Fireworks and Fed Chirps

Unlike Joey Chestnut’s win (he consumed 62 hot dogs en route to his 16th Nathan’s Famous competition win on Fourth of July), the stock market posted a modest loss during the holiday-shortened trading week, as traders digested conflicting employment data along with their July 4th barbecues and picnics. The fireworks, and the entire loss for the week, came on Thursday when the ADP report indicated that 497,000 jobs were added in the private sector in June. That job growth marked the biggest monthly gain since last July and was more than double the consensus forecast. Rather than celebrating that sign of economic resilience, investors instead focused on the increased likelihood of the Fed raising interest rates at this month’s meeting in response to that data, in what we view as a quixotic battle against inflation. The overall price level is higher than it was pre-pandemic because of a combination of the one-time trillion dollar plus transfer payment from the government to households and the supply chain disruptions. More money plus less goods and services available translated to higher prices. The surge in prices was the story of 2022, and it likely can’t be undone without a major disruption in the economy. Another 25 or 50 basis point increase in the Fed Funds rate is not the answer, unless it causes further distress in the banking system, and certainly that shouldn’t be the policy objective of the institution created to help protect the banking system. Furthermore, Friday’s official June employment data from the BLS came in below economists’ estimates, contradicting the strength in the ADP data. Stock trading was volatile in response to that softness, with buyers feeling that there would be fewer future Fed hikes, while sellers were concerned about the increased likelihood of a recession.

