Another Rate Hike

Uncertainty remained in fashion on Wall Street, with a mixture of comforting and disquieting headlines. On the one hand corporate earnings reports and the economic data releases were encouraging; on the other hand, there were fear mongering short sellers assaulting the banking system and yet another interest rate hike accompanied with the usual dose of negative jawboning from our friends at the Fed.

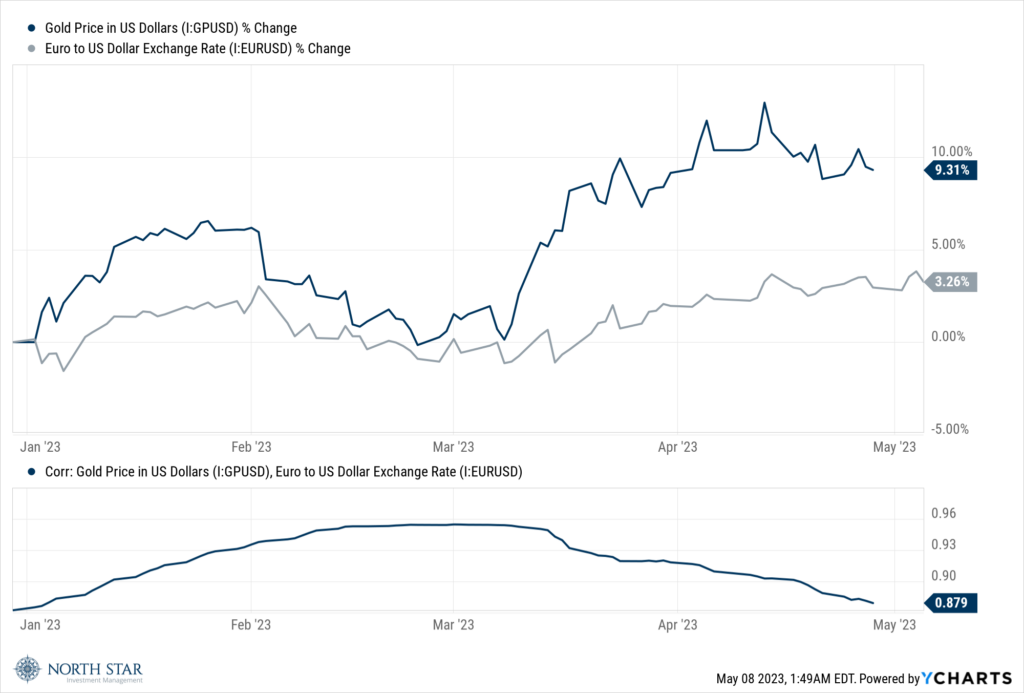

The market suffered hefty losses through Thursday’s close, with renewed concerns over the health of regional banks and the expectation and then realization of the Fed’s interest rate hike drowning out relatively positive earnings reports. First quarter earnings reports continued to exceed expectations, with the blended decline slimming down to 2.2% from 3.7% the week earlier and 6.7% at the end of March. Apple was the star of the show as its share price jumped nearly 5% on Friday after its quarterly results topped expectations. Additionally on Friday, the latest jobs report supported the “soft landing” camp, with a solid monthly gain in new jobs, albeit with significant downward revision to the previous month’s numbers. Even Regional bank shares rebounded sharply on Friday, most likely driven by traders covering their short positions in front of the weekend, ending a brutal week of declines in that sector. The gains on Friday were not enough to wipe out weekly losses for the S&P 500, which fell 0.8%, while the Nasdaq Composite eked out a 0.1% gain, and the Russell 2000 shed 0.5%. Only the Tech and Health Care sectors finished positive, and the Oil and Gas sector had the worst performance with a 5.6% decline as crude oil slid over $5/ barrel to $71.34. Gold continued to climb to record levels, gaining 1.3% to $2017/ounce, as the dollar drifted 0.5% lower (see discussion below).

