In Memory of Sheldon Goodman

It is with great sadness that we report that our beloved Sheldon Goodman passed away in his sleep Thursday night after heroically battling multiple illnesses throughout the years.

Shel began his career at the Federal Reserve Bank of New York on the Open Market Trading desk over 60 years ago and later founded the high-yield trading division at Goldman Sachs. In addition, Sheldon was a Partner, Compliance Officer, and Sales Manager at Bear Stearns; was Director of Commodities and Futures at Gruntal & Co.; and a former Director of the Chicago Board Options Exchange. Earlier in the week, Shel said that North Star, which had been his home for nearly twenty years, had been his favorite place to work and couldn’t imagine a better place to end his career. We all feel blessed to have had him as our partner and will miss his unflappable optimism and sound counsel. Most importantly, he was a loving husband to Valerie and a kind and gentle presence in the lives of his children and grandchildren.

Shel loved the markets, and both stocks and bonds treated him to one final rally, as our predictions from our previous commentary proved accurate. In that commentary we noted that the “midterm elections are on Tuesday, the outcome of which likely will have significant implications, but apparently only a minor impact on the financial markets. Very few companies have even mentioned the elections during their quarterly conference calls. The Consumer Price Index release on Thursday, on the other hand, will certainly be a major focus for stock and bond traders. Economists forecast an 8% year-over-year increase in October, down from 8.2% in September. Used car pricing and home prices have certainly cooled, but those factors may not show up in the data yet; we continue to expect slowing inflation data in the coming months, aided by both cooling input costs and easier comparisons to late 2021 and early 2022.”

Indeed, those two themes dominated the headlines, with the market essentially unchanged following the elections, and then soaring on Thursday on a report that showed slowing inflation and raised hopes that the Federal Reserve might pull back its policy of aggressive interest rate hikes. The Labor Department data pegged the annual rate of inflation at 7.7% in October, short of expectations for a 7.9% rise and down from this summer’s high of 9.1%. Growth stocks fared the best with the Nasdaq Composite soaring 8.1%, while the S&P 500 jumped 5.9%, and the Russell 2000 gained 4.6%. The yield on the 10-year Treasury dropped 34 basis points to 3.81%, and the Dollar declined over 4%.

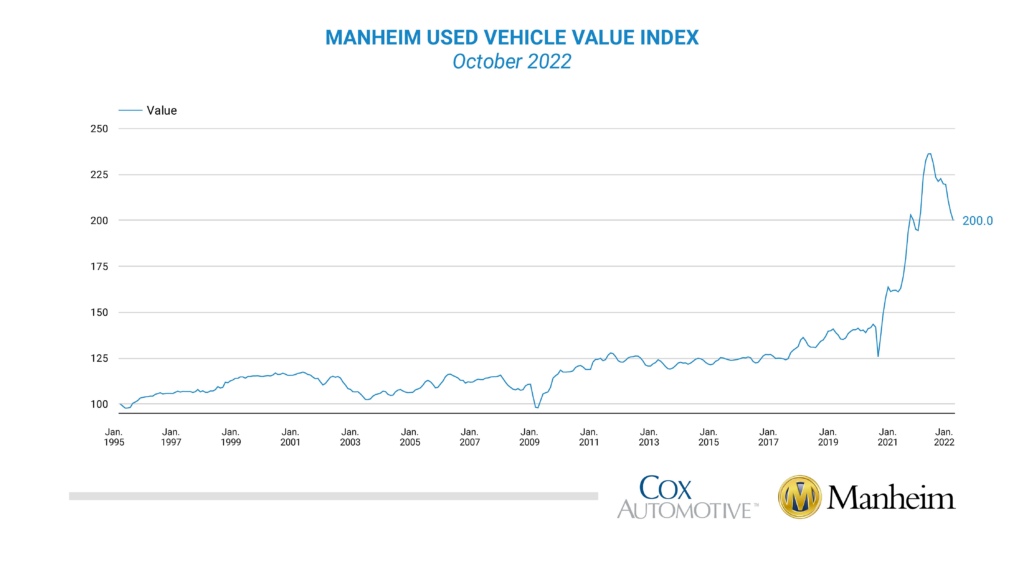

We believe this October CPI data point will eventually become a trend, as the impact of weakening home prices increases as more transactions (home sales) show up in the data, although such trends are rarely perfectly linear; our view is that inflation statistics will wiggle downward as consumers slow major purchases that are typically financed with increasingly expensive credit. Therefore, big ticket items such as appliances and furniture could also be vulnerable to rising costs of credit and rising opportunity cost of spending savings. Used car price drops may also intensify if businesses like Carvana heavily discount vehicles to encourage transactions, as seems to already be happening as shown in the Used Car Price Trend ‘Mannheim Index’ chart below. In past economic slowdowns, housing price declines typically seeped very slowly into the inflation-tracking statistical data series because home sales transactions first become less and less frequent before prices reset such that sellers and buyers see eye-to-eye and the pace of home sales picks up again. Moreover, our conversations with the management teams of our portfolio companies suggests much less aggressive plans for adding jobs and wage increases. In other words, Goldilocks might start feeling like the porridge is too cold rather than too hot.