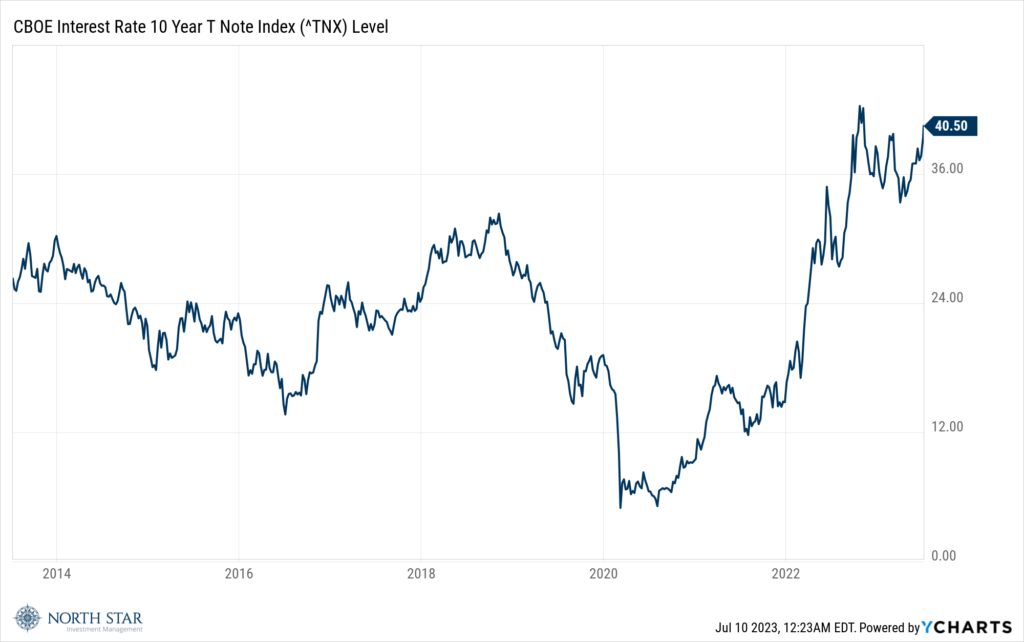

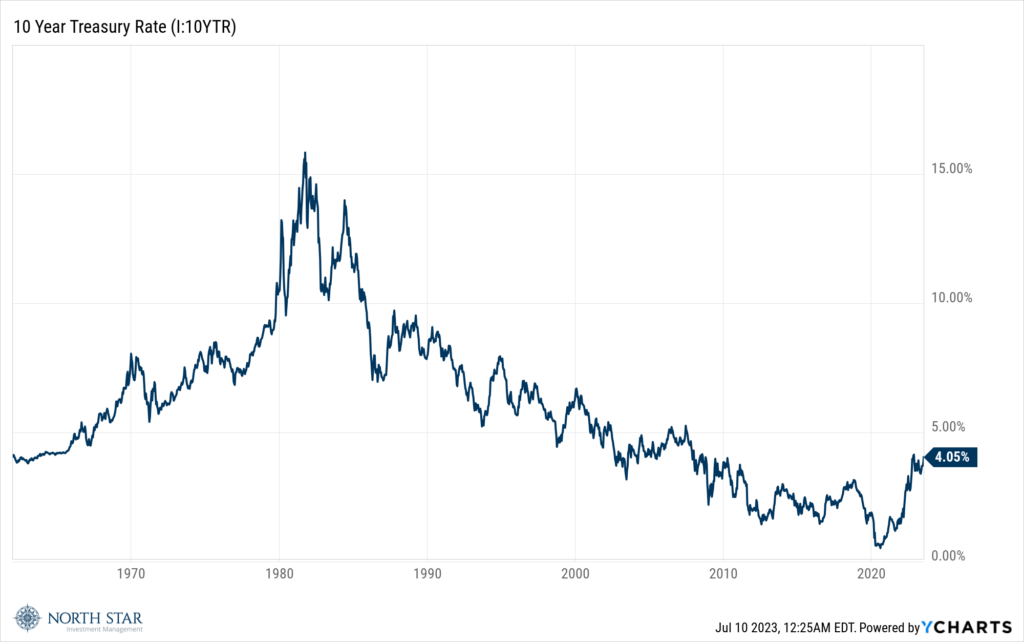

The Consumer Goods sector was the only group that finished in the green, with a very modest gain of 0.25%, while Health Care stocks suffered the largest declines. The S&P 500 lost 1.2%, the Nasdaq Composite dropped 0.9%, and the Russell 2000 shed 1.3%. Crude Oil bounced almost 5%, but Oil & Gas stocks still slipped 0.6%. Gold and the Dollar were essentially unchanged, and the yield on the 10-year Treasury surged 23 basis points to 4.05%, matching its highest level in the post 2008 financial crisis era. Before you panic about this “high” rate, some additional historical context should be considered…

…specifically prior to the financial crisis 4% was considered a very low rate for a 10-year Treasury bond. It was just the extraordinarily accommodative monetary policy response in response to that crisis that brought rates to such depressed levels and kept them there for 15 years.

We view this return to more normal interest rates as a positive, particularly for fixed income investors who finally have opportunities to earn a decent yield on their bonds. We still advise keeping maturities on the short end, with 5% plus yields available out to the middle of 2025.

There continues to be no good news to report on the Chicago sports scene.

It’s Rebound Time

Second quarter earnings season kicks off with the largest banks reporting results. The bar for overall S&P 500 earnings is set quite low, with consensus estimates calling for a steep 6.8% decline. If that estimate proves correct, it would be the biggest drop since the onset of the pandemic in the second quarter of 2020 and would mark the third consecutive quarter of earnings declines. There is light at the end of the tunnel, as earnings are expected to rebound in the following quarters.

It is also a big week for economic reports, with inflation and consumer confidence data on deck. Wednesday will feature the BLS release of CPI, followed by its PPI report on Thursday. Economists forecast the former to read at a 3.1% year-over-year increase, and the latter at an increase of just 0.4%. Both would be at their lowest levels since early 2021. The University of Michigan Consumer Sentiment Index for July will be released on Friday, with the consensus calling for a slight uptick from the previous month, albeit at a still subdued level. That report also contains a gauge of consumers’ expectations of inflation for the year ahead, which last month was 3.3%, also the lowest reading in more than two years. And when it comes to the recent impact on stocks from inflation reports, less is good and more is bad; yet another contrast to the fairly primitive and yet strangely fascinating annual Nathan’s Famous hot dog eating spectacle!