Last Week

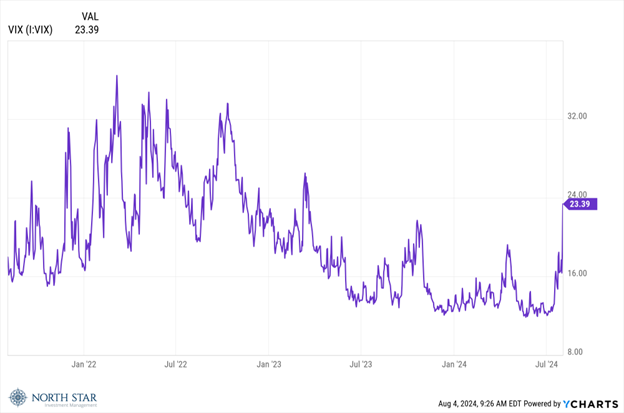

The investor sentiment pendulum swung dramatically from the Greed pole to the Fear pole, triggered by another dose of soft economic data combined with stubbornly unresponsive Fedspeak from the FOMC statement and news conference. Despite solid corporate earnings beats that increased the projected S&P 500 growth rate for the quarter by 1.6% to 11.5%, the market went into a tailspin as the S&P sank 2.1%, the Nasdaq slid 3.4%, and the Russell 2000 skidded 6.7%. The “Fear Index” VIX spiked, and the flight to safety was additionally evident in the bond market as the yield on the 10-year Treasury dropped a notable 9.7% by 41 basis points to 3.79%, reaching its lowest level of 2024. The commodity markets flashed the same warning signs: gold rallied 2%, crude oil lost almost 5%, and the dollar fell 1%. Declining issues overwhelmed advancers by more than 2-1, with the Utility sector performing best, while Oil & Gas and Tech stocks suffered the most significant losses.

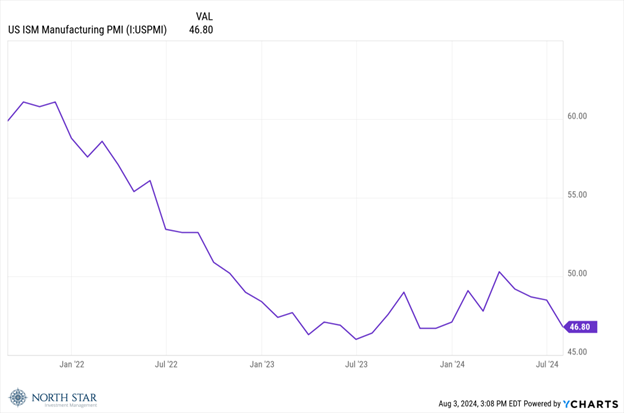

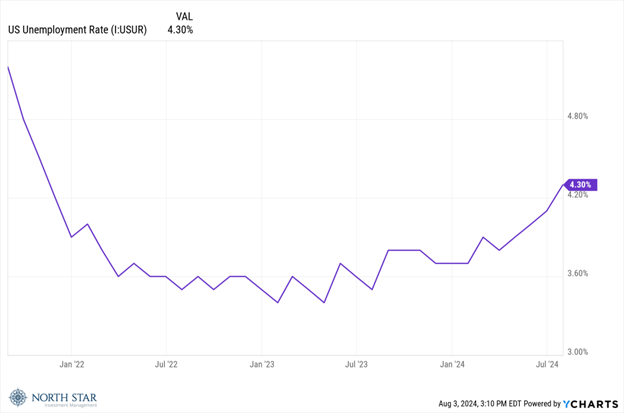

The mood shift started Wednesday afternoon as reporters peppered Fed Chair Jerome Powell with questions challenging the logic behind a highly restrictive monetary policy given a slowing economy with moderate inflation. The concern is that an economic hard landing may result if the Fed is stubbornly and woefully behind the curve. The most recent dot plot from the Fed still signals just one rate cut in 2024, which seems alarmingly disconnected from the current conditions. Those concerns were elevated on Thursday with the ISM Manufacturing Index and Friday with the July employment report.

