Margin Call

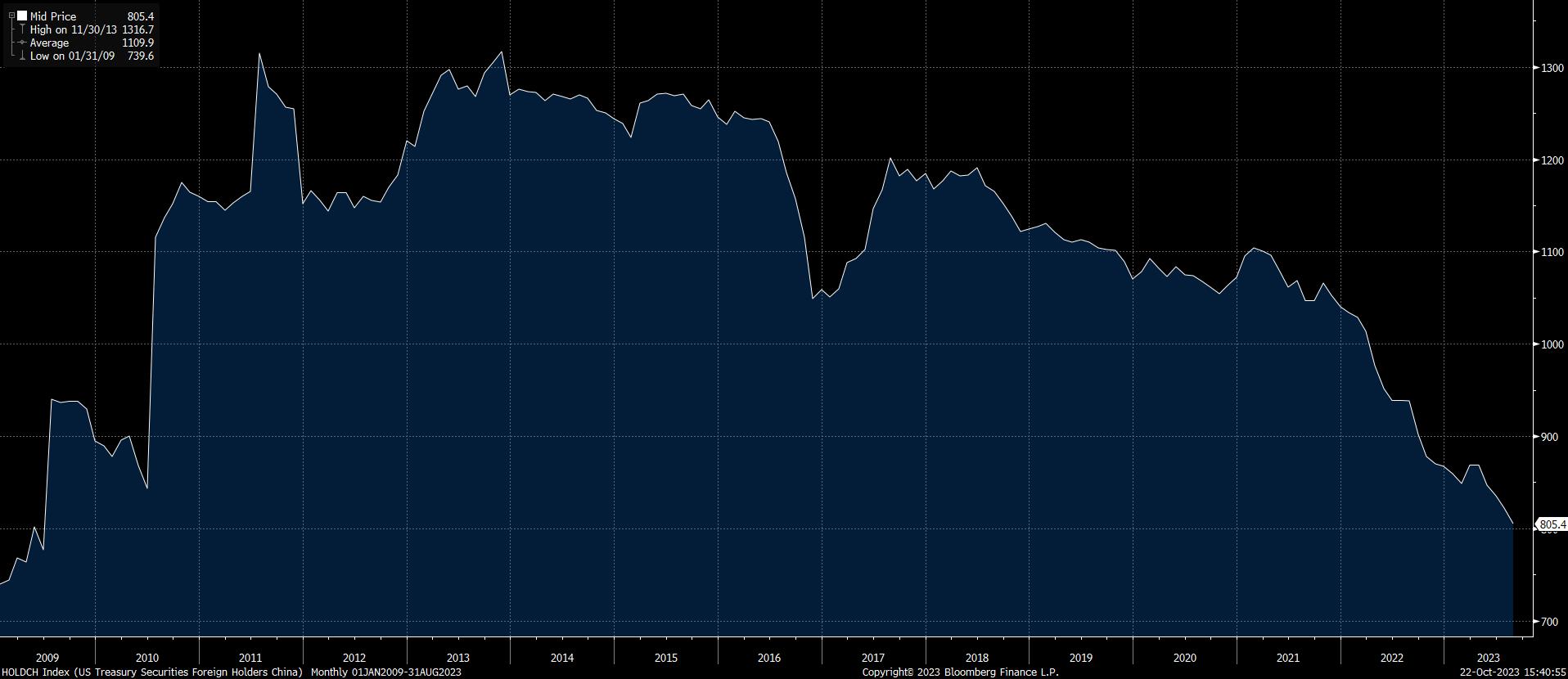

Stocks staged a modest rally on Monday, only to see mounting losses Tuesday through Friday, adding up to the worst week in a month for the market. The S&P skidded 2.4%, the Nasdaq Composite dropped 3.2%, and the Russell 2000 slid 2.3%, with declining issues outnumbering gainers by a factor of 3-1. The negative narrative remained with spiking Treasury yields, concerns over the escalation in the Middle East war, and the never-ending “higher for longer” tone from Fed chair Jerome Powell. There was a nice dose of good news, in the form of stronger-than-expected retail sales data, and lower weekly new claims for unemployment, both of which the market treated as bad news relating back to it possibly justifying continued restrictive monetary policy. The yield on the benchmark 10-year Treasury crossed 5% for the first time in 16 years on Thursday, although it pulled back to 4.92% on Friday. While economic data and Federal Reserve policy are the most common drivers of U.S. Treasury yields, some of the recent consistently upward pressure may be driven by the rapid reduction of U.S. Treasury holdings by China, as shown below.

Chinese Ownership of US Treasuries | 01/01/2009-8/31/2023

Gold breached $2,000 per ounce on Friday, likely driven by geopolitical turmoil, given that rising interest rates would normally decrease the attractiveness of all non-yield assets with carrying costs, including precious metals.

Chip stocks and regional bank shares were particularly weak, with the former reacting to limits imposed on exports of AI chips to China, and the latter posting subpar quarterly results. Solar stocks got crushed after SolarEdge warned of slowing sales in Europe.

Earnings season took a step backward, driven by disappointing results from the Healthcare sector. Projected third-quarter composite profits are now on track to slip to -0.3%, down from +0.4% the previous week. If results match current expectations, it will mark the fourth straight quarter of declines. The future looks brighter, as the consensus calls for 6.7% growth in the fourth quarter, and double-digit growth in 2024. The Bull case for stocks in 2024 is the combination of rising earnings and lower short-term interest rates, with bargain-priced small caps perhaps the biggest beneficiaries.

The Chicago Bears presented their “Bull case” on Sunday in Soldier Field, with Tyson Bagent under center leading the revived Monsters of the Midway to an impressive 30-12 victory over the Las Vegas Raiders.

Hope for the Best

There will be quarterly earnings from 160 S&P 500 companies, including the Big Tech heavyweights Alphabet, Microsoft, Meta, and Amazon.

It will also be a busy week for economic data, highlighted by Friday’s release of the personal consumption expenditures price index for September.

Geopolitical developments clearly have the potential to dominate the airwaves and heavily influence the financial markets. Let’s hope for the best and pray for peace.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.