Watch the replay of Eric’s April 20th small cap segment on TD Ameritrade Network here.

Stalemate

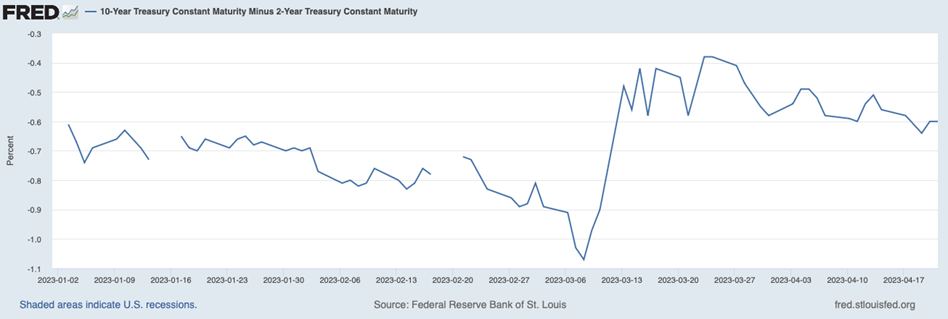

April trading remained somewhat calm and quiet, with the S&P 500 slipping 0.1%, the Nasdaq sliding 0.4%, and the Russell 2000 gaining 0.6%. It has been one of the least volatile months in the last five years, suggesting a stalemate between the bulls and the bears in the face of the myriad of uncertainties that investors are facing. Rather than referring to those uncertainties as “the wall of worry”, we are characterizing them as the pillars of pessimism. They are prices, profits, pandemic, politics, petroleum, Powell, and Putin. Prices relate to the elevated cost of goods and services following the inflationary surge that peaked last year. We believe that prices have stabilized. Corporate profits are under pressure, as evidenced by the first quarter earnings season which is forecasted to show approximately a 6% year-on-year decline. The results reported last week modestly improved the projected decline from -6.7% to -6.2%. We are in the Bull camp for a recovery in the back half of the year, but alas the next quarter also seems challenging to us. The pandemic has persisted much longer than we originally expected, but in the words of W.H.O. Director General Tedros Ghebreyesus “…this year we will be able to say that Covid-19 is over as a public health emergency of international concern.” We are bearish on politics, but we don’t believe the dysfunction will lead to a catastrophic default by the U.S. on its government debt obligations. That belief is based on the premise that our elected officials understand the consequences that would result from such an event, yet, undoubtedly the debt ceiling negotiations will go down to the wire since no politician wants to be seen as compromising before necessary. Whereas we are concerned about the recent petroleum production cuts from OPEC+, nevertheless we believe that the abundance of natural gas and the investment in other energy sources should provide alternative sources not reliant on crude to power the global economy. Fed Chairman Powell has had a very difficult job. He is intelligent and well-meaning, and will listen to all the credible economists to get it right going forward starting with not bumping rates up another 25 basis points at the next meeting in early May. As for Putin, it will be a very bullish day when his reign comes to an end. In summary, we believe the pillars of pessimism will dissipate over time, which should provide positive return opportunities for equity investors. The bond market tells a much more somber story embracing a prolonged period for the pillars of pessimism. The yield curve remained inverted for another week, with the 10-year Treasury yield inching up 5 basis points to 3.57% and the 2-year gaining 8 basis points to 4.18%. The highest yields remain at the 3-month maturity; those yields are consistent In forecasting an extended period of very low economic growth. Finally, the oft-cited “10-year Treasury Constant Maturity Minus 2-year Treasury Constant Maturity” resumed its descent to -0.60 at the end of the week, lower than the recent -0.38 at the end of March.

Down Tick

Earnings season will be in full swing, with 180 S&P 500 companies reporting results for the first quarter. Some of the key reports include updates from Credit Suisse Group (CS), The Coca-Cola Co (KO), Microsoft Corp (MSFT), Alphabet Inc (GOOGL), and Amazon Inc (AMZN). The economic calendar includes releases on consumer confidence and new home sales on Tuesday, in addition to durable goods orders on Wednesday. All are expected to be largely unchanged from the previous month. On Friday, the closely watched employment cost index is expected to show another slight down tick to an annual rate of 4.5%. We will be treated to one day of Fedspeak on Monday before the blackout period for Fed officials begins Tuesday in advance of the FOMC meeting on May 2-3. On the political front, the House may vote on a bill that would raise the U.S. debt limit for about a year and cut federal spending. As we discussed earlier, we are pessimistic about the path to a resolution, but optimistic that our elected representatives will ultimately come to a compromise. On the Chicago sports scene, the Cubs are off to a decent start, while our beloved White Sox are struggling. The real excitement will start on Thursday night when the Bears have the 9th pick in the first round, and 10 total picks in the seven-round draft. For those who have short memories, the Bears bring a record 10 game losing streak into the 2023-2024 campaign, having cleaned house of all their star defensive players.

Stocks on the Move

+17.5% Westwood Holdings Group Inc (WHG) provides investment advisory services to a broad range of institutional clients. The Company also offers trust and custodial services to institutions and high-net-worth individuals. Last week, activist investor JCP Investment Management filed a new 13/D claiming Westwood CEO Brian Casey had been soliciting financing for a potential take private deal. In the filing, JCP demands to see certain accounting records, as well as states it will oppose any proposal given WHG’s depressed valuation and the rejected $25/share takeover offer from Americana Partners 12 months ago. The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.