Last week, BWA announced it had agreed to acquire the Electric Vehicle Solution, Smart Grid, and Smart Energy businesses of Hubei Surpass Sun Electric for ¥410M.

-28.3% Value Line Inc (VALU) produces investment related periodical publications. The Company also provides investment advisory services to mutual funds, institutions, and individual clients. All total, Value Line collects data and provides analysis on around 7,000 stocks, 18,000 mutual fund and 200,000 options. There was no significant company news last week.

-16.1% Great Lakes Dredge & Dock Corporation (GLDD) offers marine services. The Company deepens and maintains waterways, shipping channels, ports, creates and maintains beaches, excavates harbors, builds docks and piers, and restores aquatic and wetland habitats. There was no significant company news last week.

-15.3% Century Casinos Inc (CNTY) operates as an entertainment company. The Company owns casinos, hotels, and luxury cruise vessels. There was no significant company news last week.

-15.2% Evolution Petroleum Corporation (EPM) explores for and produces oil and gas. The Company focuses on acquiring established oil and gas fields and applying specialized technology to increase production rates. There was no significant company news last week.

-14.6% Blue Bird Corporation (BLBD) designs and manufactures school buses and commercial buses for school districts, large national fleets, businesses, government agencies, and non-profit organizations. There was no significant company news last week.

-12.4% Boot Barn Holdings Inc (BOOT) sells western and work gear for individuals and families. The Company sells boots, jeans, shirts, hats, belts, jewelry, and other accessories. There was no significant company news last week.

-11.7% Paramount Global (PARA) operates as a multimedia company. The Company provides television and radio stations, produces and syndicates television programs, broadcasting, publishes books, and online content, as well as provides outdoor advertising. Last week, Paramount Global declared a $0.24/share quarterly dividend.

-11.2% Advanced Micro Devices Inc (AMD) operates as a semiconductor company worldwide. Its products include microprocessors, chipsets, discrete and integrated GPUs, data center and professional GPUS, and development services. There was no significant company news last week.

-10.3% Sprott Inc (SII) provides investment management services. The Company offers portfolio management, broker-dealer activities, and consulting services to clients. Its offerings primarily involve equity strategies, ETFs, and physical bullion trusts that give institutional and individual investors exposure to precious metals. There was no significant company news last week.

-10.3% Madison Square Garden Entertainment Corp (MSGE) produces, presents, and hosts various live entertainment events, including concerts, family shows, and special events, as well as sporting events, in its venues including New York’s Madison Square Garden, Hulu Theater, Radio City Music Hall, the Beacon Theater, and The Chicago Theater. The Company also operates entertainment dining and nightlife venues in New York City, Las Vegas, Los Angeles, Chicago, Singapore, and Australia under the Tao, Marquee, Lavo, Avenue, Beauty & Essex, and Cathédrale brand names. There was no significant company news last week.

-10.2% Rocky Brands Inc (RCKY) designs, develops, manufactures, and markets men’s and women’s footwear. Its footwear brands, which are sold in retail sporting goods and outdoor stores, include Rocky, Georgia Boot, Creative Recreation, Durango, Lehigh, Honeywell, XTRATUF and licensed brand Michelin. There was no significant company news last week.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.