Normalizing, Not Overheating Nor Collapsing

The stock market surged on Friday following the December employment report which showed strong hiring and a historically low jobless rate combined with cooling wage growth. Following the report, Tavis C. McCourt, Institutional Equity Strategist at Raymond James commented, “Inflation data will look increasingly good this year…” noting that it was a “…pretty goldilocks jobs report (while) job gains were a bit higher than expected in December, but most importantly, average hourly earnings decelerated, and the highly problematic November average hourly earnings number was revised meaningfully lower. So, the downward trajectory of average hourly earnings was clear in 2022.”

To those confused by the contradiction of the BLS statistics suggesting a continued tight labor market yet with decelerating wages, the Raymond James analyst cites the Philly Fed Report and concludes, “What we’re seeing is not a contrary set of data with meaningfully positive jobs growth resulting in decelerating average wages, perhaps what we are seeing is a jobs market that is softening, but government data over-estimating job creation.” We agree with this analysis, and the action in the bond market also supports that outlook.

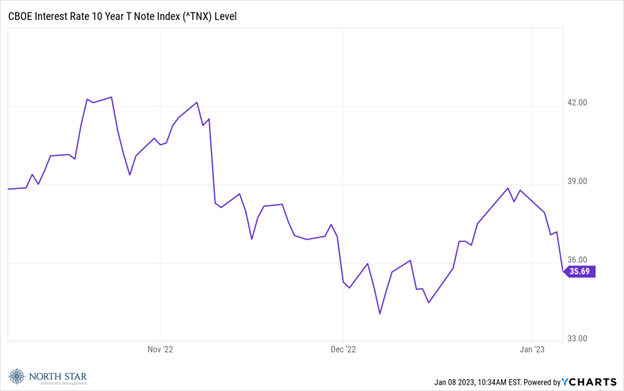

As the chart above shows, the 10-year Treasury yield has now declined 70 basis points in the last two months, including a drop of 31 basis points to 3.57% during last week. In general, falling 10-year Treasury yields historically are more consistent with expectations for less inflation, rather than with expectations for more inflation.

More significantly, interest rates are on the lower end of historic levels. As the chart above illustrates, with the exception of the extended period of ultra-accommodative monetary policy following the financial crisis, 4% was the floor for 10-year yields over the last 50-years.

The ISM reports also showed a slowing economy, with the December Manufacturing PMI® registering at 48.4 percent, 0.6 percentage point lower than the 49 percent recorded in November. Those readings under 50 indicate a contracting economy, following 30 straight months of expansion. The December Services PMI® registered 49.6 percent, 6.9 percentage points lower than November’s reading of 56.5 percent. It was the first month of contraction for the Services index since May 2020. Services economic trends have been a major source of upward inflation data in the form of wages growth; slowing services economic activity could encourage the U.S. Federal Reserve to reduce its recent hawkish tone and its pace of contractionary interest rate actions.

Once again, we believe the economy is normalizing – not overheating nor collapsing. The stock market continued to digest the news reasonably well with Friday’s rally resulting in a weekly gain of 1.5% for the S&P 500, 0.9% for the Nasdaq Composite, and 1.8% for the Russell 2000. Oil was the big loser, posting nearly a 10% decline, while Gold continued its recent upward trend, and the Dollar was steady.

On the Chicago sports scene, the Bears earned the number one overall pick in the 2023 NFL Draft after a 29-13 loss to the Minnesota Vikings in the season finale. The Bears finished 3-14 and ride an impressive 10-game losing streak into the next season.

Low Bar

We will be holding our breath on Thursday morning awaiting the CPI report for December. The headline consumer price index reading for December is expected to cool to +6.7% from +7.1% in November and be up 0.1% on a month-over-month comparison. Core CPI is forecast to be up 5.6% and up 0.2% month-over-month. We continue to encourage investors to focus on the month-over- month changes, as the year-over-year numbers are skewed by extremely high increases from March through June of 2022. Analysts expect both core goods and energy prices to have declined again in December, while food inflation and core services inflation may have remained stickier.

