Bears Took Over

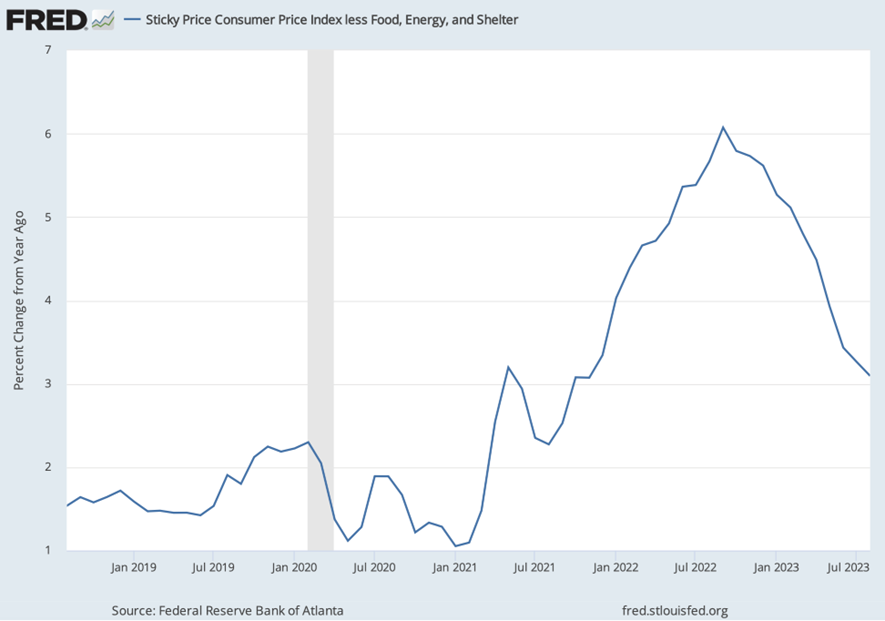

Through Thursday’s close, the financial markets displayed solid resilience despite the looming threat of an autoworkers strike and a slightly hot producer price index (PPI) reading. Surging energy prices were responsible for a monthly rise of 0.7% in the PPI, the biggest increase since June 2022. The core rate excluding energy and food was 0.3%, consistent with the prior month, and the PPI report followed a CPI report that included deceleration in one of the Fed’s key inflation indicators, core CPI ex-shelter, which rose just 3.1% year-over-year in August. (see chart below). Traders generally looked past the energy bump in the PPI on Thursday, instead focusing on the steady downward trajectory in inflation data since September 2022, which should lead to a less restrictive Fed policy going forward.