These trends in manufacturing and employment could be canaries in the coal mine. The good news is that the economy is still in relatively good shape and that the oxygen supply can be restored by easing monetary conditions to a neutral policy rather than remaining in the most restrictive policy in recent history, best represented by the roughly 200 basis points spread between the Fed Funds Rate (FFR) and recently inflation data. Given recent employment data and industrial data trends, albeit with inflation data still slightly above the Fed’s target of 2%, we believe a more appropriate spread would be around 75-100 basis points.

This Week

Investors will be on high alert after seeing the tech-heavy Nasdaq Composite slide into correction territory. The “Fear Index” spiked late last week, with the VIX surging 50% to its highest level in over 15 months. The selling pressure intensified over the weekend, with global markets in a steep sell-off on Monday morning including the biggest one-day decline ever in Japanese stocks. Increasingly loud calls for an intra-meeting Fed rate cut would not surprise us, as the Fed does not meet in August, and patience seems to be wearing thin given the sharp fall in bond yields last week (a typical sign of a ‘risk-off’ consensus among the investment community).

Monday will see measures on the U.S. services sector, with attention on the employment and price components. The services sector has held up much better than the manufacturing sector, but June’s reading was the lowest in four years. Thursday’s weekly initial jobless claims report will also be in focus following the softness in the July jobs report last week.

The second quarter earnings season will enter its latter innings, with 79 S&P 500 companies releasing results, including reports from Walt Disney and Caterpillar that will shed additional color on the health of the consumer and construction.

Domestic politics and the alarmingly unstable geopolitical landscape could easily dominate the news flow, with uncertain effects on the financial markets. Iran has publicly asserted it will retaliate against Israel and its ally, the United States, and therefore, investment flows towards more risk-off sectors such as Utilities, consumer Staples, and Energy would not surprise us.

July Small-Cap Stocks on the Move

+27.3% Green Brick Partners Inc (GRBK) jumped with the rest of the homebuilders during the month and reported stellar second-quarter results on the last day of July, with net new home orders up 4.0% y/y, revenues up 23% y/y, and earnings of $2.32 beating estimates by $0.55 per share.

+23.9% The Hackett Group Inc (HCKT) was up in July on no significant company news.

+22.3% Acme United Corp (ACU) shares rose during the month after reporting solid second-quarter earnings that demonstrated higher net sales, expanded margins from manufacturing/distribution improvements, and continued execution on gaining share in First Aid via several accretive tuck-in acquisitions.

+22.5% QCR Holdings Inc (QCR), a bank holding company and one of North Star’s newer positions, was up last month in line with the general rotation into small caps, particularly those in defensive sectors such as financials. Additionally, the company reported strong Q2 earnings, highlighted by improved margins, higher deposits, and strong wealth management fees.

+21.6% Monro Inc (MNRO) rose in July with its small-cap peers. MNRO also reported first quarter fiscal year 2025 earnings that included better same-store sales growth, improvement in higher margin sales categories, and strong cash flow.

+19.9% Miller Industries Inc (MLR) shares rose in July on no significant company news.

+17.5% Flexsteel Industries Inc (FLXS) saw gains in July on no significant company news.

-12.8% Rocky Brands Inc (RCKY) shares sank during the month after the company’s spring quarter order trends were challenged by inadequate weather and persistent inventory issues with smaller customers. We feel RCKY represents a tremendous bargain, and the story has meaningfully improved due to: debt paydown and favorable refinancing, expanded sales and distribution for certain brands with large retailers, and an anticipated normalized cadence of replenishment/reorders across all channels.

-16.4% Bowlero Corp (BOWL) gave back June gains with no significant company news.

-20.7% Axcelis Technologies Inc (ACLS) sold off in July due news on a likely ban on US semiconductor companies and related components providers exporting to China. Despite these concerns, ACLS continues to execute as demonstrated by solid earnings and management confidence in long-term growth strategies.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvest.com.