A Dedication to Mickey Lefton

“As my memory rests

But never forgets what I lost

Wake me up when September ends.”

Green Day frontman Billie Joe Armstrong penned those lyrics inspired by the grief he felt over the death of his father when he was a young boy. Unfortunately, at North Star, we lost Milton “Mickey” Lefton this past week. Mickey was a cherished and valuable team member for the last 13 years. He was a kind and caring person who treated everyone with the highest level of integrity. We will miss him.

Turning to the markets, the S&P 500 slipped 0.7%, its fourth straight week of losses totaling a nearly 5% decline for September, representing its worst monthly performance since December. The song remained the same as investors fretted over the Federal Reserve’s message of higher-for-longer interest rates, surging crude oil prices, and the looming threat of a government shutdown. The bond market also suffered, with the benchmark 10-year Treasury yield rising 13 basis points to 4.57%, the highest level in 16 years. Utility stocks got crushed, but most other sectors were relatively stable, in fact, the Russell 2000 advanced 0.5%, while the Nasdaq Composite eked out a 0.1% gain. The dollar and crude oil continued to trend higher, but gold declined sharply, sinking to its lowest level since March.

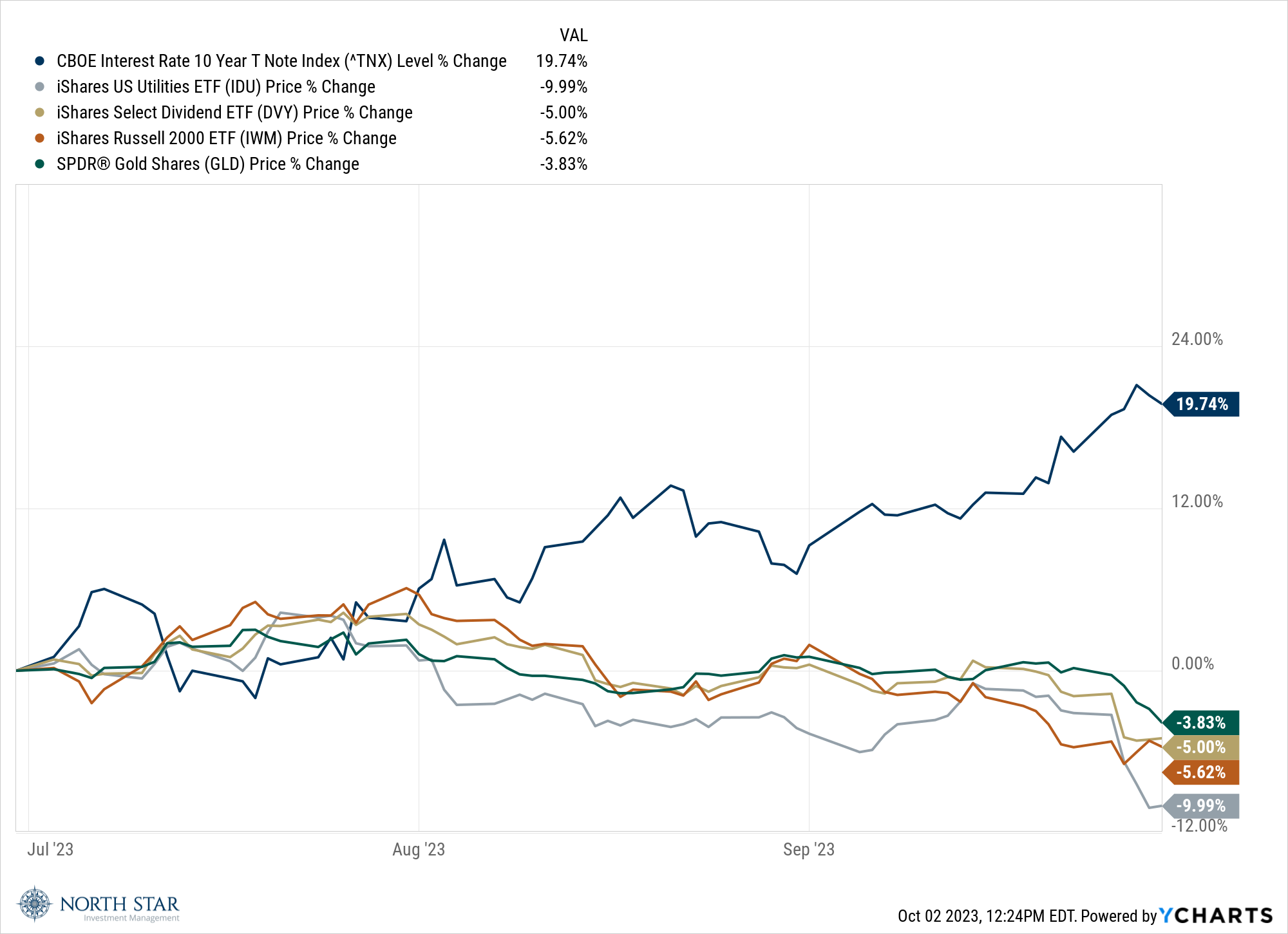

There was some good news during the week; specifically, the Fed’s favorite inflation measure, the monthly personal consumption expenditures price index excluding food and energy (core PCE), increased just 0.1%. If inflation continues its recent moderating trend, some out-of-favor investment areas might become attractive. During the last three months, as the 10-year rate has spiked, dividend-paying stocks, including the Utility sector, small caps, and gold, have all experienced meaningful declines.

