Inflation Cooling, Earnings Warming, and Sentiment Heating Up

There are hundreds of songs that relate life’s “ups and downs” to the weather. Our favorites cover the spectrum from Bob Dylan’s “Hurricane” to the Allman Brothers Band’s “Blue Skies”. Similarly, the constant “ups and downs” of the financial markets frequently get analogized to the weather. Of course, professionals are always trying to forecast both the weather and the markets, usually with similar success rates! Famously, in June 2022, JPMorgan Chase CEO Jamie Dimon cautioned investors to brace themselves for an economic hurricane that the combination of the Fed’s tightening and the war in Ukraine could generate.

While it has certainly been windy as the Fed tightened relentlessly and the war raged on, we weathered the storm, and on Friday Dimon provided a much more comforting forecast following JPM’s second quarter earnings release: “The U.S. economy continues to be resilient. Consumer balance sheets remain healthy, and consumers are spending, albeit a little more slowly. Labor markets have softened somewhat, but job growth remains strong.” The strong earnings from JPM and other financial sector companies got earnings season off to a reasonably good start, with 80% of those that reported exceeding estimates. Nevertheless, the consensus still calls for approximately a 7% decline for S&P 500 composite quarterly earnings. Clearer skies are in the forecast for third and fourth quarter results.

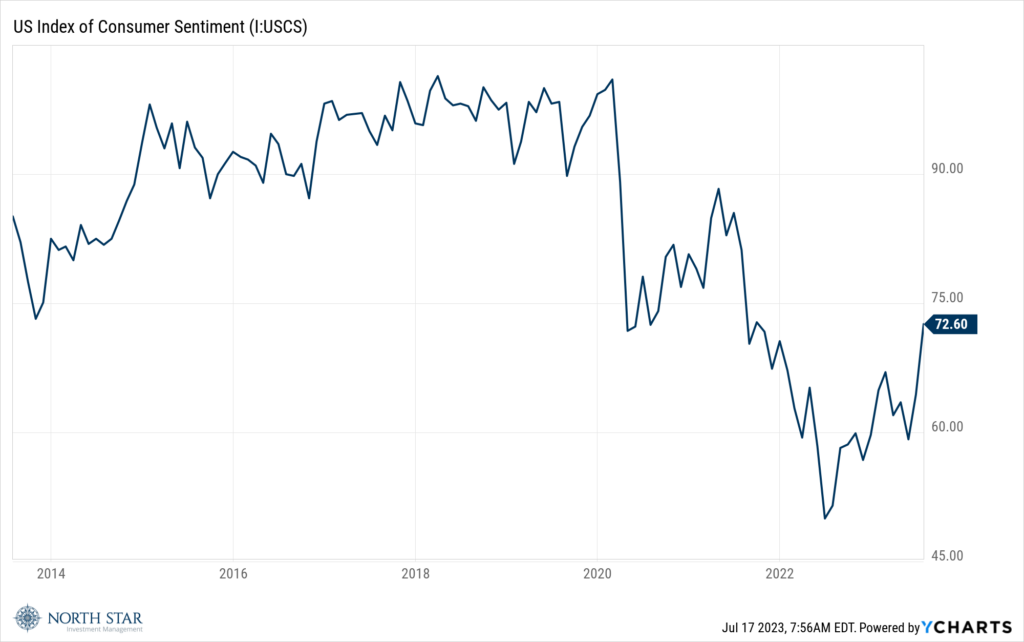

In yet another financial and weather-related dynamic, the University of Michigan preliminary sentiment for July 2023 rose to 72.6 versus 64.4 in the prior month and an expected 65.5. The 13% increase was the best reading since September 2021. As stated on Yahoo!Finance, “Not since Hurricane Katrina has there been such a fast pace of increase in consumer sentiment, according to the University of Michigan’s preliminary reading on consumer sentiment in July.”

The inflation outlook showed continued improvement with both the CPI and PPI coming in below forecast, with the former rising just 0.2% for the month and the latter inching up 0.1%. The Fed is still almost certainly going to hike rates again at its meeting at the end of the month, as Powell continues to close the barn door a year after he let the horse out, but hopefully the Fed’s accompanying statement will be clear that we are at the end of that hiking cycle.

The markets responded very positively to the consumer sentiment, earnings and inflation news, with the S&P gaining 2.4%, the Nasdaq Composite climbing 3.2%, and the Russell 2000 rocketing 3.6%. We still believe small caps are well positioned for further gains, particularly in the scenario where the Fed stops tightening and the economy continues to be resilient.

The dollar weakened to reach its lowest level since April 2022. The weaker greenback will provide an earnings boost for those companies with international revenues and will make U.S. exports more competitive.

Although still underperforming several broad equity market indices, according to Seeking Alpha, “front-month Comex gold for July delivery closed +1.7%for the week to $1,960.10/oz, its third straight weekly gain and its best settlement since June 9, while July Comex silver ended +8.3% this week to $25.014/oz, also a third straight positive week and the highest settlement since May 10.” Potential continued weakening inflation reports, and weaker job reports would likely support higher gold prices as central banks would be less anxious to raise interest rates further.

The yield on the 10-Year Treasury reversed the entire 24 basis point rise from the previous week to finish at 3.81%. We believe that the broader market remains relatively inexpensive with the 10-year at that level and the equally weighted S&P 500 index (RSP) at approximately 15x forward earnings.

The Sox, Cubs, and Sky, all continued to be cold.

On a hotter note, Eric Kuby, North Star’s Chief Investment Officer, journeyed to Las Vegas for the WNBA Allstar game (114 degrees), and came away feeling positive about the future for the Sky. Additionally, he toured the Sphere (SPHR 2% holding in NSOIX), which will be opening in September and is probably the coolest entertainment venue ever created.

Moderate Temperatures

Earnings season will pick up speed with 60 S&P 500 companies scheduled to report results for the second quarter. We expect mostly moderate temperatures, with an occasional storm, as earnings season progresses.

The economic calendar includes several real estate industry releases, the Census Bureau data on retail sales, and the Conference Board’s leading indicators index for June.