Five Words

The combination of 5 dovish words from the Fed and encouraging data on the economy was able to overcome lackluster earnings reports and drive stock prices higher.

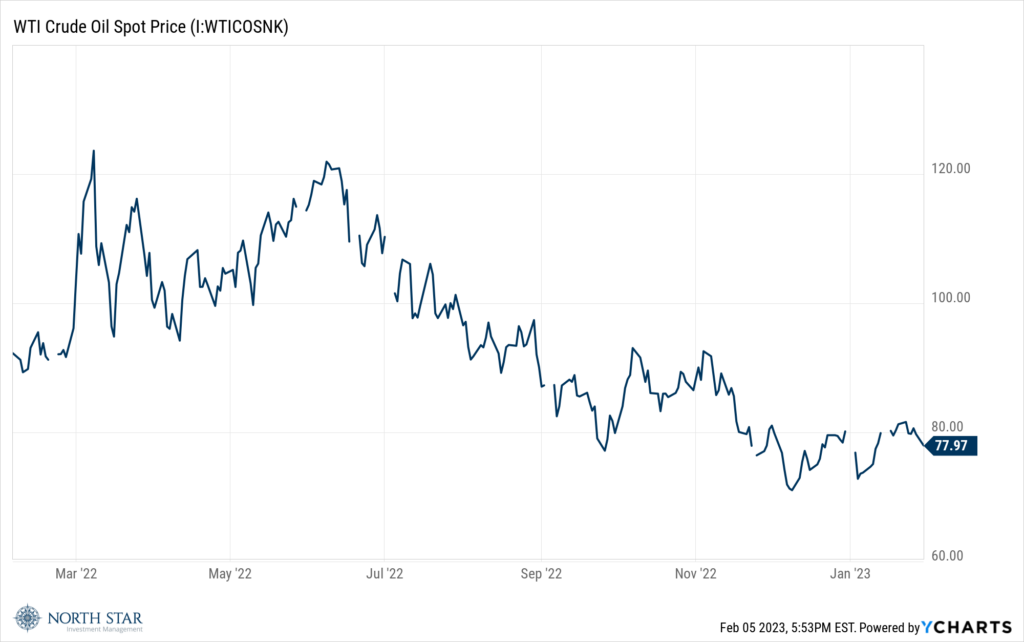

Earnings reports continued to be subpar midway through the fourth quarter earnings season with the expected blended earnings decline expanding to -5.3%, compared to -5.1% as of the end of last week and -3.3% at the end of the fourth quarter. Negative earnings surprises and downward revisions to earnings estimates for companies in the Financials and Communication Services sectors have been the largest contributors to the increase in the overall earnings decline trend for the index since December 31. The Energy sector is reporting the highest earnings growth of all eleven sectors at 57.7%. If the Energy sector were excluded, the blended earnings decline for the index would increase to -9.4% from

-5.3%. It is worth noting that crude oil prices have been trending lower since surging last March and will likely be below year-ago levels on average during the first quarter of 2023. Those lower oil prices will be an earnings headwind for the Energy sector, while at the same time a tailwind for most of the other sectors.

In addition to digesting the soft earnings reports, the market also struggled until Wednesday afternoon in nervous anticipation of the outcome of the FOMC meeting. At that meeting, the Fed raised rates by 25 basis points as expected, but the surprise came when Chairman Powell added to his narrative that “the disinflation process has started.” Equities responded with a handsome rally to finish the week with the S&P 500 up 1.6%, the Nasdaq Composite up 3.3%, and the Russell 2000 up 3.9%. The yield on the benchmark 10-year Treasury dropped 18 basis points following Chairman Powell’s comments, but then reversed direction after the employment report to finish the week essentially unchanged at 3.53%. The Bureau of Labor Statistics report indicated that a whopping 517,000 jobs were added in January, with the unemployment rate falling to 3.4%, its lowest level since May 1969. Meanwhile, wage pressures continued their downward trend now registering a 4.4% year-over-year increase down from 4.6% in December, and 5.7% in January 2022. One could characterize the labor market either as strong (optimistic) or tight (pessimistic). We think it is terrific that jobs are plentiful with solid yet slowing wage growth, although we recognize that the Fed will likely keep short-term rates high until the wage growth slows even further.

The other encouraging data release came from the ISM Services PMI® which registered at 55.2 percent, 6 percentage points higher than December’s seasonally adjusted reading of 49.2 percent. The reading over 50 indicates the Services sector was back in expansion territory after a single month of contraction and the prior 30-month period of growth. The composite index has indicated expansion for all but three of the previous 155 months.

We were happy to see Pfizer Inc (PFE), a high conviction holding at North Star, was the subject of the cover story this week with the stock called attractive after the sharp share price drop. The article points out that despite the drop in revenue after vaccine sales slowed, analysts think the pipeline is strong enough to support a bounce back, and highlights that on a valuation basis, PFE trades at a 13x multiple and sports a well-protected dividend yield of 3.72%.

