Modest Rebound

Trading got off to a crude start Monday as oil prices surged following news of a production cut led by Saudi Arabia. Regional banks got hit on Tuesday as analysts cut price targets on the group, in an excellent example of closing the barn door after the horse has bolted. The SPDR Regional Bank ETF (KRE) for example has declined approximately 25% in the wake of the SVB failure, and now trades at depressed valuation multiples with the average holding below book value, at a single digit P/E multiple, and with a dividend yield over 3.5%. The rest of the week saw a modest rebound in stocks as investors digested a series of signs suggesting a slowing economy, including weak data on private payrolls and job openings. The muted response to the soft data highlights the conundrum of whether bad news is good news for equities, and whether recession worries or rate hike worries are more meaningful to stock prices in the short term. The Oil & Gas sector, along with the sectors that are generally considered defensive, such as Health Care, Utilities, and Telecommunications, fared the best. The Dow Jones, which has the highest weightings in those sectors, gained 0.6% for the week, while the S&P lost 0.1%, the Nasdaq dropped 1.1%, and the Russell 2000 sank 2.7%. The Russell 2000 is suffering from the perception that small caps are more vulnerable in a recession, as well as from the heavy concentration in financials in the index. We believe terrific bargains have resulted from this latest downturn.

The bond market embraced the signs of an economic slowdown, with the yield on the 10-year Treasury sliding 16 basis points to 3.29%, its lowest level since September. The 10-2 spread remained inverted at -58 basis points, signaling recession concerns; however, the fact that the inversion did not expand last week could be viewed favorably.

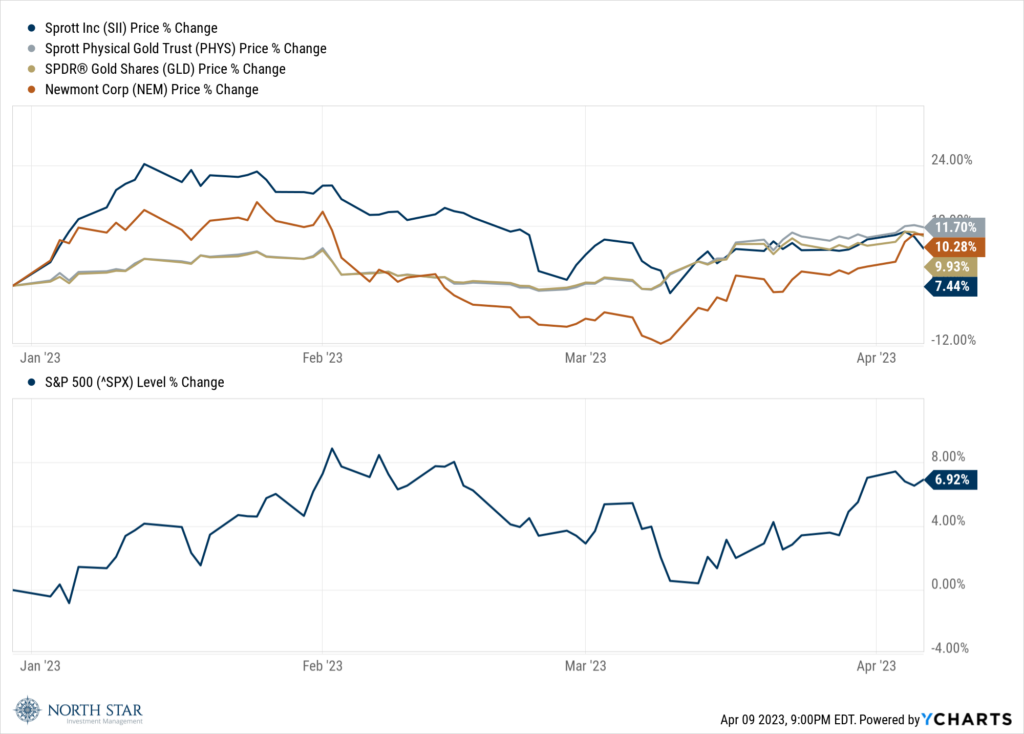

Turns out, all that glitters actually is gold, as the precious metal broke through the $2,000 per ounce ceiling to approach its record price level. We still believe that gold-related holdings, such as SPDR Gold Shares (GLD), Sprott Physical Gold Trust (PHYS), Sprott Inc (SII), and Newmont Corp (NEM), are good pieces of the investment puzzle; all have outperformed the S&P 500 year-to-date in 2023 (see chart below). China’s military exercises late in the week, and which crossed the informal over-water border between Taiwan and China, possibly in response to the U.S. Speaker of the House meeting with Taiwan’s president recently, likely drove incremental interest among investors in such gold investments.

Downward Trend

The futures markets over the weekend were calm following the release of the March jobs report last Friday when the markets were closed; the report showed a slowing in nonfarm payrolls with modest wage growth.

The Bureau of Labor Statistics will release its reports on March CPI on Wednesday, and March PPI on Thursday. Both reports are expected to show a continuation of the downward trend in inflation, with the PPI forecasted to rise at its slowest pace since February 2021. We continue to expect a “wiggle-down” of inflation trends, consisting of more months showing decelerating inflation measures than months showing accelerating inflation.

Corporate earnings season will kick off with reports from Citigroup Inc (C), JPMorgan Chase & Co (JPM) and Wells Fargo & Co (WFC) on Friday. Those results will be of particular interest given the recent upheaval in the financial sector.

Retail Sales data for March and the University of Michigan consumer sentiment index for April will also be released on Friday. Those reports are expected to be “slow and steady”, as the consumer hopes to “win the race” by keeping a moderate pace.

On the Chicago sports scene, the Bulls will play the Toronto Raptors on Wednesday in the NBA’s win or go home Play-In Tournament. The Blackhawks finished in last place in the NHL Central Division. The Cubs and Sox are both off to mediocre starts in baseball. The WNBA season is about a month away. Wouldn’t it be great to see Caitlin Clark in a Sky uniform? One can only dream.

Stocks on the Move

-13.7% Movado Group Inc (MOV) designs, manufactures, retails, and distributes watches, as well as jewelry, tabletop, and accessory products. Its brands include Movado, Hugo Boss, Lacoste, Ferrari, Coach, and Tommy Hilfiger. There was no significant company news last week.

-10.4% Napco Security Technologies Inc (NSSC) manufactures electronic security devices, fire detection products, access control systems, and digital lock equipment used in residential, commercial, institutional, and industrial installations. There was no significant company news last week.

-10.1% Allied Motion Technologies Inc (AMOT) designs, manufactures, and sells motion control products into applications that serve various industry sectors. The Company supplies precision motion control components that incorporated into a number of end products, including high-definition printers, barcode scanners, surgical tools, robotic systems, wheelchairs, and weapon systems. There was no significant company news last week.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.