Last Week

Market participants enjoyed an across-the-board rally on Friday to end a wild week in which the primary theme was the rotation out of tech stocks and into small caps. The damage for tech investors all came on Wednesday following earnings reports the previous evening from Alphabet and Tesla. In fact, the Nasdaq Composite’s decline of 3.6% on Wednesday marked its worst one-day loss since 2022. The bounce on Friday left that index down 2.1% for the week, while the S&P 500 finished -0.8%. It was a different story for small and mid-caps, with gains of 3.5% and 2% respectively. Advancing issues comfortably outnumbered declining issues by a factor of 1.7 to 1, with the equal weight S&P up about 1%. Outside of equities, the rest of the financial markets were quiet, with the dollar and gold both basically unchanged and the yield on the 10-year Treasury slipping 4 basis points to 4.2%. Crude oil slid 3.5%, although the Oil & Gas equity sector held steady. The defensive sectors were the top performers, led by Utilities, Health Care, and Financials. One notable industry seeing revenue and earnings weakness in 2024 has been luxury goods, which suggests a broadening of consumer spending deceleration and is supportive of a more dovish tone from central banks globally.

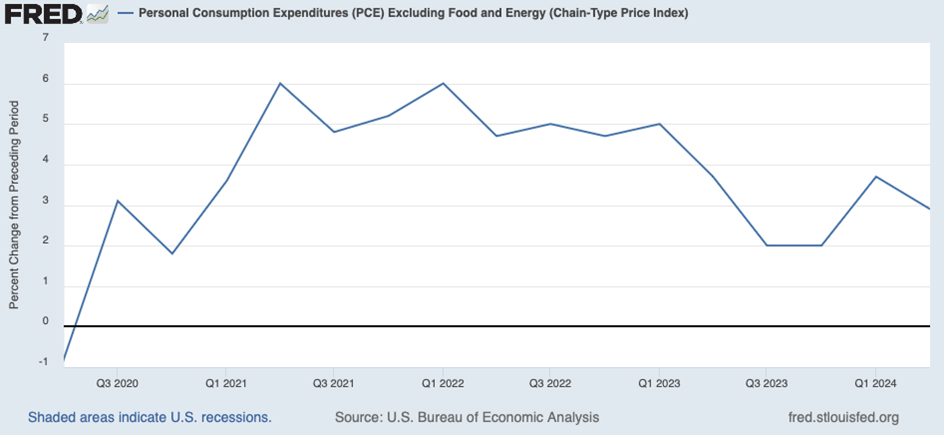

The economic data was comfortably in the “Goldilocks” camp, with a solid GDP report followed by a tame PCE reading. The below graph shows that elevated inflation PCE readings in the post-pandemic era are now much more controlled, and the current contractionary Fed policy is unwarranted. Earnings season progressed with steady progress, suggesting 9.8% composite growth for the quarter, slightly higher than the previous week. At this current pace, 2Q24 would be the strongest quarterly earnings since the 4th quarter of 2021, when the economy was rebounding from the pandemic.

On the Chicago Sports Scene, the Cubs are back in last place in the NL Central, and the White Sox are 36.5 games out of first place in the AL Central with 11 fewer wins than any other team in baseball.

This Week

Earnings and the labor market will be in focus. Four of the Magnificent Seven and more than 150 S&P companies will report results during the busiest week of the earnings season. The BLS will release the July jobs report on Friday. Economists forecast an increase of 177,000, with the unemployment rate remaining steady at 4.1%.

The FOMC will announce its monetary policy decision on Wednesday, with almost unanimous support for remaining unchanged rates. It would be nice to see a surprise cut, after all, the data suggests it is warranted, and there is nearly a 100% probability of a September cut. Why wait? We will be ready with the “surprise, surprise, surprise” Gomer Pyle meme just in case.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.