Earnings season officially kicks off on Friday with major banks and financial institutions reporting results. The bar has been set pretty low, with downward revisions to earnings estimates by analysts and the negative EPS guidance issued by companies. The S&P 500 is now expected to report a year-over-year earnings decline of -4.1%, compared to estimated (year-over-year) earnings growth of 3.5% on September 30. The Energy sector is the only sector that has recorded an increase in expected earnings due to upward revisions to earnings estimates; however, the recent decline in oil prices will likely provide a headwind for the sector going forward.

Equities seem reasonably priced with the forward 12-month P/E ratio for the S&P 500 at 16.5, which is below the 5-year average of 18.5 and below the 10-year average of 17.2, and in-line with the longer-term average multiple. The trailing 12-month P/E ratio is 18.6, which is below the 5-year average of 22.7 and below the 10-year average of 20.5. Small-caps seem inexpensive with the Russell 2000 trading at a 13.25 trailing 12-month P/E ratio. We run two screens each week, currently our value screen identifies 145 candidates, up from 103 a year ago, and our small cap dividend screen has 248 candidates, up from 204 a year ago. Please feel free to contact us if you are interested in learning more about our small cap value focused funds, or our favorite picks in that area.

Stocks on the Move

Stocks with news…

+12.7% Paramount Global (PARA) operates as a multimedia company. The Company provides television and radio stations, produces and syndicates television programs, broadcasting, publishes books, and online content, as well as provides outdoor advertising. Despite having its FY22 and FY23 estimates cut by Macquarie last week, Paramount rode Disney’s tailwinds and ended the week up.

+11.3% Freeport-McMoRan Inc (FCX) is a leading international mining company with headquarters in Phoenix, AZ. FCX operates large, long-lived, geographically diverse assets with significant proven and probable reserves of copper, gold, and molybdenum. FCX jumped last week as copper prices rose. Experts are predicting China’s efforts to boost its economy will create higher demand for metals.

Stocks with no news…

+22.3% Blue Bird Corporation (BLBD) designs and manufactures school buses and commercial buses for school districts, large national fleets, businesses, government agencies, and non-profit organizations.

+19.0% Rocky Brands Inc (RCKY) designs, develops, manufactures, and markets men’s and women’s footwear. Its footwear brands, which are sold in retail sporting goods and outdoor stores, include Rocky, Georgia Boot, Creative Recreation, Durango, Lehigh, Honeywell, XTRATUF and licensed brand Michelin.

+17.0% Westwood Holdings Group Inc (WHG) provides investment advisory services to a broad range of institutional clients. The Company also offers trust and custodial services to institutions and high-net-worth individuals.

+15.6% Denny’s Corporation (DENN) operates as a full-service family restaurant chain directly and through franchises. The Company consists of more than 1,700 franchised, licensed, and company-operated restaurants around the world.

+12.6% Turtle Beach Corporation (HEAR) operates as a sound technology company. The Company designs and markets audio peripherals for video game consoles, personal computers, and mobile devices.

-11.5% Sono Group N.V. (SEV) manufactures and sells electric cars with integrated solar cells and panels. In addition, the Company monetizes its variable battery technology for integration in numerous types of vehicles, including buses, trucks, camper vans, trains, and boats, as it aims to reduce carbon emissions and provide clean and affordable transportation for the masses.

+11.4% Escalade Inc (ESCA) manufactures and sells specialty sporting goods. The Company is the world’s largest producer of tables for table tennis under the Ping-Pong and STIGA brands; it’s other products include hockey and soccer tables, play systems, archery, darts, soccer nets, and fitness equipment.

+10.2% Green Brick Partners Inc (GRBK) operates as a homebuilding and land development company. The Company develops residential homes, complexes, and communities. Green Brick Partners invests in a range of real estate investments, as well as provides land and construction financing to its controlled builders.

+13.3% Sprott Inc (SII) provides investment management services. The Company offers portfolio management, broker-dealer activities, and consulting services to clients. Its offerings primarily involve equity strategies, ETFs, and physical bullion trusts that give institutional and individual investors exposure to precious metals.

+11.3% DallasNews Corporation (DALN) is the Dallas-based holding company of The Dallas Morning News and Medium Giant. The Dallas Morning News is Texas’ leading daily newspaper with a strong journalistic reputation, intense regional focus, and close community ties. Medium Giant is a media and marketing agency of divergent thinkers who devise strategies that deepen connections, expand influence, and scale success for clients nationwide.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.