Stalled Out

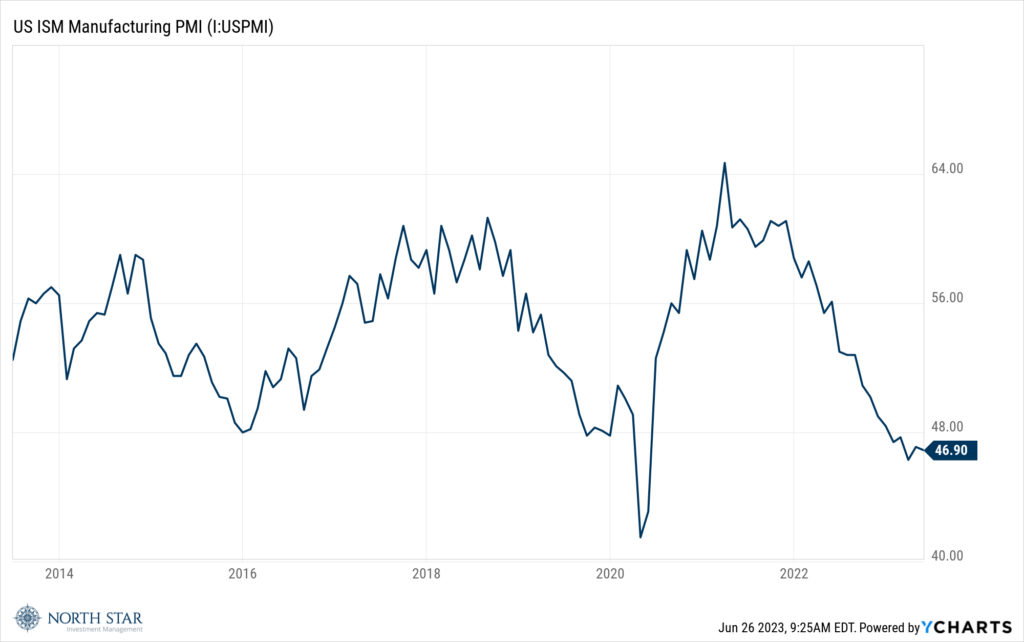

The stock market rally stalled during holiday shortened trading, as the indices suffered their worst weekly losses since the collapse of the Silicon Valley Bank in March. Further evidence of a slowing economy combined with the continuous “further tightening” jawboning from Federal Reserve Chair Jerome Powell were enough to darken the mood on Wall Street. Evidence of economic softness came on Tuesday with a disappointing earnings report from FedEx (FDX) which showed that total revenue in the fourth quarter was down 10% year over year as volumes declined with demand remaining soft across the market. Additionally on Friday, the Manufacturing Purchasing Index for May registered at 46.3, missing the consensus estimate of 48.5, and marking the lowest level since May 2020 when the economy was shut down because of the pandemic. Readings under 50 indicate economic contraction, and there have now been seven consecutive months of readings below 50. The chart below illustrates the downward trend that has coincided with the Fed’s monetary tightening campaign:

