Confidence Restored

“If I had ever been here before I would probably know just what to do…”

The lyrics from the CSNY song “Déjà Vu” – which was released exactly 53 years to the day from the onset of the SVB collapse – provide our rationale that the mistakes that exacerbated the financial crisis in 2008 will not be repeated in 2023. Specifically, both government and financial industry leaders have been swift to provide policies and capital to protect depositors and restore confidence in the financial system. Nevertheless, it was a stressful and volatile week with winners and losers, with more work to be done to assuage nervous investors. Perhaps a more accurate lyric would be “I would have a clue just what to do…” which rhymes better anyway.

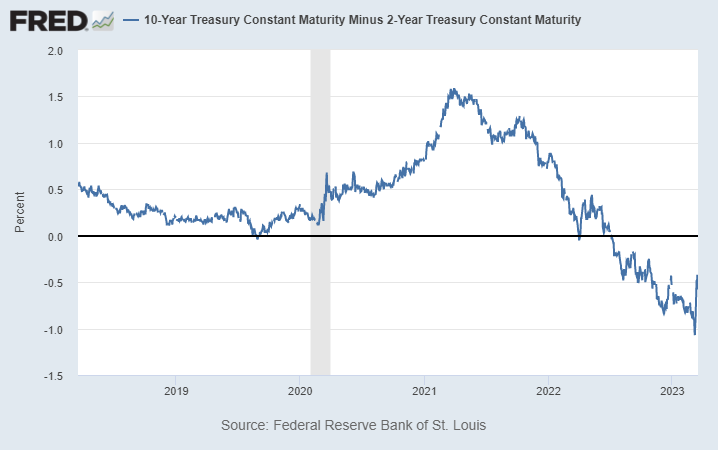

Underneath the surface, the biggest winners were the very institutions that just 2 weeks ago were suffering massive losses in their bond portfolios, as the yield on the 10-year Treasury plummeted from its early March high of 4.09% to 3.39% on Friday. It is worth noting that the yield is now back at its lowest level in the last six months, which suggests that the unrealized losses on financial institutions’ (banks, insurance companies, etc.…) bond portfolios should have been significantly reduced. The two-year Treasury rate has dropped even more, from above 5% to 3.85%, leaving the 10-2 spread slightly less inverted at -46 basis points, (see chart below), which still suggests likely recession but perhaps of a lesser magnitude. The flight to safety trade also benefited the large cap Technology, Consumer, and Utility sectors, which all posted nice gains for the week. Cyclical stocks and Financials, on the other hand, suffered losses, with the Oil and Gas sector performing the worst with a 5.5% decline. The S&P managed to finish up 1.4% and the Nasdaq Composite jumped 4.4%.

Despite the headline gains in the S&P 500 and Nasdaq Composite, it was a tough week for equities overall, with declining issue outnumbering advancing issues by over 2-1, and more new lows than new highs. Mid caps sagged, with the S&P Mid Cap Index losing 3.2%. The Russell 2000 declined 2.6%. Regional banks comprise a high percentage of the Russell, and small caps are also generally viewed as being more economically sensitive and riskier than larger companies. We think this latest downturn has once again created bargain buying opportunities in small caps, as many solid companies have seen double-digit price declines over the last few weeks.

Gold was a big winner, gaining over $100 to $1,969 per ounce. We continue to recommend gold as a hedge to other dollar denominated investments, with PHYS, GLD, NEM, and SII as our preferred investment vehicles. The cover story of this week’s Barron’s was “Buy the Big Banks”. We agree, with JP Morgan Chase & Co (JPM) and Bank of America Corp (BAC) our favorites in that group. We also believe that some of the regional banks have overreacted and are attractive, such as Chicago-based Wintrust Financial Corp (WTFC), New Jersey’s OceanFirst Financial Corp (OCFC), and Bank of Hawaii Corp (BOH).

Disruption

Developments in the disruption in the global banking system will dominate the narrative early in the week. Equity markets remained volatile Monday morning, particularly in the Financial sector, despite news that Credit Suisse had reached a deal to be acquired by UBS in a deal brokered and assisted by the Swiss government. Riskier credit instruments that were not backstopped plummeted in price, which lead to further contagion concerns amongst various financial institutions.