The bond market showed terrific stability, with the yield on the 10-year Treasury holding steady at 3.45%. The 10-2 spread remained inverted but moved 12 basis points closer to even at -0.48%, its smallest inversion since March. The top of the yield curve remains between 3 and 6 months, with the 9-month T-bill rate more than 60 basis points lower than the 3-month rate, suggesting a likelihood of rate cuts in the fall or winter of 2023. Corporate earnings should also resume growth in those quarters, perhaps setting the stage for more rewarding equity markets.

Internationally, both the ECB and the Australian central bank raised interest rates by 25 basis points last week, in sync with the Federal Reserve’s 25 basis point increase. However, unlike the Federal Reserve, the ECB did not signal potential slowing or pausing its upward interest rate trajectory. On Thursday, ECB President Christine Lagarde stated, “I think it’s fair to say that everybody agreed that increasing the rate was necessary and that second we are not pausing, that is very clear…and we know that we have more ground to cover.” This makes sense given that the ECB’s benchmark rate is now 3.5% versus the U.S. Federal Reserve’s target range for fed funds rate is 5.0%-5.25%.

Similarly, this past week, the Reserve Bank of Australia raised by 25 basis points to 3.85%. Thus, it seems clear that the U.S. Federal Reserve has been ahead of foreign central banks in attacking inflation. This bodes well for U.S. businesses that export, given that foreign central banks will likely continue raising rates while the U.S. Fed likely pauses; this should strengthen foreign currencies versus the U.S. Dollar, thereby making U.S. exports incrementally more attractive. This scenario may also be good for gold prices, that historically have risen when the U.S. dollar depreciates relative to other currencies.

On the Chicago sports scene the Cubs slipped to .500 ball at 17-17, defining the slogan “win some lose some”, while the White Sox have been in the “win some lose some more” camp. There is hope, however, since both their divisions seem to be populated with mediocre teams.

Final Inning

It’s the final inning of earnings season, with just 32 S&P companies reporting results for the first quarter.

On the economic data calendar, the April CPI report due out on Wednesday is the headliner event with economists forecasting a 0.3% month-over-month increase in inflation, consistent with the recent trend. On Thursday, the April PPI report latest will be released with a consensus forecast of a 0.3% increase, even though in March PPI unexpectedly fell 0.5%. A similar surprise drop would be an extremely positive sign for future inflation and open the door for an easing of monetary policy.

Stocks on the Move

Regional banks that moved with market-related volatility…

-32.5% Territorial Bancorp Inc (TBNK)

-12.9% OceanFirst Financial Corp (OCFC)

-10.6% First Hawaiian Bank Inc (FHB)

Companies with earnings…

-27.7% Paramount Global (PARA) Last week, PARA reported a significant first quarter loss and cut its quarterly dividend from $0.24/share to $0.05/share.

-28.2% Rocky Brands Inc (RCKY) Last week, Rocky Brands reported an unexpected first quarter loss and revenue miss. While inventory sell through has been stable, retailer inventory sell-in, or replenishment, has been challenging.

+29.0% Green Brick Partners Inc (GRBK) Last week, GRBK reported a significant first quarter earnings and revenue beat with EPS of $1.37 and revenue of $452M topping estimates by $0.71 and $170M, respectively.

+16.5% Turtle Beach Corp (HEAR) Last week, Turtle Beach reported a first quarter loss per share of $0.27 on revenue of $51M. The Company also raised its guidance for full year revenues and EBITDA.

+11.6% ACCO Brands Corp (ACCO) Last week, ACCO announced solid first quarter results with EPS of $0.09. The Company also reaffirmed its full year 2023 outlook.

Companies with other news…

-14.0% 1-800-Flowers.com Inc (FLWS) Last week, 1-800-Flowers announced it had acquired SmartGift, an intelligent corporate gifting platform. Transaction details were not disclosed.

+11.2% Sphere Entertainment (SPHR), a spin-off of MSG Entertainment, closed the sale of Tao Group last week. SPHR received just over $360M for its 66.9% interest in Tao and entered into a multi-year deal for ongoing consulting, marketing, and support services.

One company with no news…

-11.7% NAPCO Security Technologies Inc (NSSC)

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.