Back in the Headlines

The retail sector will be in focus with earnings reports due out from Home Depot, Lowe’s, Walmart, Target, and Macy’s. Additionally, the Census Bureau will report retail sales data for October, with expectations of a modest increase from September.

Inflation data will be back in the headlines with the release of the Producer Price Index for October on Tuesday. Although still elevated, it is forecasted to continue the downward trend that started after peaking in March. We believe this trend is important as producer prices often influence consumer prices with a modest lag.

Housing data later in the week will likely exhibit softness in response to the surging mortgage rates, as mentioned above.

Stocks on the Move

+20.1% ACCO Brands Corporation (ACCO) manufactures office products. The Company produces staplers, daily scheduling diaries, shredders, laminating equipment, and presentation boards. Last week, ACCO reported Q3 earnings of $0.25 per share and revenue of $485.6M, representing a 24% and 7.8% year-over-year decline in earnings and sales, respectively. Management discussed strong international growth offset by macro and currency headwinds, indicated future cost and pricing actions, and expects FY23 free cash flow to increase to $90M-$100M.

+13.2% Napco Security Technologies Inc (NSSC) manufactures electronic security devices, fire detection products, access control systems, and digital lock equipment used in residential, commercial, institutional, and industrial installations. NSSC reported strong results last week with Q3 GAAP EPS of $0.17 and revenue of $39.5M beating by $0.04 and $3.15M, respectively. Demand for NAPCO products and services is strong, and management expects to deliver revenue growth and increased profitability in FY23 and beyond.

+10.3% The Eastern Company (EML) manufactures and markets a variety of locks and other specialty industrial hardware. The Company primarily offers locks and latches for truck bodies, computers, office equipment, and various applications for the electrical, automotive, and construction industries. On Monday, EML reported Q3 earnings of $0.72 per share and record sales of $71.6M, up 12.1% y/y. Backlog remains strong, and management expects very favorable long-term demand trends across core markets.

-13.7% Sono Group N.V. (SEV) manufactures and sells electric cars with integrated solar cells and panels. In addition, the Company monetizes its variable battery technology for integration in numerous types of vehicles, including buses, trucks, camper vans, trains, and boats, as it aims to reduce carbon emissions and provide clean and affordable transportation for the masses. SEV ended the week down after a two-day rally on news that it had signed a partnership agreement with Bosch Automotive Aftermarket for Bosch Car Service workshops to perform all the maintenance and repair service on the Sono Sion car.

+13.1% Qualcomm Incorporated (QCOM) operates as a multinational semiconductor and telecommunications equipment company. The Company develops and delivers digital wireless communications products and services based on code-division multiple access (CDMA) technology. Chip stocks rose last week after an announcement from Taiwan Semiconductor (TSM), the world’s largest chip maker, that October sales were up nearly 55% from the year before.

+10.1% Advanced Micro Devices Inc (AMD) operates as a semiconductor company worldwide. Its products include microprocessors, chipsets, discrete and integrated GPUs, data center and professional GPUS, and development services. AMD shares also responded positively to the announcement from Taiwan Semiconductor (TSM).

Companies with no significant news…

+10.7% Allied Motion Technologies Inc (AMOT)

+11.0% Blue Bird Corporation (BLBD)

+11.3% 1-800-Flowers.Com Inc (FLWS)

+11.5% LSI Industries Inc (LYTS)

+11.8% Century Casinos Inc (CNTY)

+12.7% Boot Barn Holdings Inc (BOOT)

+12.9% Value Line Inc (VALU)

+13.7% Rocky Brands Inc (RCKY)

+15.0% The Blackstone Group Inc (BX)

+17.2% Green Brick Partners Inc (GRBK)

+19.9% Hamilton Beach Brands Holding Company (HBB)

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.

Chicago Sports Scene

The Chicago Bears lost to the Detroit Lions 31-30, dropping to 3-7 on the year. The Bears blew a 14 point lead in the fourth quarter, before Justin Fields thrilled the fans at Soldier Field with a 67 yard touchdown run. Cairo Santos missed the extra point, and the Lions marched 91 yards to score in the final minutes to secure the victory.

On a brighter note, The University of Chicago basketball team has looked terrific in starting the season 3-0. The Maroon nation will be in full force this upcoming weekend for the Midway Classic with games against Colorado College and Colby at the Ratner Center. Good seats are still available.