Liftoff

The Santa Claus rally seemed to get a nice liftoff Tuesday morning with the release of the November CPI, which showed solid evidence that inflationary pressures were easing dramatically. Importantly, with the month over month increase of just 0.1%, the cumulative inflation over the last five months has been just 1%. At one point early Tuesday morning, the S&P 500 had rallied 5% for week, but the approaching winds of the FOMC meeting scheduled for the following day quickly blew Santa’s sled off course, slicing the gains in half by the end of the day. The Fed raised rates at that meeting by 50 basis points as expected, but once again despite mounting evidence of a rapidly softening economy Chairman Powell opted to jawbone down sentiment further. Additionally, the updated dot plot showed that the central bank expects to raise rates ultimately to 5.1% by the end of 2023, a half-point higher than projected in September, and lower them only to 4.1% by late 2024. All the gains for the week had evaporated by the time Chairman Powell left the podium at his post meeting press conference. On Thursday morning, the November retail sale release showed a 0.6% decline, the largest drop of the year, and double the decline that had been forecasted. But this time bad economic news, was not taken as an indicator Fed rate increases would slow.

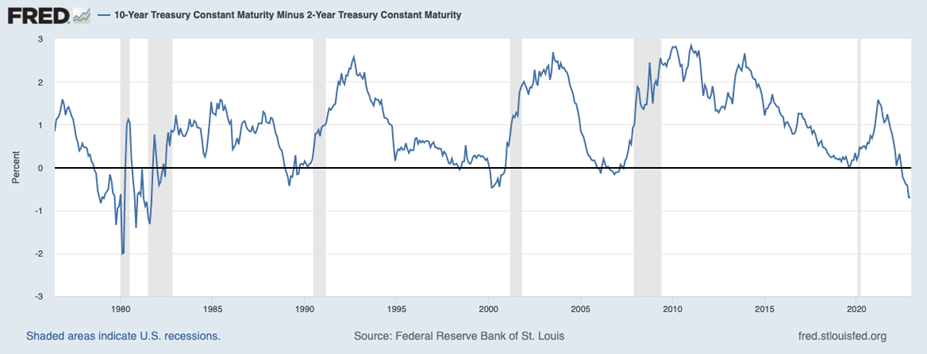

By the time the closing bell rang Friday afternoon, the indexes had posted a second consecutive week of losses with the S&P down 2.1%, the Nasdaq off 2.7%, and the Russell 2000 off 1.9%. The dollar and gold were essentially unchanged, while the yield on the 10-year Treasury dropped 9 basis points to 3.48%. As seen in the below graph, the 10-year versus 2-year U.S. Treasury yield inversion did not worsen this past week but remains deeply inverted relative to all available historical periods besides the last multi-year period of elevated inflation in the late 1970s and early 1980s.

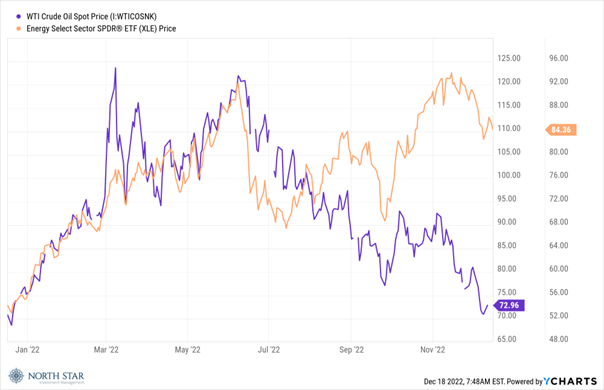

The Oil & Gas sector finished up 3.3% as crude oil bounced almost 5% off a recent low. We continue to underweight energy stocks, which historically are highly correlated to the underlying commodity prices but have dramatically outperformed over the last 5 months. We believe that relationship will be restored either by crude prices rising and/or with the stocks in the sector declining.

North Star seems to be in tune with Barron’s, which highlighted the “Shattered” REIT sector in this week’s edition. We recently finished our white paper on the Real Estate sector as part of our Small Cap Bootcamp Series, in which we identified a few bargains from our portfolio.