Attention will turn Wednesday to the FOMC’s monetary policy decision, with futures trading suggesting a high probability of a 25 basis point rate hike by the Fed and a reasonable chance of no hike at all. Because the likely rate hike of 25 basis points is highly expected, the language of the accompanying Fed statement is going to be our focus on Wednesday. In our view, the Fed will act more dovish by raising rates 25 basis points but will probably maintain a more hawkish tone such as that it could continue raising rates as economic data emerges. Although such Fed statement language could be stating the obvious (different data, different response), Chairman Powell might believe that he needs to maintain the face of a hawk even if recent banking system events have brought on dovish incentives. The Fed moved too slowly, then moved too rapidly in the pace of rate increases. Those sharp shifts contributed to the surge in inflation as well as the recent financial panic (poor risk management at the banks clearly share the blame for the latter).The financial system would be better served by a monetary policy that is steadier and more transparent.

Reports on February existing home sales on Monday and durable goods on Friday are both expected to show some improvement from depressed levels in January but are unlikely to move the markets.

Stocks on the Move

Companies with news…

-20.4% The Eastern Company (EML) manufactures and markets a variety of locks and other specialty industrial hardware. The Company primarily offers locks and latches for truck bodies, computers, office equipment, and various applications for the electrical, automotive, and construction industries. Last week, EML reported full year 2022 results with GAAP earnings of $1.77 per share and revenue of $279.2M. The share price decline was likely contributed to earnings being down from $2.58 in the prior year due on higher input costs, as well as contracting margins.

-15.0% Superior Group of Companies Inc (SGC) designs apparel products. The Company manufactures and sells a wide range of uniforms, corporate identification, career apparel, and accessories. Super Group of Companies serves hospital and healthcare fields, hotels, fast food and other restaurants, public safety, industrial, transportation, and commercial markets. Last week, SGC reported a $(0.06) loss per share for the fourth quarter due to a write down related to the Company’s Healthcare Apparel segment. Management provided upbeat commentary for FY23 and included guidance of sales between $585M-$595M (vs $579M in FY22) and earnings per share between $0.92-$0.97 (vs $0.62 in FY22).

+18.4% Advanced Micro Devices Inc (AMD) operates as a semiconductor company worldwide. Its products include microprocessors, chipsets, discrete and integrated GPUs, data center and professional GPUs, and development services. Last week, investment firm Citi named Advanced Micro Devices as one of the “most popular” stocks in the chip sector to own.

+12.0% NVDIA Corporation (NVDA) provides graphics, and compute and networking solutions in the United States, Taiwan, China, and Internationally. The company’s products are used in infrastructure for gaming platforms, robotics, automobiles, software, and other networking and similar ecosystems. Last week, investment firm Citi named Nvidia as one of the “most popular” stocks in the chip sector to own.

+12.1% Alphabet Inc (GOOGL) operates as a holding company. The Company, through its subsidiaries, provides web-based search, advertisements, maps, software applications, mobile operating systems, consumer content, enterprise solutions, commerce, and hardware products. Last week, Google announced that due to rising content costs, it would be raising the monthly subscription price for YouTube TV from $64.99 to $72.99 effective April 18, 2023.

Financials and Energy stocks that moved with the news of SVB collapse and other economic fears….

-15.4% Westwood Holdings Group Inc (WHG)

-10.6% OceanFirst Financial Corp (OCFC)

-19.4% Bank of Hawaii Corporation (BOH)

-12.2% The Mosaic Company (MOS)

-10.7% APA Corporation (APA)

-13.8% Evolution Petroleum Corporation (EPM)

Companies with no specific news…

-16.2% Q.E.P. Co Inc (QEPC)

-16.0% BGSF Inc (BGSF)

-15.8% The Container Store Group, Inc. (TCS)

-15.2% Delta Apparel Inc (DLA)

-13.0% Great Lakes Dredge & Dock Corporation (GLDD)

+10.1% Flexsteel Industries Inc (FLXS)

+10.4% Napco Security Technologies Inc (NSSC)

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.