Last Week

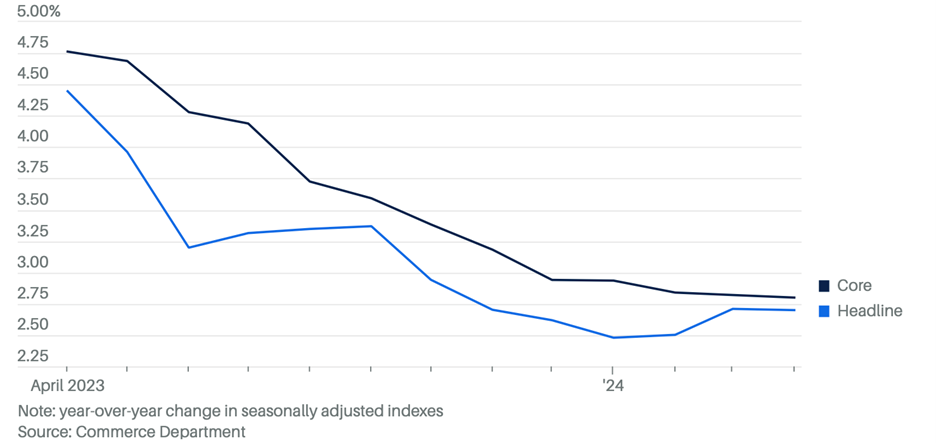

Following the pattern from the previous week, gains in a narrow band of mega-cap momentum stocks masked underlying weakness in the broader market on Tuesday to kick off the holiday-shortened trading week. The mood worsened on Wednesday as hawkish Fedspeak pushed interest rates higher and stock prices lower. On Thursday, weaker-than-expected results from Salesforce Inc (CRM) led to a slide in the Tech sector, while the overall market suffered from interest rate jitters in front of the PCE report that was on the calendar for Friday. The week ended on a more upbeat note, as traders breathed a sigh of relief after the PCE Price Index came in on target and showed a trend consistent with the downward trend in inflation during the past 12 months (see graph below). Despite the Friday bounce, the S&P 500 snapped its five-week winning streak after posting a 0.5% decline. The Nasdaq Composite set a record high on Tuesday but finished -1.1% for the week. Under the surface, the market was healthier, with Small and Mid Caps posting modest gains. The yield on the 10-year Treasury moved four basis points higher to 4.51%, with the dollar and gold relatively stable.

This Week

The May jobs report this week on Friday will be in focus. The update on nonfarm payrolls will be the last one before the Federal Reserve meets on June 11-12. The magnitude and timing of Fed rate cuts are widely debated amongst forecasters. A Fed Chair Jerome Powell portrait adorns the cover of Barron’s most recent edition, with the header “Why He Won’t Cut Rates This Year.” The essence of the argument is that even with 5.25%-5.5% Fed Funds rates, the economy is proving resilient. That combination puts the Fed into a corner where holding rates steady is the default option. The article also points out that the PCE increases in May and June 2023 were quite modest, which makes any year-over-year improvement difficult in the near term. It also suggests that the stock market has, and can continue, to perform well without rate cuts.

On the other hand, none of the Chicago professional sports teams are performing well. The Cubs and the Sox have combined for two wins in their last 20 games. The WNBA’s Chicago Sky, with talented rookies, is our only team that can be in the playoffs this summer.

Stocks on the Move

+73.0% Blue Bird Corp (BLBD) soared in May after posting record EBITDA for the second quarter and raising full-year guidance. Eric Kuby met with the company at the Craig-Hallum Annual Institutional Investor Conference and was pleased to hear about the robust demand for EV school buses, as well as ample opportunities for future EV solutions, such as last-mile delivery trucks.

+51.3% Rocky Brands Inc (RCKY) continues to execute ahead of expectations as the company reported a nice earnings beat at the end of April. The company has seen improvement due to cost savings initiatives and topline momentum.

+25.9% Superior Group of Cos Inc (SGC) was up in May after its first quarter earnings release indicated major operational improvements. As such, the Company raised its full-year sales and EPS guidance.

+24.8% Miller Industries Inc (MLR) is on a steady climb after posting another quarter of record revenues as the supply chain environment, particularly for chassis, has improved. Additionally, the company announced a $25M buyback program in April.

+23.7% Cantaloupe Inc (CTLP) shares rose in May as the company continues to execute its international expansion and aggressive selling of its subscription Point-of-Sale services. Eric Kuby met with the CTLP management team at the Craig-Hallum Institutional Investor conference and reiterated conviction in the name.

+21.1% Oil-Dri Corp of America Inc (ODC) was up in May on no significant company news.

+19.0% Select Water Solutions Inc (WTTR) was up in May despite a slight earnings miss at the end of April. The company continues to expand its connections via acquisition and multi-year contracts, as well as operate with enhanced profitability.

-18.6% WK Kellogg Co (KLG) gave back some of its YTD gains in May despite posting solid first quarter earnings and reiterating its guidance for FY24.

-14.7% The Eastern Company (EML) shares slumped in May, although the stock has done very well year-to-date. EML’s first quarter earnings, released on May 6, highlighted gross margin and earnings improvement, as well as a 35% increase in backlog, demonstrating increased demand for various truck assemblies.

-12.8% Quest Resources Holding Corp (QRHC) was down for the month, although its first quarter earnings release on May 9th painted a picture of enhanced client relationships (larger contracts), expanded operating margins, and other related ongoing improvements.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.