Swelling Bills and Spy Balloons

Earnings season will continue, with 95 S&P 500 companies reporting results for the fourth quarter.

On Tuesday, Chairman Powell will be giving a speech at the Economic Club in Washington D.C. Also on Tuesday, the Federal Reserve will report consumer credit data for December. Credit card debt has been rising sharply over the last several months reaching new record levels.

The Michigan Sentiment Index on Friday is expected to remain at a depressed level equal to the previous month. The silver lining could be inflation expectations for the year ahead, which last month came in at the lowest level since April 2021.

Geopolitics are always a wild card, and tensions are growing between the U.S. and China following the shooting down this weekend of a Chinese spy balloon over South Carolina. While recently disinflationary price measures encourage us, the U.S. military deflation of the China balloon via weapons on U.S. fighter jets is less comforting. The numerous geopolitical risks are another good reason for some exposure to gold, with Newmont Corporation (NEM), Sprott Inc. (SII), Sprott Physical Gold (PHYS), and SPDR Gold Shares (GLD), holdings in North Star strategies. Please feel free to contact us if you are interested in more information on those securities or strategies.

Speaking of deflation, we bid a fond farewell to Tom Brady who announced his retirement last week.

Stocks on the Move

+21.0% Accuray Inc (ARAY) designs, develops, and sells advanced radiosurgery and radiation therapy systems for the treatment of tumors throughout the body. ARAY reported solid earnings last week with $(0.02) and revenues of $114.76M beating Wall Street estimates by $7.73M. The company reaffirmed its full year guidance and is focused on expanding its commercial customer base, improving on product and services margin, and growing a younger, healthier backlog.

+17.1% Advanced Micro Devices Inc (AMD) operates as a semiconductor company worldwide. Its products include microprocessors, chipsets, discrete and integrated GPUs, data center and professional GPUS, and development services. AMD reported fourth quarter results that topped estimates last week with earnings of $0.69 per share and revenue of $5.6B. Most analysts agree that the company is executing well, but growth could slow over the next year due to overall weakness in the industry.

+12.9% Central Garden & Pet Company (CENT) supplies consumer lawn and garden and pet supply products. The Company’s products are sold under brands names such as Pennington Seed, Zodiac, Four Paws, Island, and Grant’s. Central also offers value-added services, including inventory management, advertising and promotional programs, in-store service, and sales program development. CENT reported an in-line quarter with FQ1 net sales of $628M and FQ1 loss per share of $0.16. While the company is still churning through higher costs and a difficult macroeconomic environment, it reaffirmed its guidance for the year.

+10.9% 1-800-Flowers.com Inc (FLWS) is an e-commerce provider of floral products and gifts. The Company’s product offerings include fresh-cut and seasonal flowers, plants, floral arrangements, home and garden merchandise, and gift baskets. FLWS reported very strong FQ2 earnings of $1.28 and revenue of $897.8M as the company continues to execute on its cost-saving and strategic pricing initiatives. FLWS expects consumer spending to remain resilient for major upcoming holidays, while everyday gifting may soften as macroeconomic pressures continue.

+10.4% Amazon.com Inc (AMZN) is an online retailer that offers a wide range of products. The Company products include books, music, computers, electronics, and numerous others. Amazon is also the dominant cloud services provider (through Amazon Web Services, or AWS), an influential entertainment company through its video streaming operations, a force to be reckoned with in grocery with its ownership of Whole Foods, and a leader in digital personal assistant devices (Alexa and Echo). AMZN reported mixed earnings last week with fourth quarter EPS of $0.03 missing estimates by $0.14, and revenue of $149.2B beating estimates by $3.4B. AWS sales came in slightly lower, while advertising revenue and North American sales remained strong.

+10.4% McGrath RentCorp (MGRC) rents and sells relocatable modular offices, as well as electronic test and measurement instruments. The Company’s offices are used as temporary offices adjacent to existing facilities, sales and construction field offices, and classrooms. MGRC announced the acquisition of Vesta Modular for $400M and the sale of Adler Tank Rentals for $265M. The acquired business will accelerate growth in the core mobile module business with increased geographic coverage and longer-term revenue contracts.

+13.0% Ethan Allen Interiors Inc (ETD) designs, manufactures, sources, sells, and distributes a range of home furnishings and accessories. Through its portfolio of ten furniture factories, one sawmill, one lumberyard, as well as 300 Ethan Allen Stores, the Company offers a variety of products including beds, dressers, tables, chairs, buffets, entertainment units, home office furniture, and wooden accents. There was no significant company news last week.

+10.2% Orion Energy Systems Inc (OESX) manufactures, sells, installs, and implements energy management systems for commercial office and retail, exterior area lighting, and industrial applications in North America. It offers interior light emitting diode (LED) high bay fixtures; smart building control systems; and LED troffer door retrofit for use in office or retail grid ceilings. In addition, it provides lighting-related energy management services, such as site assessment, utility incentive and government subsidy management, engineering design, project management, and recycling. There was no significant company news last week.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.