Following those declines, bargain prices have developed. Please contact us if you are interested in our small-cap dividend strategies, favorite utilities, gold-related investments, or fixed-income opportunities.

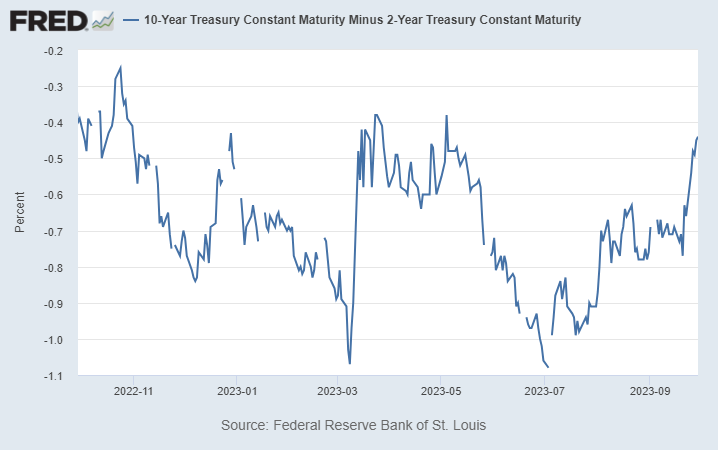

On another positive note, the oft-cited recession-predictive “10-year U.S. Treasury Yield Minus 2-year U.S. Treasury Yield” spread has narrowed to 44 basis points from more than 100 basis points at two occurrences earlier in 2023. In fact, in just the last ten days of September, the spread narrowed by 33 basis points (see chart below). Although a “soft landing” might not be the Fed’s “base case scenario,” nevertheless, the odds of that scenario seem to be dramatically improving. Once again, in that scenario, the beaten-up sectors we just highlighted could rebound handsomely.

Here Comes October

October should be off to a better start, as a deal was reached over the weekend to avert a government shutdown by kicking the can down the road for 45 days.

On the economic calendar, the September jobs report on Friday will be in focus. It is expected to show 168,000 nonfarm payroll jobs were added during the month, with unemployment dropping to 3.7%. Investors hope the report is neither too hot, leading to renewed “higher for longer” hawks, nor too cold, leading to recession doom and gloom soothsayers. There will also be updates on activity in the manufacturing and services sectors of the economy, as well as the latest read on job openings.

October brought no relief to Chicago sports fans, as the Cubs collapsed and failed to make the playoffs, while the Bears lost at home to the Denver Broncos in a fashion that escapes any rational discussion.

Stocks on the Move

+13.9% U.S. Silica Holdings Inc (SLCA) Barclay’s shined a light on SLCA’s improving business conditions after the CEO Energy-Power Conference during the first week of September.

+11.5% Build-A-Bear Workshop Inc (BBW) D.A. Davidson initiated coverage on BBW with a Buy rating and $42 price target, categorizing it as an underappreciated small-cap growth idea.

+10.7% Encore Wire Corp (WIRE) Following a nice rally for the month of September, Barron’s highlighted WIRE as a D.A. Davidson “Best of Breed Bison” stock pick.

-21.1% Century Casinos Inc (CNTY) completed a sale-leaseback transaction with VICI Properties Inc (VICI) involving four properties in Alberta, Canada. We believe the proceeds from the transaction will be deployed to fund a stock buyback or special dividend.

-18.0% Evolution Petroleum Corp (EPM) EPM’s stock price experienced a massive selloff post-FQ4 2023 earnings where volumes slightly missed. We believe this was an overreaction. Additionally, the Company announced a new strategic partnership with Pedevco to co-develop an area in the Permian basin. EPM is highly experienced in these types of partnerships, and we see this deal as value-enhancing for shareholders.

-17.3% Rocky Brands Inc (RCKY) CFO Sarah O’Connor resigned from the Company on September 12th. COO and former CFO Tom Robertson will assume the duties of Chief Financial Officer until a replacement has been identified.

-18.5% Cracker Barrel Old Country Store Inc (CBRL) ended the month down near March 2020 levels despite a profit-beating FQ4 2023 earnings release. Investors are concerned that the stock will cut their dividend amidst lower traffic levels and seniors having less discretionary dollars. We believe the dividend is safe for now with improving free cash flow and earnings.

-15.2% Monro Inc (MNRO) was initiated by Wells Fargo at Equalweight with a $35 price target. The firm sees a resilient business model with opportunity for improvement but awaits a period of more consistent, profitable growth.

-29.1% Methode Electronics Inc (MEI) reported an earnings miss and cut its full-year forecast due to operational and supply chain inefficiencies, as well as weak e-bike demand.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.