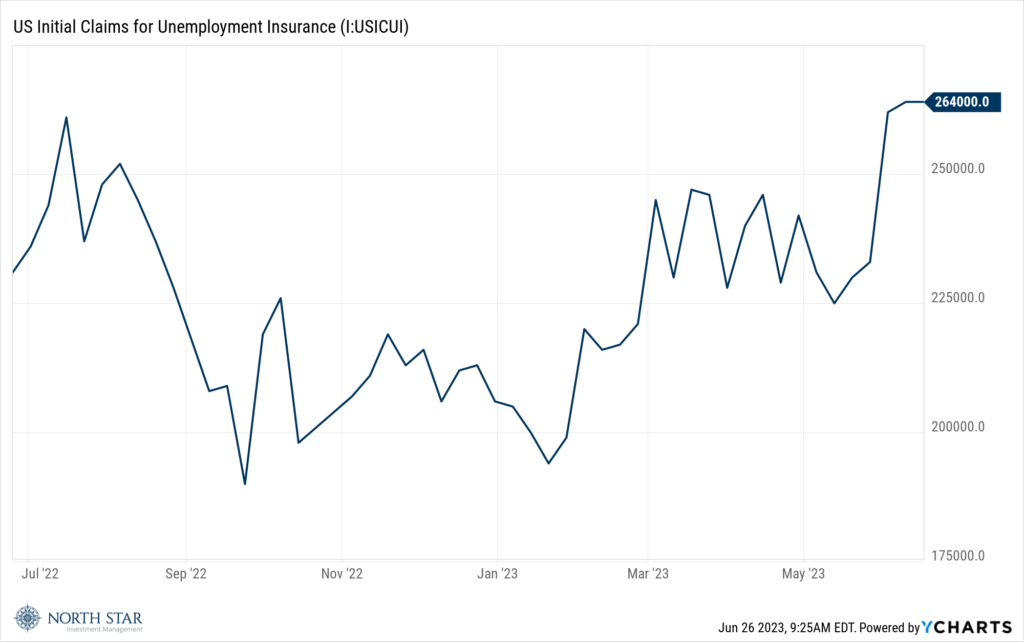

Speaking of the Fed, on Wednesday Chairman Powell doubled (tripled, quadrupled?) down on his message that more rate hikes are coming to fight inflation. Responding to that message, Fed fund futures currently suggest another quarter point hike is likely in July, despite the recent tame CPI report and the sharp decline in the PPI. The weekly trend for new unemployment claims has also been rising with moderating wage growth suggesting that the jobs market has begun to cool off as well:

By the closing bell on Friday the S&P 500 was down 1.4%, ending five straight weeks of gains, the Nasdaq had declined 1.4%, snapping an eight-week winning streak, and the Russell 2000 had lost 2.9%. We are not technicians, but still it seemed like the charts did influence trading, with the S&P 500 hitting a resistance level at 4,400. The Healthcare sector broke even, while all the other sectors suffered declines, with Oil & Gas faring the worst again. Crude Oil slid almost 4% to $69.16, providing additional evidence of global soft demand.

Despite the gloomy past week, we remain optimistic, and embrace the Up & Down Wall Street in the recent Barron’s edition “Take It to the Bank: There Won’t Be a Recession This Year” so long as the Fed remains “data dependent” and avoids any dogmatic or political influences. As the disruptions from the pandemic move into the history books, the combination of supply chains and material costs normalizing, with major infrastructure projects budgeted and a likely rebound in consumer sentiment, the table is set for a brighter tomorrow. The risks remain primarily geopolitical upheaval and Fed policy missteps.

Chicago Sports Scene

The Bulls traded up to pick Julian Phillips in the second round of the NBA draft. Phillips spent one season at Tennessee, appearing in 32 games and playing 24.1 minutes per contest. He averaged 8.3 points, 4.7 rebounds, and 1.4 assists per game on 41.1 percent shooting from the field and 23.9 percent shooting from behind the three-point line. We don’t see any light at the end of the tunnel at the United Center.

On the South Side the White Sox continue to tread water, fortunately in the worst division in MLB, so hope remains. Meanwhile at the friendly confines in the North Side the Cubs have gotten hot, winning 8 out of their last 10 games.

The Skies are cloudy over Wintrust arena, as Chicago’s WNBA franchise has hit a 6-game losing streak.

Stress Test

The most significant economic releases will both be out on Friday with the BEA personal income and expenditures report as well as the University of Michigan Sentiment survey. Spending is forecasted to have slowed in May, while the personal consumption expenditures price index is expected to have remained steady from the previous month. Consumer sentiment is also predicted to have remained steady, although anecdotally it sure seems busy at restaurants, airports, hotels, and the Taylor Swift concerts.

The Federal Reserve will be back in the headlines on Wednesday with the release of its annual stress test of the nation’s largest banks. The test is a key factor in determining the capital cushion that the banks must keep, thus influencing stock buybacks and dividend payouts. We believe that the big banks are generally in very solid financial condition, with many trading at bargain prices because of the NIM (net interest margin) compression they have suffered generated by the Fed’s rapid rise in short term interest rates over the last 18 months. Their future could certainly be brighter as the yield curve will ultimately normalize.