A Case for the Consumer

Last week, the equity markets rose supported by mounting evidence of disinflation and solid results from JPMorgan Chase & Co (JPM) and other large banks. The gains were muted by the release of the Fed’s March FOMC minutes on Wednesday and an unexpectedly weak retail sales report on Friday. Small caps fared the best, with the Russell 2000 gaining 1.5%, followed by the DJIA up 1.2%, the S&P 500 adding 0.8%, and the Nasdaq Composite the laggard with a 0.3% advance. The dollar softened modestly, while crude oil tacked on another 2.2%, and the yield on the 10-Year Treasury jumped 23 basis points to 3.52%. Meanwhile, although recent gains in the gold price were interrupted, the precious metal spot price is up more than 9% year-to-date. Clearly, the metal is much more popular among investors lately (as suggested by two bullish articles in the weekend Barron’s) and as value investors we generally prefer less popular investments. It is our opinion that it remains an important portfolio consideration for investors seeking to maintain the purchasing power of their savings.

Consumer sentiment in the US improved modestly in early April with the University of Michigan’s Consumer Confidence Index rising to 63.5 from 62 in February. This reading came in better than the market expectation of 62 but remains at very depressed levels. Short-term Inflation expectations rose from 3.6% in March to 4.6% in April, while the long-run inflation expectations remained remarkably stable. The CPI report on Wednesday showed that consumer inflation continued to moderate in March, and the PPI report on Thursday showed a month over month decline of 0.5%. That decline is significant, given that lower producer prices lead to lower consumer prices. Additionally, the biggest contributor to the consumer inflation was the shelter component, and an article on Page 2 of the Wall Street Journal this weekend indicates residential rents fell in March 2023 for the first time in a year. That data suggests as the residential shelter numbers filter into the CPI reports and other inflation data, we will likely get more evidence of slowing inflation.

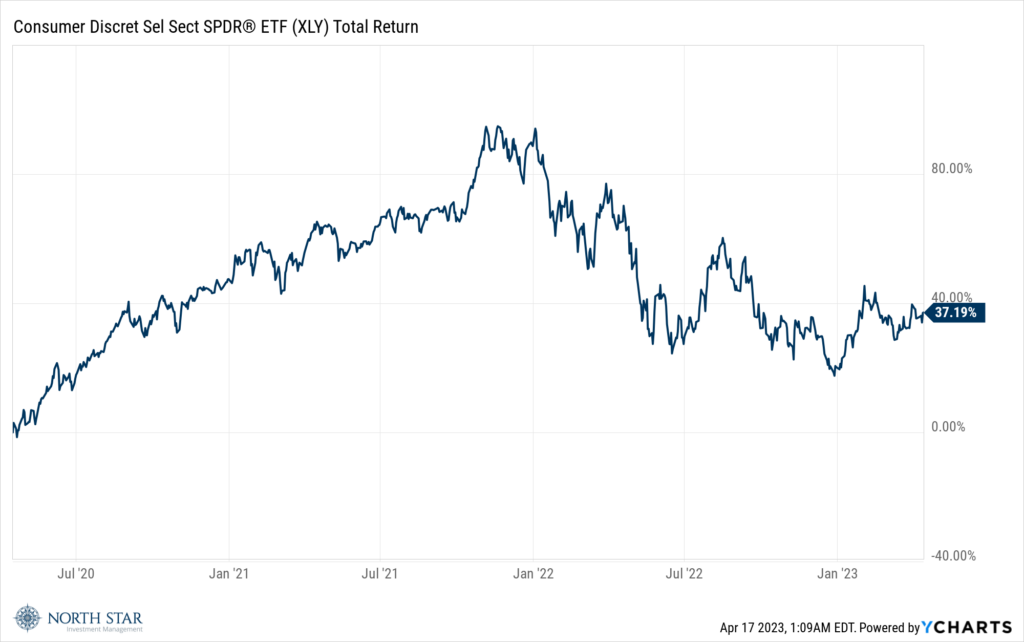

The bull case for stocks is that the Fed’s rate hiking cycle may be over, and that corporate profit growth should resume in the back half of 2023 and into 2024 fueled by improved demand and lower input costs and easier year-over-year comparisons. Under that scenario, small cap stocks should perform well, specifically small cap consumer companies, many of which are trading at depressed prices. In particular, some consumer companies have been among the casualties of higher interest rates since early 2022, as shown by comparing Consumer Discretionary ETFs to broader equity market indices (see chart below). Therefore, such Consumer Discretionary stocks may be among the biggest beneficiaries of the end of the Fed’s rate hiking cycle.

Heating Up

Earnings season will heat up, with 60 S&P 500 companies reporting results for the first quarter. Composite earnings are on track for a year-over-year decline of 6.5%, which would mark the worst results since the onset of the pandemic in the second quarter of 2020.

The economic calendar is light, with housing data dominating the releases, including the NAHB Housing Market Index for April on Monday. Thirty-year fixed mortgage rates have trended lower since reaching a multi-decade high in October, which has led to some modest improvement in home builder’s sentiment.

The NBA playoffs will continue without the Chicago Bulls, who were eliminated by the Miami Heat on Friday night 102-91. The Heat closed the game on a 15-1 run to end the Bulls season.

Stocks on the Move

-14.0% Lakeland Industries Inc (LAKE) manufactures and distributes protective work clothing. The Company offers disposable, chemical, cleanroom, hand, arm, fire, and heat protective clothing for on-the-job hazards, toxic-waste cleanup, and industrial work. Last week, Lakeland announced its fourth quarter earnings of $0.03 per share and revenue of $29 million for the period. Better-than-expected results in Europe and the U.S. were offset by lower sales in Asia. Margins also came in lower than anticipated at 37.5% versus 41.5% mostly due to taking price concessions to clear excess inventory. LAKE ended the quarter with $25 million in cash and no debt. For the year, the company repurchased $5.4 million of common stock.

-12.3% Orion Energy Systems Inc (OESX) manufactures, sells, installs, and implements energy management systems for commercial office and retail, exterior area lighting, and industrial applications in North America. It offers interior light emitting diode (LED) high bay fixtures; smart building control systems; and LED troffer door retrofit for use in office or retail grid ceilings. In addition, it provides lighting-related energy management services, such as site assessment, utility incentive and government subsidy management, engineering design, project management, and recycling. There was no significant company news last week.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.