Pressure

The stock market continued to be under selling pressure, as the S&P slid 1.6%, the Nasdaq dropped 3.1%, and the Russell 2000 shed 1.2%. Health care and Financials shares fared better thanks to solid earnings reports from several of the key components of those sectors, such as JPMorgan Chase & Co. (JPM) and UnitedHealth Group Inc (UNH). The Dollar climbed to a new multi-decade high, Crude Oil sank over 7% giving back all its increases from the previous week, while Gold slid over 3% to approach its low for the year. The yield on the 10-year Treasury increased 12 basis points to exceed 4% for the first time since 2007, while the 10-2 spread widened to a negative 48 basis points. An inverted yield curve is viewed as a reliable indicator of an impending recession, and the curve has now been inverted since July 8, and is at its most negative spread in over 40-years.

The theme song for 2022 could very well be Metallica’s “Nothing Else Matters”, although the band was probably not referencing inflation in that 1992 ballad. One hour into trading on Thursday morning the market reached its lowest level since November 2020, following slightly hotter than expected PPI and CPI reports. The market then staged an amazing 5% rally over the next few hours, perhaps based on technical trading and short covering. Unfortunately stocks sharply declined on Friday after the University of Michigan’s survey showed inflation expectations for the next year of 5.1% versus expectations of 4.7% the previous month. At North Star, based on analysis of more than 40 different economic data series each month, we believe that inflation will moderate back to its long-term 2.5%-3% range by mid 2023, and that something else will matter to investors before then, which very well may be anemic growth in real GDP.

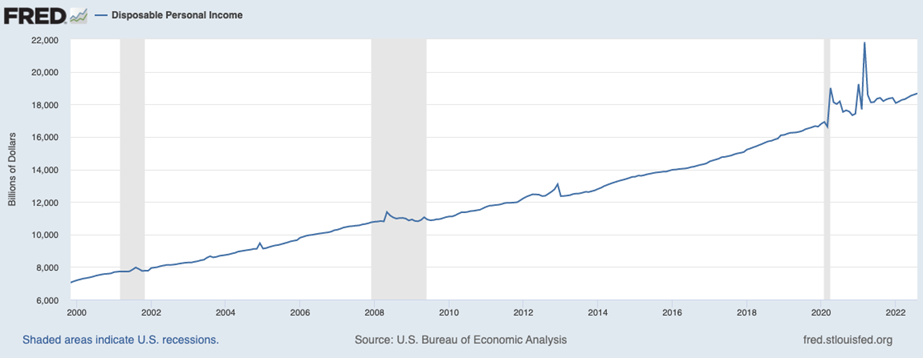

The basis for our outlook for steadily moderating inflation, likely coupled with anemic GDP growth can be seen in Disposable Personal Income trends. This graph shows that in past recessionary periods, prior to the recent Covid pandemic-induced recession, the Federal Reserve’s measure of Real Disposable Income fell both during and immediately following the recessionary periods (shown in grey bands). However, in very sharp contrast, the 2020 recession shows both during and immediately following as well as several months later, Real Disposable Income spiked amid unprecedented fiscal and monetary stimulus. Initial downturns in CPI at the start of the panic may have even boosted the “real” part of disposable income beyond what the Fed and Congress expected from their stimulus measures. But the current situation is in sharp contrast to earlier post-pandemic months because the Fed is now taking contractionary actions and businesses are slowing employment growth or reducing employment levels on an absolute basis. Higher interest rates reduce purchasing power with credit/borrowings, and consumer confidence and spending frequently declines with negative labor market news. Thus, we believe this is evidence for our outlook on slowing inflation trends and slowing real GDP growth especially now that unprecedented stimulus is dissipating, and rising interest rates have reduced real disposable income purchasing power.

“It’s a profit deal!”

Profits matter, and the third quarter earnings season will ramp up with 66 S&P 500 companies scheduled to release results. Given the headwinds of very low consumer sentiment, the sharp rise in costs, and the strong dollar, the bar has been lowered to expectations of a very modest 1.6% increase in aggregate earnings. Additionally, forward guidance is likely to be constrained due to all of the uncertainties. The early results have been weaker than normal, as the number and magnitude of positive earnings and revenue surprises have been smaller than average, and analysts have continued to lower earnings estimates for companies. Stock prices have already fallen much more dramatically than the decline in earnings estimates, suggesting that this soft patch in profits has already been discounted in the market.

The economic data will include releases from the Federal Reserve on Manufacturing and Industrial Production, both of which are expected to show a stable economy. Housing data, on the other hand, is forecasted to indicate weakness, as the higher mortgage rates are taking its toll on the real estate market.

Stocks on the Move

+16.1% Oil-Dri Corporation of America (ODC) develops, manufactures, and markets sorbent products to the grocery products industry, mass merchandisers, warehouse clubs, and pet specialty retail outlets. The Company’s cat litter products are marketed under the Cat’s Pride and Jonny Cat brands; additionally, ODC manufactures the Fresh Step brand exclusively for Clorox. Last week, Oil Dri reported Q4 GAAP EPS of $0.77 and all-time high revenue of $93.16M (+19.3% y/y). The higher sales were mainly driven by price increases, as well as growth in animal health, cat litter, fluids purification, and the industrials/sports segments. Sales in co-packing remained flat. Gross margin remained at 19% and the Company will continue to focus on restoring margins to pre-Covid level in mid- to high-20’s.

+34.2% Value Line Inc (VALU) produces investment related periodical publications. The Company also provides investment advisory services to mutual funds, institutions, and individual clients. All total, Value Line collects data and provides analysis on around 7,000 stocks, 18,000 mutual fund and 200,000 options. There was no significant company news last week.

-18.9% Blue Bird Corporation (BLBD) designs and manufactures school buses and commercial buses for school districts, large national fleets, businesses, government agencies, and non-profit organizations. There was no significant company news last week.

-13.9% Turtle Beach Corporation (HEAR) operates as a sound technology company. The Company designs and markets audio peripherals for video game consoles, personal computers, and mobile devices. There was no significant company news last week.

-28.5% Sono Group N.V. (SEV) manufactures and sells electric cars with integrated solar cells and panels. In addition, the Company monetizes its variable battery technology for integration in numerous types of vehicles, including buses, trucks, camper vans, trains, and boats, as it aims to reduce carbon emissions and provide clean and affordable transportation for the masses. There was no significant company news last week.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.