Congrats Fed, You Are Winning

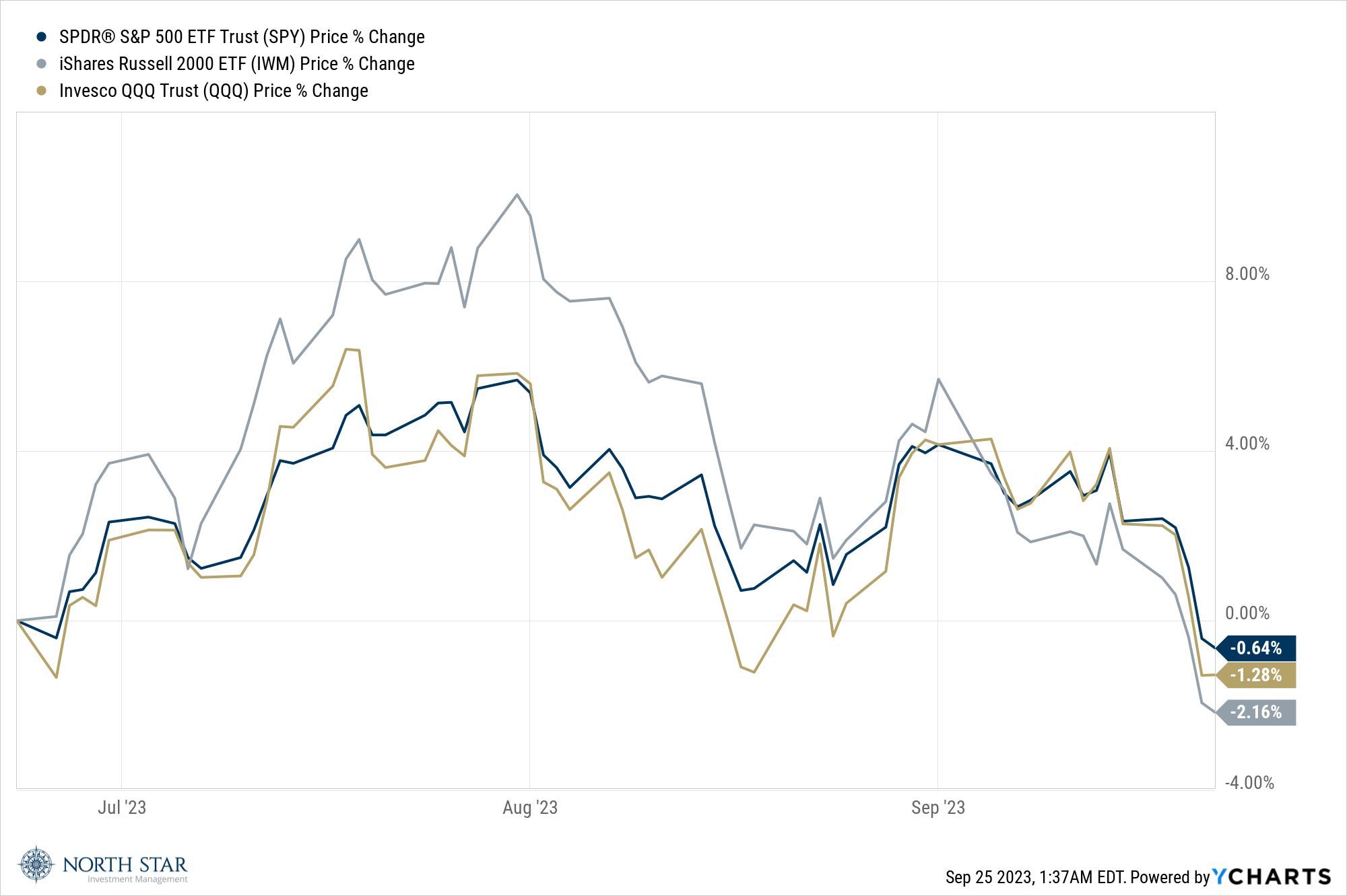

Whereas we would prefer to be discussing the resilient economy, with full employment and supply chain disruptions finally alleviating, instead, once again, it was Chairman Powell and the Fed dominating the narrative. Spoiler alert: that’s rarely a happy tale. Indeed, the stock market posted four straight daily losses to end a rocky week at the lowest level since the end of June.