Chicago Sports Scene

We suffered through a triple-header on a frigid Sunday in Chicago, with the Bears, Bulls, and Blackhawks all losing. The Bears have now lost seven games in a row, and with three tough opponents left on the schedule it seems probable they will eclipse the franchise record of eight straight losses.

The Bulls gave up 150 points to the Minnesota Timberwolves. Perhaps a team video session watching Jerry Sloan and Norm Van Lier playing defense in the 1970s might be helpful?

The Blackhawks lost their eighth game in a row, and tenth at home, 7-1 to the New York Rangers. They look really awful.

Closing Out 2022

The economic calendar includes readings on the housing market, consumer confidence, leading indicators, personal income and expenditures, all of which are likely to paint a picture of a slowing economy. The BEA report on the core personal expenditures price index on Friday could be in focus, as it is the Fed’s preferred inflation gauge.

As 2022 comes to a close, the spread of Covid-19 and the Russian invasion of Ukraine remain sources of tremendous human suffering as well as major disruptions to the global economy. The recent surge in Covid-19 cases and deaths in China is receiving increased media attention, with some sources suggesting that fatalities might reach one million over the winter, but so far without much of a reaction from the financial markets.

Stocks on the Move

-14.4% Alico Inc (ALCO) operates as an agribusiness and land management company in Fort Myers, FL. Alico Citrus cultivates citrus trees to produce oranges for delivery to the processed and fresh citrus markets. Land Management owns, manages, and leases land for recreational and grazing purposes. Last week, ALCO reported FY2022 earnings per share of $1.65 and revenue of $91.95M. For the fourth quarter, the Company reported a loss of $(2.78) per share related to Hurricane Ian. While the Company maintains catastrophe and P&C insurance, the claims were not large enough to be covered by its policy. As a result, the Company also slashed its dividend by 90% to $0.05 quarterly per share.

-16.3% Value Line Inc (VALU) produces investment related periodical publications. The Company also provides investment advisory services to mutual funds, institutions, and individual clients. All total, Value Line collects data and provides analysis on around 7,000 stocks, 18,000 mutual fund and 200,000 options. Last week, Value Line reported its fiscal second quarter results with GAAP earnings of $0.46 per share, down almost 50% year over year.

-19.8% Blue Bird Corporation (BLBD) designs and manufactures school buses and commercial buses for school districts, large national fleets, businesses, government agencies, and non-profit organizations. Last week, BLBD reported a $(0.66) loss per share for its fourth quarter on revenue of $257.67M. The Company mentioned in the earnings conference call that they believe the worst is behind them, but supply chain issues persist. Demand is strong, price increases are being realized, and Blue Bird has taken the opportunity to lean up on some operational inefficiencies during this transitional period.

+11.1% CarParts.com Inc (PRTS) retails automobile parts online. The Company offers mirrors, engines, headlights, brakes, interior and exterior accessories, tools, wheels, lighting, bumpers, and other aftermarket autobody parts in its network of over 1.2 million SKUs. There was no significant company news last week; however, the North Star research team had an introductory meeting with the newly hired COO, Michael Huffaker, and believes CarParts is in good hands under his extensive supply chain expertise. Mr. Huffaker previously worked at Amazon for 15 years as Vice President, Group Leader, for Amazon Fresh Grocery. His main priorities are focusing on safety, accuracy, and speed in CarParts.com’s distribution centers.

-16.1% Turtle Beach Corporation (HEAR) operates as a sound technology company. The Company designs and markets audio peripherals for video game consoles, personal computers, and mobile devices. There was no significant company news last week.

-13.8% Delta Apparel Inc (DLA) designs, markets, and manufactures branded and private label active and headwear apparel. The Company’s products are sold to boutiques, department stores, outdoor and sporting goods retailers, college bookstores, screen printers, and the US military. There was no significant company news last week.

-10.0% The Container Store Group, Inc. (TCS) operates as a retailer of storage and organization products and solutions in the United States. The Company also designs, manufactures, and sells custom closet solutions via its elfa and Closet Works segments. There was no significant company news last week.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.