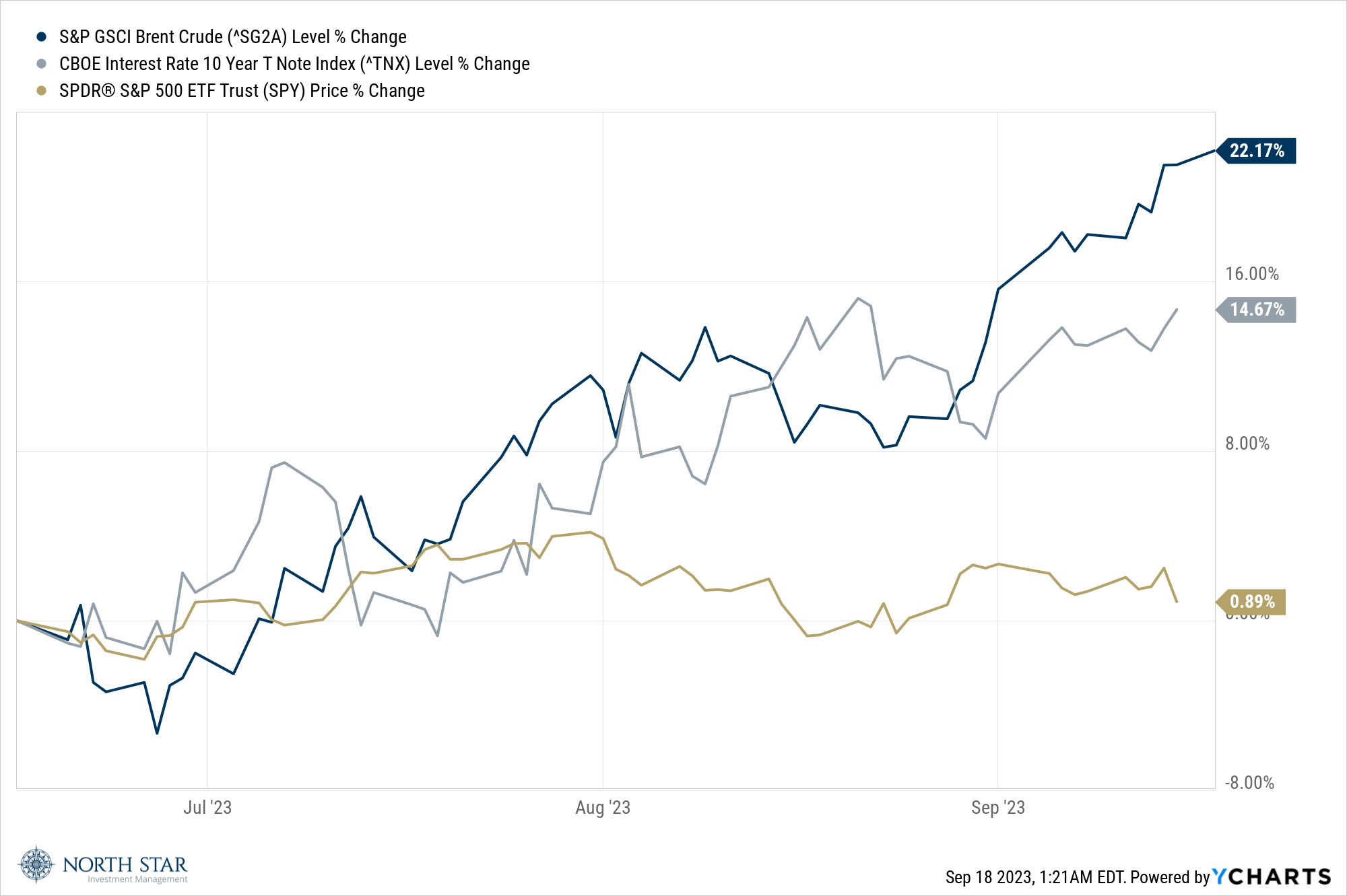

On Friday, however, the bears took over emboldened with the onset of the strike, the first time in the UAW’s 88-year history that all three major automakers were targeted simultaneously. Tech stocks were especially weak, particularly chip equipment makers Applied Materials, Lam Research, and KLA Corp, which all fell more than 4% following a report that Taiwan Semiconductor was delaying deliveries, raising concerns about weak consumer demand. Adding to the gloom was rising oil prices, which have pushed past $90 per barrel to year-to-date highs. In concert, Treasury yields pushed slightly higher, with the benchmark 10-year yield climbing to 4.32%. The declines on Friday left the equity markets modestly lower for the week, as the S&P 500, Nasdaq Composite, and Russell 2000 were down by 0.2%, 0.4%, and 0.2%, respectively.

Internationally, many (if not ALL) economists’ eyes seem to be on China economic trends and its central bank’s actions. Following cuts to key interest rates in the past few months, on Thursday, the central bank cut a short-term, 14-day lending rate but, even more importantly, cut its reserve requirement ratio, freeing up almost $70 billion of bank lending capacity. The People’s Bank of China monetary policy easing actions contrast sharply with banks in other world economic powers, which lean much more toward tightening policy actions.

Overall, oil prices and interest rates rising, and a sideways stock market was the dominant story for the week, as it has been for the summer of 2023.

As the lyrics from the Grateful Dead classic U.S. Blues go, “Summertime done, come and gone, my, oh, my.” Perhaps the fall can blow in a more favorable climate?

Spotlight

The spotlight will once again be on the global central bankers, with the Fed, the Bank of England, and the Bank of Japan all holding policy meetings; in addition, there will be rate decisions from the central banks of Norway, Sweden, and Switzerland. U.S. markets will be focused on the language from the Fed statement, as it is almost certain that rates will remain unchanged. It is worth noting that the market reaction to these Fed meetings has become increasingly muted, following the wild swings in late 2021 and most of 2022.

Economic reports due during the week include updates on housing starts, crude oil inventories, and initial jobless claims, none of which are likely to be market moving.

The other dramas capturing headlines will be the countdown toward a potential government shutdown on October 1 and developments in the UAW strike.

We would like to wish a happy New Year to those who celebrate Rosh Hashanah. May you have a good and sweet year.

It was three strikes, and you’re out on the Chicago sports scene. The Cubs had a bad and sour week, calling into question our comment in last week’s commentary that they were a “lock for a wild-card spot in the playoffs.” The Sky got beat badly twice by the Las Vegas Aces and were eliminated from the WNBA playoffs in the first round. The Bears, well, words can’t describe the agony felt by their faithful fans just two weeks into what could be a gloomy season. We stopped discussing the White Sox back in late July.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.