Bond investors also continued to suffer, with the 10-year Treasury benchmark yield surging 12 basis points to 4.44%, its highest rate in 16 years. To be fair, Chairman Powell’s “higher for longer” jawboning wasn’t new, and the Fed Funds rate was kept steady as was widely anticipated. The extra hawkishness came from the latest dot plot, which signaled one more rate hike this year, along with fewer rate cuts in 2024. Moreover, Powell, at the post-decision conference, seemed to suggest that a soft landing was not a baseline expectation, which further shook investor confidence. It is worth noting that the dot plot has not been a very good predictor of future rate moves, and Chairman Powell has almost continuously been cautionary since assuming the role in May 2018. For the week, the S&P tumbled 2.9% in its biggest loss since mid-March, the Nasdaq Composite closed 3.6% lower, and the Russell 2000 slid 3.8%. Declining issues outnumbered advancing issues by three to one, with all eleven sectors finishing in the red. Bank stocks were hit particularly hard, declining 5.2%, as the higher short-term interest rates weigh heavily on the sector’s profitability.

In a nutshell, the Fed is succeeding in depressing financial markets (“Wall Street”) sentiment. We think evidence is emerging that the Fed is also succeeding in depressing some business leader and household leader (“Main Street”) sentiment as well. This past week, the monthly homebuilder sentiment index fell 5 points to 45 (50 is a neutral reading). Additionally, consumer sentiment has been stuck at levels consistent with readings last seen at the time of the Great Recession. While consumer spending has held up, that has contrasted with such sentiment readings as the University of Michigan Sentiment Index. The most likely reason for these depressed sentiment trends is prevailing interest rates, compliments of the Fed. While the Fed Funds Rate is nowhere near the mid-teens shock levels of the 1980s, the nominal 10-year U.S. Treasury yield above 4% in 2023 has resulted in real (inflation-adjusted) 10-year yields at 15-year highs (see chart below), leading to 30-year mortgage rates around 8% and credit card rates in the area of 30%. These levels seem consistent with the Fed’s goals of cooling any economic optimism. If so, the Fed is likely done raising interest rates, and given recent inflation slowing, the real interest rate shown in the chart below will rise further without any further increases in the Fed Funds Rate.

In other news, The United Auto Workers union expanded its strike against major carmakers Friday, walking out of all 38 parts-distribution centers operated by General Motors and Jeep and Ram owner Stellantis in 20 states but sparing Ford from further shutdowns. Meanwhile, in Hollywood, writers and studios reached a tentative agreement over the weekend as the industry hopes to end the costly 146-day Writers Guild of America strike. Even if the writers agree to a new deal, the actors’ strike will continue, as there have been no known contract talks between the studios and the actors’ 160,000-strong SAG-AFTRA guild since that strike began. Concerns over wage inflation are an important input into the Fed’s hawkish monetary policy. Still, it doesn’t seem that higher interest rates would address the imbalances in the labor market, and the Unions renewed negotiating power.

On a positive note (it’s not all doom and gloom), crude prices modestly declined during the week, finishing at $92.24 a barrel.

Cooling Off

The Bureau of Labor Statistics release of the personal consumption expenditures price index for August on Friday will be in focus. The consensus estimate is for a 3.4% increase year over year, slightly higher than the reading in July.

Earnings reports from Costco and Nike will provide investors with an update on the health of the U.S. consumer.

Other economic reports include updates on durable goods, consumer confidence, new home sales, and the advanced goods trade balance. We believe the data releases could confirm a cooling economy, supporting our view that the Fed is winning its campaign to depress consumers. We hope these trends will motivate an easing of monetary policy before millions of Americans lose their jobs.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.