Swooped In

The inflation data was just hot enough to cool investors’ animal spirits, leading to a modest sell-off in both the stock and bond markets. On Tuesday, the CPI came in at +3.1% year-over-year versus the 2.9% consensus forecast. The equity markets sold off, with small caps declining 4%, the worst trading day for the Russell 2000 in almost two years. Bargain hunters swooped in on Wednesday and Thursday. Still, the selling resumed following the PPI report on Friday that sparked concerns over the timing of interest rate cuts from the Federal Reserve. According to the CME FedWatch tool, the odds of a rate cut by the Fed in March is now just 11% versus 63% a month ago. The major stock market indexes broke their five-week winning streak, with the S&P 500 closing down 0.4% and the Nasdaq Composite sliding 1.3%. Despite the brutal days on Tuesday and Wednesday, the Russell 2000 finished up 1.1% for the week! There were more advancing issues than declining issues, and only the tech sector finished in the red, so beneath the surface, it was a decent week for equities. Bond prices moved modestly lower during the week, with the yield on the 10-year Treasury rising ten basis points to 4.29%.

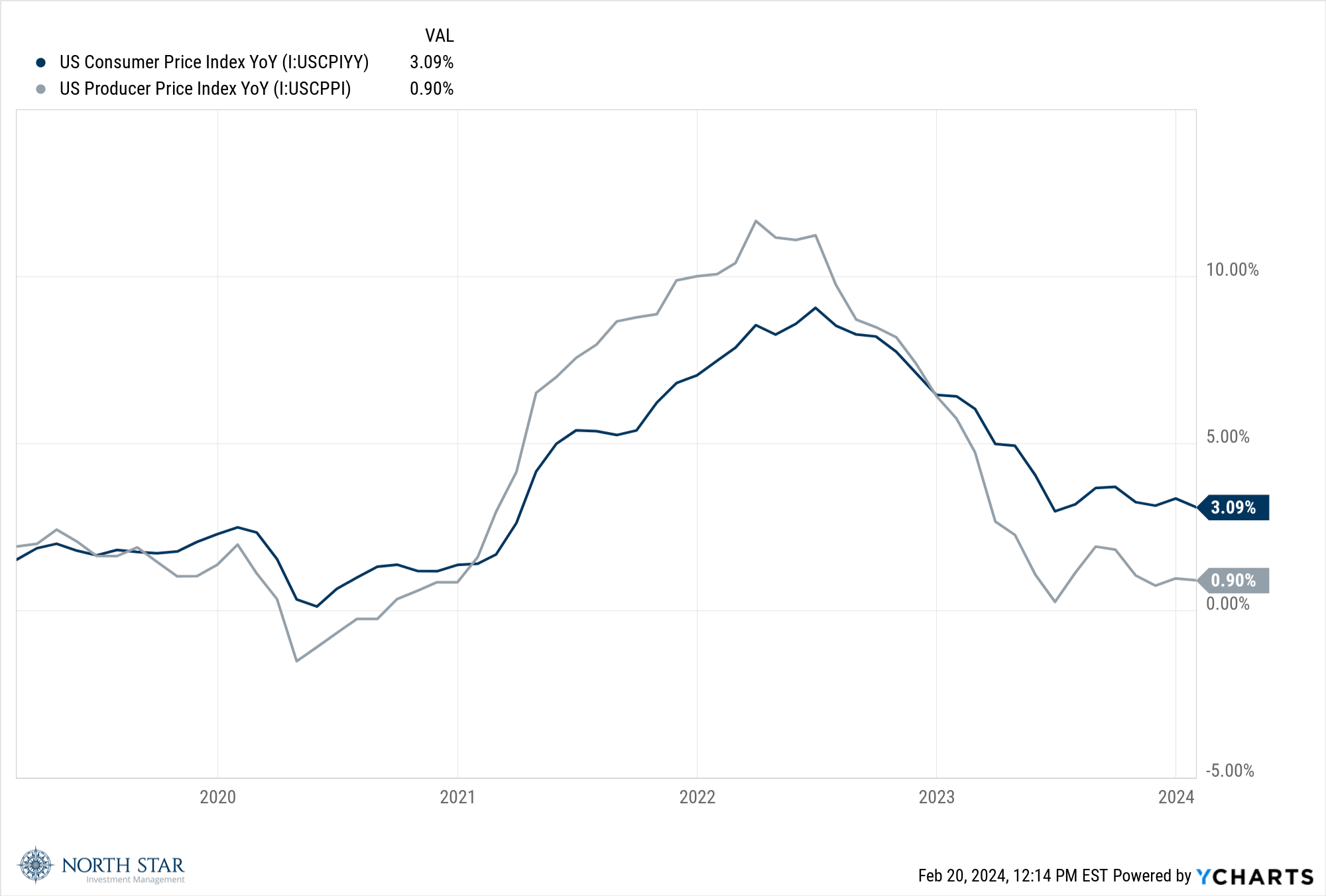

Whereas the recent data makes a rate cut in March unlikely, we still firmly believe that short-term rates will steadily trend lower during 2024. We also note that inflationary pressures have dramatically eased and are at historically normal levels:

It is also worth peeling back the onion skin on the CPI report to see the constituents comprising the increases. We have previously noted the elevated shelter costs, particularly the “Owners Equivalent Rent”, as a significant artificially constructed contributor. Additionally, the food category posted a gain of 0.4% in January. This included a 0.5% gain for the food-away-from-home category and a 0.4% gain for the food-at-home (FAH) category. Year-over-year, these two categories were up 5.1% and 1.2%, respectively, suggesting that eating out has been another source of inflationary pressures.

Earnings Season is now in its final innings; once again, results exceeded expectations. As a result, S&P 500 profits are expected to show 3.2% growth for the fourth quarter, up from 2.8% the week before. The magnitude of the earnings “beats” during the quarter is fairly typical, and the forward guidance on balance has also been uneventful.

The University of Chicago Men’s basketball team lost their home games over the weekend. We will have to wait until next year for the Maroons to bring glory to the South Side. Meanwhile, the Northwestern Wildcats are on a roll, so we turn our attention to Evanston or Champaign, where the Illini are also surging.

Shortened Week

The U.S. financial markets were closed on Monday during the Presidents’ Day holiday.

54 S&P 500 companies will report results, including Walmart Inc (WMT) and The Home Depot Inc (HD), which both released better-than-expected earnings this morning before the market opened. On Wednesday, tech traders will be focused on the earnings from the market’s AI darling, NVIDIA Corp (NVDA).

The minutes from last month’s FOMC meeting will also be released on Wednesday, which will lead us to sing another round of “How Long Has This Been Going On?”.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.